Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

Earnings has been a common theme this week, with Facebook and Intel dropping consistently after publishing their financial results. The social media giant is trending first this week, followed by General Motors and Intel. Oil major ExxonMobil closes the list.

View our previous edition of trends here.

Facebook Swoons as Scandals Hit Prospects

Technology darling Facebook (FB ) has dropped massively in the aftermath of a downbeat earnings report for the second quarter, despite some market participants describing it as mixed. The debacle stirred viewer interest, with traffic surging as much as 560% in the past week. Facebook’s stock, which does not pay a dividend, has dropped 15% since the earnings report was revealed last Tuesday.

The social media juggernaut missed analyst estimates on almost all fronts, as the company is suffering the aftermath of the Cambridge Analytica scandal and the implementation of a new privacy policy in Europe that gives users more freedom over their personal information. Revenue came in at $13.23 billion versus $13.36 billion estimated by analysts, while global daily active users (DAU) was 1.47 billion compared with 1.49 billion forecasted by pundits. On the bright side, earnings per share of $1.74 beat expectations of $1.72 as revenue per user increased in the U.S.

Despite the Cambridge Analytica scandal, U.S. users continued to use the company’s platform, with DAU remaining flat. In Europe, the impact of the European Union privacy changes left a mark on DAU, down to 282 million. Chief Operating Officer Sheryl Sandberg said the rollout of the privacy changes is just at the beginning, potentially affecting advertising revenues in the coming quarters.

Investments in some news products may hit profitability over the next quarters, particularly given that Facebook badly missed on advertising revenue projections – $13.04 billion against $13.16 billion. In addition, Facebook’s stated focus on privacy will undoubtedly hit revenue growth. Tough times ahead.

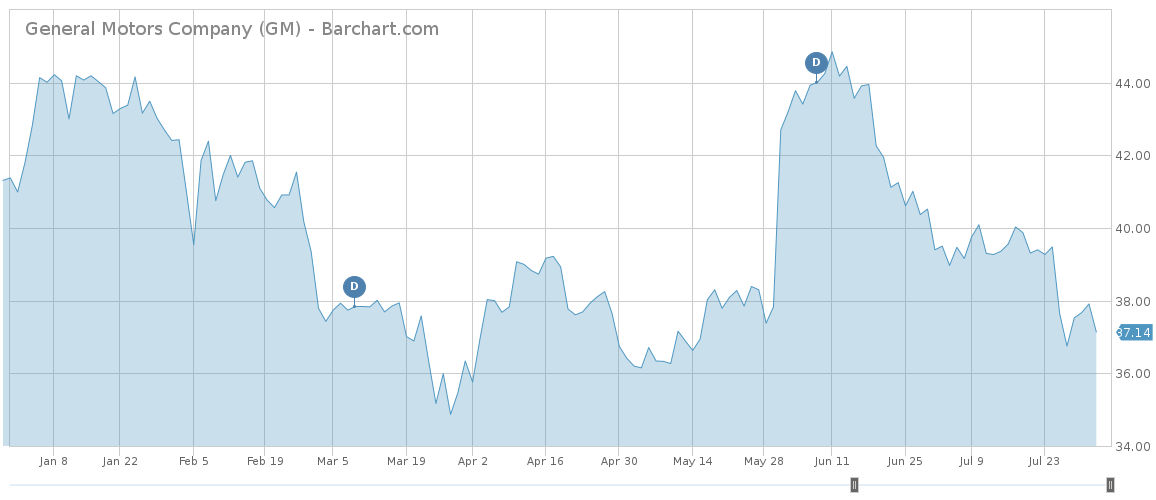

General Motors Slumps on Poor Outlook

Car manufacturer General Motors (GM ) saw brighter days. In a sign that Donald Trump’s trade war is already starting to bite local manufacturers, the car giant reduced its outlook due to higher prices for aluminum and steel. The stock price dropped more than 6% on the news reported on July 24 but recovered some of the ground since then and is now down just 2.6%. Traffic to GM increased 71% during the past week.

The automaker forecasted earnings of $6 per share in 2018 compared to $6.30 and $6.60 expected previously. GM said increases in commodity prices will hit profitability as a tit-for-tat battle in the car market makes it almost impossible to pass the price increases on to consumers. Indeed, rival Fiat Chrysler also cut its outlook and the stock price tumbled, although the unexpected death of CEO Sergio Marchionne also had an impact.

Higher commodity prices was not the only reason for the lower outlook. GM said the foreign exchange impact of the Argentine peso and Brazilian real weighed on business expectations.

Second-quarter results were impressive, however. Net income rose 40% to $2.39 billion, while adjusted earnings per share came in at $1.81, higher than the $1.78 figure expected by analysts. Revenue was $36.76 billion, higher than estimates but down 0.6% compared to the same period a year earlier.

GM returns to shareholders 25% of its profits annually, equal to a solid yield of 4.10%. The company is on track to pay its $0.38 quarterly dividend at the beginning of September.

