Microsoft Corporation (MSFT ) develops, manufactures, licenses and sells computer software, consumer electronics, PCs and other services. Its best-known software products are the Microsoft Windows operating systems, Microsoft Office and Internet Explorer web browser.

The company was founded by Bill Gates and Paul Allen in 1975 and is currently headquartered in Redmond, Washington. Once “King of the Operating System,” Microsoft has lost footing to competitor Apple Inc. (AAPL ) as well as developed new competition with companies like Amazon.com, Inc. (AMZN) and Alphabet Inc. (GOOG). However, the software giant still brings in nearly $90 billion in revenues, as of their fiscal 2017.

In 2014, the company took itself in a new direction when it parted ways with CEO Steve Ballmer and brought on current CEO, Satya Nadella, who was heading Microsoft’s cloud division – a key focus for the company now. Both analysts and shareholders seem to like the direction the company is now going, focusing on its Azure cloud-computing platform, which has established itself as a prominent name in the cloud-services space along with the offerings from peers, Amazon and IBM (IBM ).

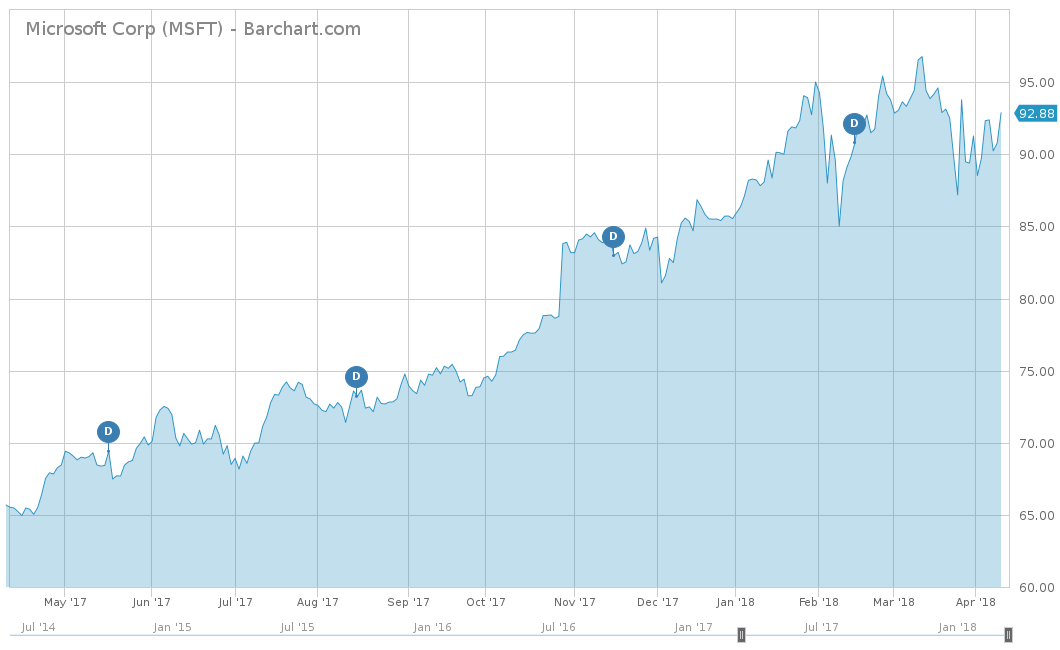

On a year-to-date basis, MSFT’s stock price is up 7.39%, outperforming the S&P 500’s year-to-date performance of negative 1.18%. Over the longer term, Microsoft has been a star in a rising market, up over a cumulative 217% for the trailing five-years. This is more than three times the result of the S&P 500’s cumulative return of 65.82% for the same time period. The last five years of success can be partially attributed to the effectiveness of the strategic direction adopted by Nadella.

For investment concepts, visit our Dividend Investing Ideas Center.

