Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

T-Mobile and Sprint have launched a charm offensive on U.S. regulators in a bid to get the merger between the third and fourth carriers approved. T-Mobile was first in the list this week, followed by Apple, which reported strong earnings for the latest quarter. Beer manufacturer Anheuser-Busch InBev was third in the list, as the high-dividend yield company reported its first quarter results. The list is closed by McDonald’s.

T-Mobile Scrambles to Get Sprint Merger Approved

T-Mobile (TMUS ) has launched a charm offensive on U.S. regulators in an attempt to convince Uncle Sam that a merger with Sprint (S) is in the best interests of consumers. As a result, traffic to T-Mobile has surged 386% in the past five days with investors closely watching the developments in the approval process.

T-Mobile and Sprint have argued that a stronger combined company would be better positioned to compete with AT&T (T ) and Verizon (VZ ), the first- and second-largest carriers in the U.S., respectively. They contend that pooling their costs to implement next-generation 5G wireless networks will have the end result of better services to customers. The main idea is that it’s better to have three strong carriers competing neck and neck than having a big divergence between two strong players and two weak ones.

However, competition analysts argue that the U.S. wireless market is already an oligopoly, according to the textbook, which indicates that 10 players are needed for perfect competition. As a result, three competitors instead of four would definitely harm competition and lead to higher prices and poorer services for consumers.

The Federal Communications Commission must decide if the combined benefits the public interest, while the Justice Department must determine if the merger will lead to lower competition. A host of consumer activists made the case that the merger will increase prices and hit low-income Americans.

Neither T-Mobile nor Sprint pays a dividend. T-Mobile’s stock declined more than 2% in the past five days, extending year-to-date losses to more than 12%. The prospect of a dividend will rise if the merger is allowed to proceed.

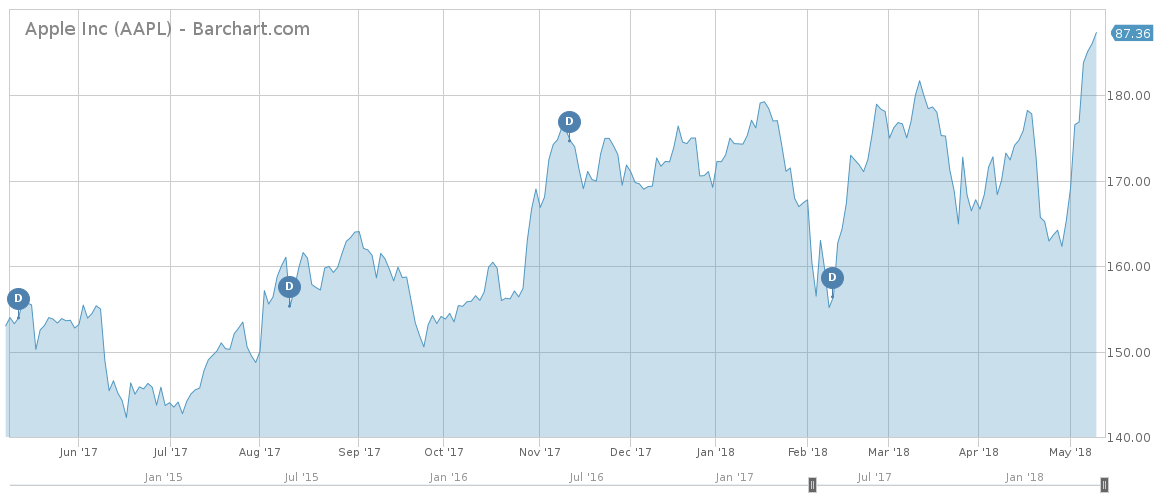

Apple Nears Trillion Mark After Earnings

Apple (AAPL ) stock has surged more than 5% in the past five days, hitting record highs, after the company posted strong earnings for the first quarter. As a result, viewership increased by 146% over the last week.

Apple sold 52.2 million iPhones during the first three months of the year, around 800,000 fewer than analysts had expected. However, the company’s revenues increased by 16% to $61 billion, largely thanks to higher prices for its flagship model – iPhone X. As a result, profits climbed by a staggering 25% to $13.8 billion.

On the back of strong results and a windfall from U.S. tax reform, Apple said it would buy back another $100 billion of its shares and increase the dividend by 16%. Currently, the company has an annual dividend yield of 1.55% and a payout ratio of around 25%. The company is going ex-dividend today, i.e. May 11.