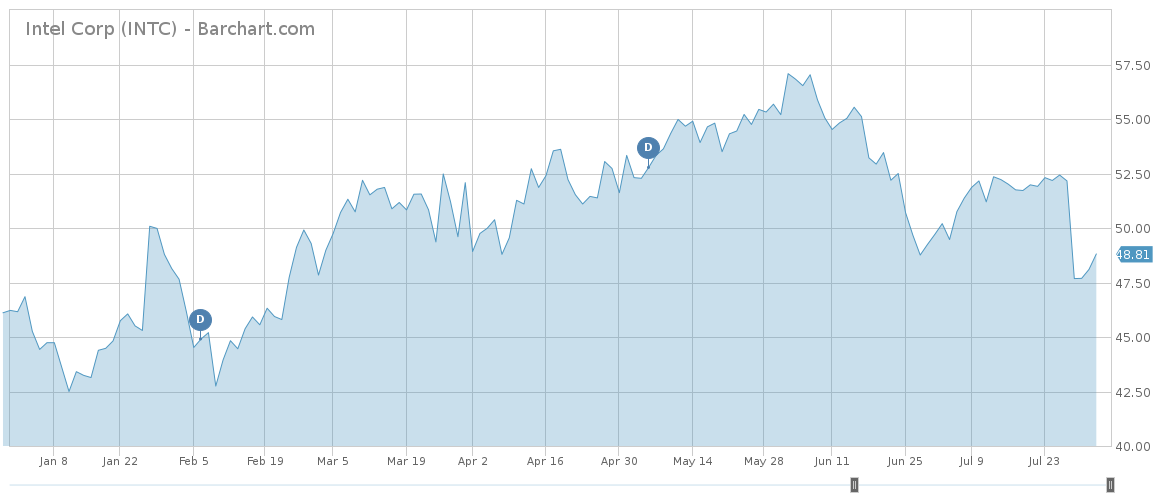

Intel Falls Despite Beat

Even companies that beat earnings expectations are failing to convince bulls. Chip giant Intel (INTC) has dropped more than 6% after it reported better-than-expected earnings. Intel has seen its viewership advance 48% in the past five days.

On revenues of $16.96 billion the company posted earnings per share of $1.04, excluding certain items, in the second quarter. Analysts had expected revenues of $16.77 billion and earnings per share of $0.96. The beat was possible thanks to strong business in Intel’s largest segment – client computing group. The other two sectors, data centers and memory, largely disappointed.

Intel also increased its guidance for the full year, with earnings per share expected to come in at $4.15 and revenues at $69.5 billion. The company, founded 50 years ago, believes gross margins will suffer in the fourth quarter.

The strong results come as CEO Brian Krzanich abruptly resigned recently due to a consensual relationship with an Intel employee, a behavior that is against the company’s policies. Given the competitive pressures, the company cannot afford a protracted CEO search given that interim CEO Bob Swan said he is happy with his current role as chief financial officer.

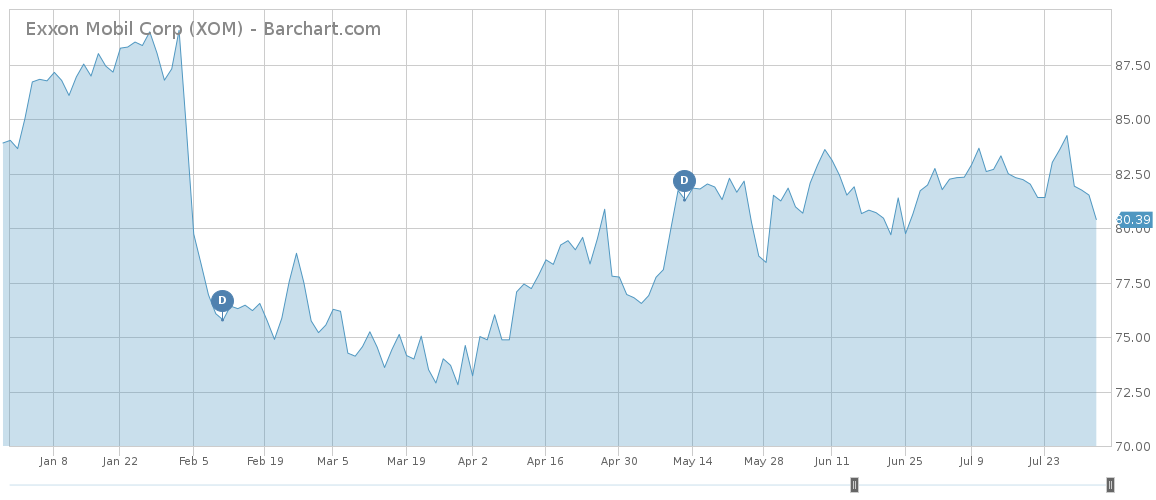

ExxonMobil

ExxonMobil (XOM ) has seen its viewership rise 38% in the past week as the company reported earnings for the second quarter. Despite improving revenues from higher oil prices, weaker earnings in the marketing and refining segment hit the bottom line. As a result, the company again missed analyst expectations. The oil major’s stock has plunged more than 4% in the past five days, extending year-to-date losses to 5.5%.

Profits rose 18% to around $4 billion thanks to rising oil prices, but maintenance costs in the division that refines oil and sells gasoline took a toll on results. Earnings per share of $0.92 were woefully below expectations of $1.27. Revenues of $73.5 billion topped estimates by $900 million.

The Bottom Line

Facebook’s stock has plummeted as investors were disappointed by the relatively bleak outlook provided by the social media giant. General Motors has slumped as higher commodity prices are expected to hit the bottom line. Intel also dropped despite strong earnings, while Exxon’s results woefully underwhelmed.