Fundamentals

Over the last five years, MSFT has had a reasonably successful revenue growth rate of 4.1%, although it was bogged down in 2016 after the company saw a serious decline in its PC sales. However, this led the management to refocus its core business into other areas, like cloud computing, to increase its revenues.

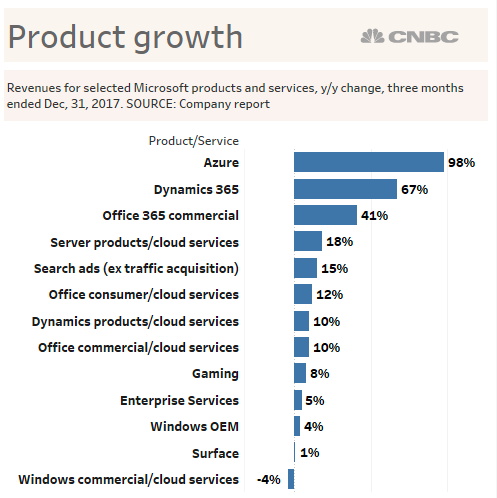

As a result, fiscal 2017 (September 2016 to June 2017) saw an increase of 5.4% to over $89 billion in revenues. Most recently in the first quarter and second quarter of fiscal 2018, Microsoft’s revenues have exceeded expectations with measures of $24.5 billion and $28.9 billion, respectively. This is attributed to the company converting its existing clientele into its cloud-based services. During the most recent quarter, the productivity & business processes segment saw an increase of 25% in revenue to reach nearly $9 billion, while the Intelligent cloud segment saw an increase of 15% to reach almost $7.8 billion. Both segments continue to see a growing trend on an annual basis since their creation in 2015. Productivity & business processes saw almost no change from 2015 to 2016, but saw the big jump of 15% for the year from 2016 to 2017. The intelligent cloud has seen even greater success with a growth of 6% from 2015 to 2016 and a 10% growth in 2016 to 2017. With these growing segments, analysts expect the company to maintain its momentum for 2018 and expect a year-end revenue total of $107.26 billion, equal to an increase of over 11% from fiscal 2017. Same goes for 2019, where analyst expect Microsoft to bring in $116.51 billion in sales, an increase of over 8%.

On an earnings-per-share basis, CEO Nadella has really trimmed the company to maximize its bottom line. Over the last five years, Microsoft has an average earnings growth of 6.3%.

After seeing a serious decline in 2015, thanks to a Nokia bust of over $7.6 billion, the company has been soaring. In 2016 and 2017, the company bounced back with earnings growth of 41.9% and 29.0%, respectively. Much of this has to do with Nadella’s new approach to maximizing its bottom line and streamlining inefficiencies within the company. Most recently, the company released its second-quarter earnings to a loss of $0.82 per share, after a hit from the $13.8 billion charge related to the Tax Cuts and Jobs Act (TCJA). However, when adjusting for the TCJA, Microsoft had earnings of $0.96 per share, beating expectations.

Analysts expect Microsoft to bounce back in a big way the remaining two quarters and predict 2018 to total $3.62 per share. Same goes for 2019, where analysts see earnings reporting at $3.94 per share. Now that the one-time tax hit is behind them, Microsoft expects its new tax rate to be in the 16% range, considerably lower than in previous years.

Strengths

The largest strength of Microsoft is currently its productivity & business processes division, which consists of its Office Suite, LinkedIn and Dynamics Solution. Although its more personal computing division (i.e. Windows, gaming, search & advertising) still makes up its largest portion of sales, at just over 42%, the company knows it’s on the steady decline. Instead of seeing its PC and software business clients move to its competition, Microsoft is transitioning them into its new cloud-based services. This segment overall saw an increase of 25%, especially thanks to the commercial revenue growth of 41%, which was driven by Office 365. Both the commercial and consumer office product and cloud services revenues saw double-digit revenue growth during the last quarter. Microsoft 365 is very easy to use, leading to the likelihood that more companies will not only replace their Office 2016 software with 365, but will also get hooked to other relevant integrated services that Microsoft has to offer. Excel, for example, has an Insights feature that uses machine learning to detect and highlight patterns. Office 365 also has Cortana built in, where users may dictate their emails or have them read. This high level of integration allows Microsoft to both maintain and grow its existing customer base.