Apple stock had dropped on market fears that demand for the latest iPhone was not as strong as expected due to its high price tag. Investor jitters increased after a Chinese supplier said demand was weak, but the latest results put cold water on the rumors. Apple has become a cash cow, with the iPhone its strongest attraction, but worries remain about its innovation prowess. The company’s HomePod was not as successful with consumers as Amazon’s Alexa, likely giving the latter an advantage in the race to bring artificial intelligence to consumers. Apple’s airpods, however, proved an instant hit and the company is now considering an upgrade.

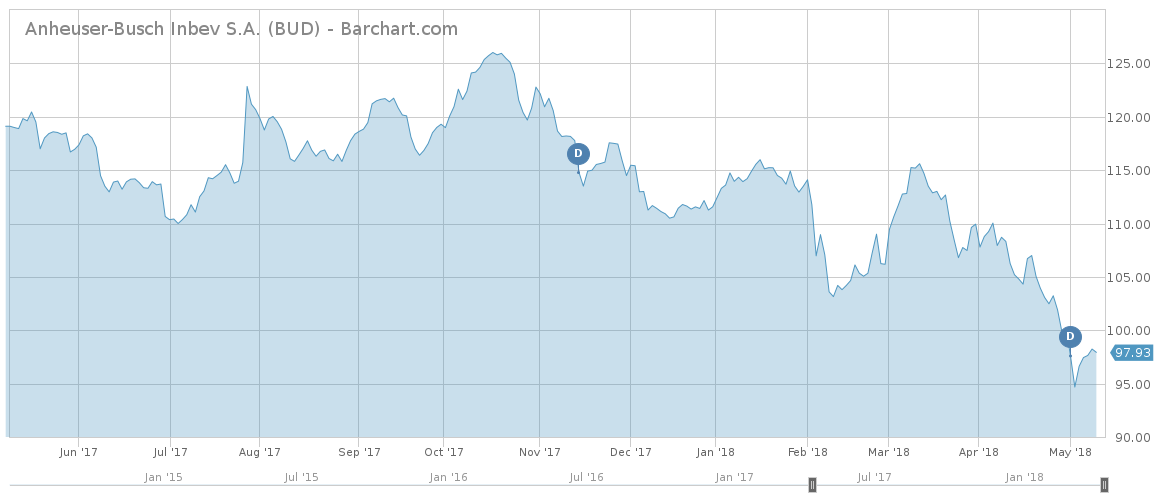

A-B InBev Rises on Strong Global Demand

Anheuser-Busch InBev (BUD ) has taken the third position in the list with a rise in viewership of 44%.

The largest beer company in the world is falling out of fashion in the U.S. but is gaining traction in foreign markets. Sales of A-B InBev flagship beer Budweiser dropped 1.3% during the first quarter due to falling volumes in the U.S. Overall sales, however, were slightly up compared to the same period a year ago thanks to booming demand from emerging markets, including Latin America and Asia. Revenues from emerging markets shot up by 2.5%. Notably, sales of Stella Artois surged 12% due to strong demand in the UK and Argentina.

The company has been struggling with falling demand at home as U.S. consumers are increasingly choosing craft beers. A-B InBev has acquired several smaller craft beer companies to capitalize on the trend, but its strong position in the global markets provided a bigger boon.

Shares in A-B InBev have risen 1.4% in the past five days, trimming year-to-date losses to 13%. A-B InBev yields a solid dividend of nearly 5.25% annually, representing close to 99% payout.

McDonald’s Up on Rebranding Effort

Burger joint McDonald’s (MCD ) has taken the last spot in the list with a 37% rise in viewership, as the company just launched a rebranding effort that it hopes will revive sales growth. Shares in MCD have risen 2.6% in the past five days, bringing year-to-date performance slightly into positive territory.

McDonald’s, which pays an annual dividend of 2.45%, will start using fresh, instead of frozen, meat in its burgers, as it tries to plug the gap with its competitors, including Wendy’s (WEN ). That way, the company expects to boost sales and therefore the stock price by stealing health-conscious customers from competitors.

The Bottom Line

This week, T-Mobile was in the spotlight as the third-largest telecommunications company in the U.S. is trying to get regulators to approve a merger with Sprint. Apple posted solid results for the first quarter thanks to higher prices for its latest iPhone, squashing fears of lower demand for its products. Beer giant Anheuser-Busch InBev is facing a declining market at home but the slack is recouped by overseas demand. Meanwhile, McDonald’s is attempting to boost sales through its latest initiative of using only fresh meat in its burgers.