Another strength that Microsoft added to its books is with its acquisition of LinkedIn in 2016 for $26.2 billion. The company needed a way to compete with Facebook Inc. (FB ) and did so through acquiring the employment-oriented networking site. Now, Microsoft has direct access to the 546 million members of LinkedIn, which span over 200 countries all across the world. With five full quarters under Microsoft’s books, LinkedIn has contributed $1.3 billion in revenues in the latest quarter and seen sessions growth of 20%+ for the fifth consecutive quarter.

Growth Catalyst

The largest growth potential for Microsoft is undoubtedly its intelligent cloud segment, driven by Azure, which is Microsoft’s comprehensive set of cloud services that developers and IT professionals use to build, deploy and manage applications through the company’s global network of data centers. Although the intelligent cloud segment is currently the smallest revenue producer for Microsoft, only accounting for over 26%, it has the most upside potential.

In its recent quarterly call, Microsoft announced that server products and cloud services revenue grew by 18%, driven primarily by Azure’s revenue growth of 98%. Currently, Amazon Web Services makes up 62% of the world’s cloud-computing hosting business, where as Microsoft is at 20%, followed by Alphabet at 12%. However, Amazon is losing market share, as it dropped from 68% to 62% in 2017, thanks to traction from Azure, which grew its share from 93% as of Q3 2017 to close at 98% as per the most recent estimates. This is primarily due to Nadella’s initiative around cloud computing, which has finally started to pay off.

What really drives Microsoft’s success is its hybrid consistency, developer productivity, AI capabilities and trusted security & compliance. This gives Microsoft the architectural advantage that helps address both existing enterprise workloads and new workloads such as the Internet of Things (IoT) and Edge AI. As Microsoft continues to leverage its current clients into Azure and Office 365 platforms, expect revenues, earnings and the stock price to continue to soar to new highs.

Dividend Analysis

Microsoft stock has a yield of 1.83% and has a higher yield than the Technology Sector Dividend Yield average of 1.24%. Microsoft has maintained itself as a company that likes to grow its dividend, as evidenced by its 14-year track record of dividend hikes. Its most recent dividend hike was after its fiscal 2017 year, where management announced an increase of 7.6% to $0.42 per quarter. With revenues and earnings on the rise, expect another rate hike around the same time of year for its 2018 fiscal year end.

To find more high-quality dividend stocks, check out our Dividend Screener. You can even screen stocks with DARS ratings above a certain threshold.

Find all the companies that have increased their dividends for more than 25 consecutive years on our 25-Year Dividend Increasing Stocks page, and for more than 10 consecutive years on our 10-Year Dividend Increasing Stocks page.

Risks

The biggest risk to Microsoft is the constantly growing competition within the technology sector. Ten years ago, Amazon, Alphabet and Facebook were not competitors of Microsoft. However, with Microsoft changing its focus and with technology and innovation, Microsoft has ventured into new territory. That being said, if Microsoft does not keep up with its competitors in regards to innovation, it could soon find itself back to the struggles it saw prior to 2014 before Nadella took the helm.

The Bottom Line

With Nadella as CEO, the culture of Microsoft has changed from top to bottom. The company has changed its focus from PC software into the future, with cloud computing and its Office 365 and Azure solutions. What is especially promising is the 98% growth from Azure, which is helping Microsoft take market share from Amazon Web Services. Now that the tax reform charge is past, expect Microsoft to break through with new record highs in revenues, earnings and a stock price well past the $100 per share mark. Microsoft looks to be back to becoming a leading force again and the stock should be an immediate buy, if not already part of an investor’s portfolio.

Check out our Best Dividend Stocks page by going Premium for free.