Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

Beer giant Anheuser Busch Inbev and Tesla are sharing the podium in the trends this week due to negative publicity lately. General Electric is third in the list as the fallen U.S. industrial icon may be on track for a recovery. J.P.Morgan Chase, which also trended two weeks ago, closes the list.

Dark Clouds Ahead for Anheuser Busch

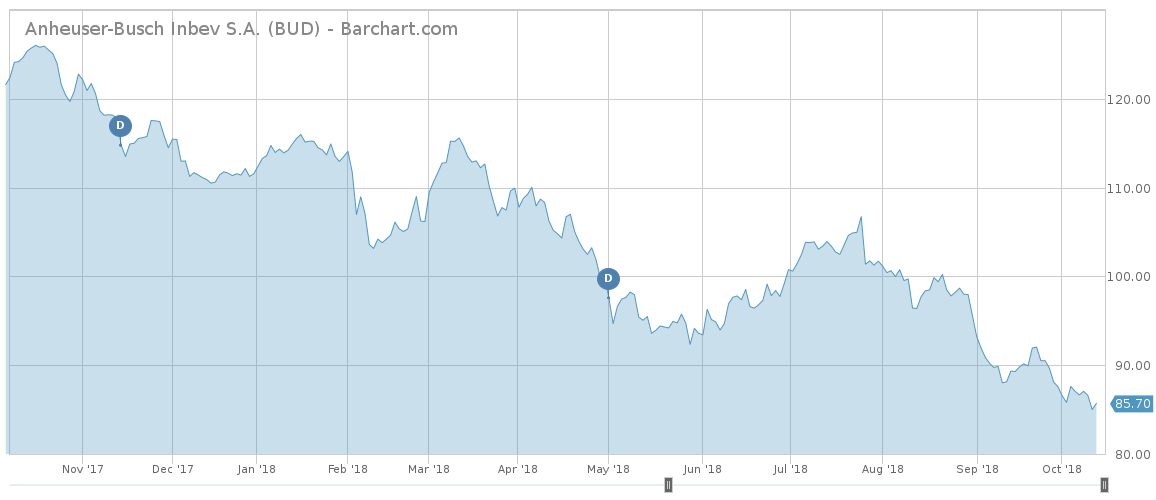

U.S. beer giant Anheuser-Busch InBev (BUD ) saw its viewership rise as much as 19% in the past week, as the company is at the risk of halting dividend payments due to its high debt. Anheuser-Busch, which yields as much as 5.5% annually, pays out more than a 100% of its profits to investors, making the current dividend rather unsustainable.

The company, which counts Budweiser, Leffe and Stella Artois among its brands, has seen its stock drop around 22% in the past year to a market valuation of $170 billion, as a result of increasing competition in the beer market from smaller craft breweries, which are particularly popular with Millennials. Anheuser-Busch has more than $100 billion in debt on its balance sheet, more than double compared to two years ago. The company borrowed heavily to complete the acquisition of SABMiller for $108 billion.

To reduce its debt, the company may very well lower its dividend or even halt it altogether. It may resume dividend payments when the balance sheet is healthier.

The company also faces troubles with European Union regulators over its selling practices. Some brands are more expensive in Belgium than in neighboring countries like the Netherlands and France due to higher competition. The European Union authorities opened an investigation into the matter and Anheuser may receive fines. Even if it avoids penalties, margins in Belgium will likely suffer.

Tesla CEO Deriding SEC Settlement

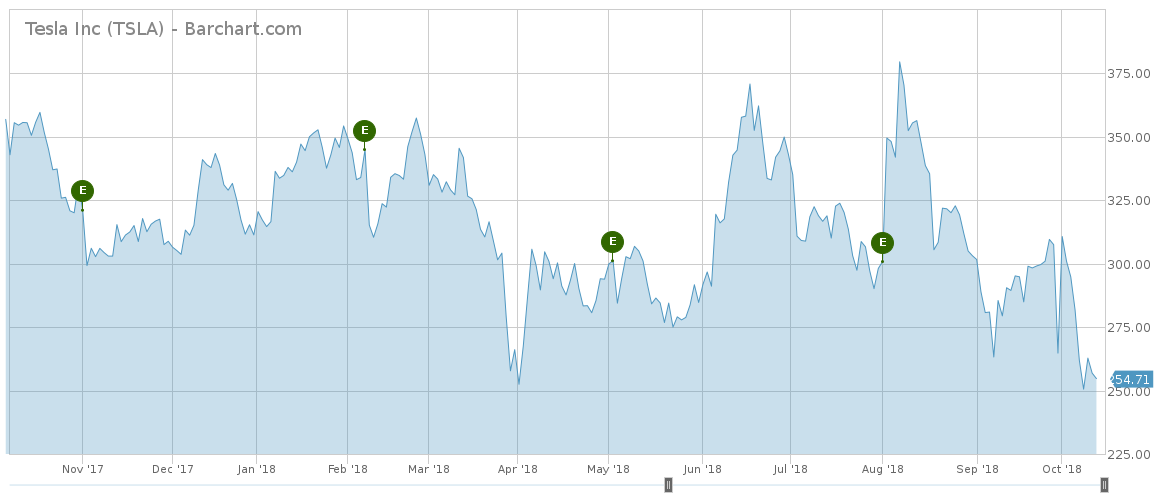

Tesla (TSLA) has been on a rollercoaster ever since CEO and visionary founder Elon Musk started posting controversial tweets that eventually led to an investigation by the Securities and Exchange Commission (SEC).

In a fierce battle with a spate of short sellers, Musk tweeted that he had “funding secured” for taking Tesla private at $420 per share. The stock rallied on his odd Twitter announcement, likely bringing losses to short sellers. The event caught the attention of the SEC because Musk deceived public markets and did not have funding secured to take the firm private. After the SEC threatened to sue Tesla and Musk, the sides eventually reached a deal under which they will pay a $20 million fine each and Musk agreed to relinquish his chairman role for three years.

Shortly after the deal was inked, Musk came out with another controversial tweet, describing the SEC as “Shortseller Enrichment Commission.”

Tesla stock has dropped 14% in the past five days, extending year-to-date losses to nearly 20%. At their peak this year, Tesla shares traded at $370 per unit and were up 20% since the start of the year. They have never approached the $420 mark, suggesting investor skepticism regarding Musk’s announcement.

Tesla is one of the most loved and hated companies at the same time on Wall Street. Fans are believing in Musk’s vision to create an environment-friendly ecosystem of cars and homes, while detractors point out that the company is burning cash at a fast rate and will eventually collapse.

GE Makes Fresh Start

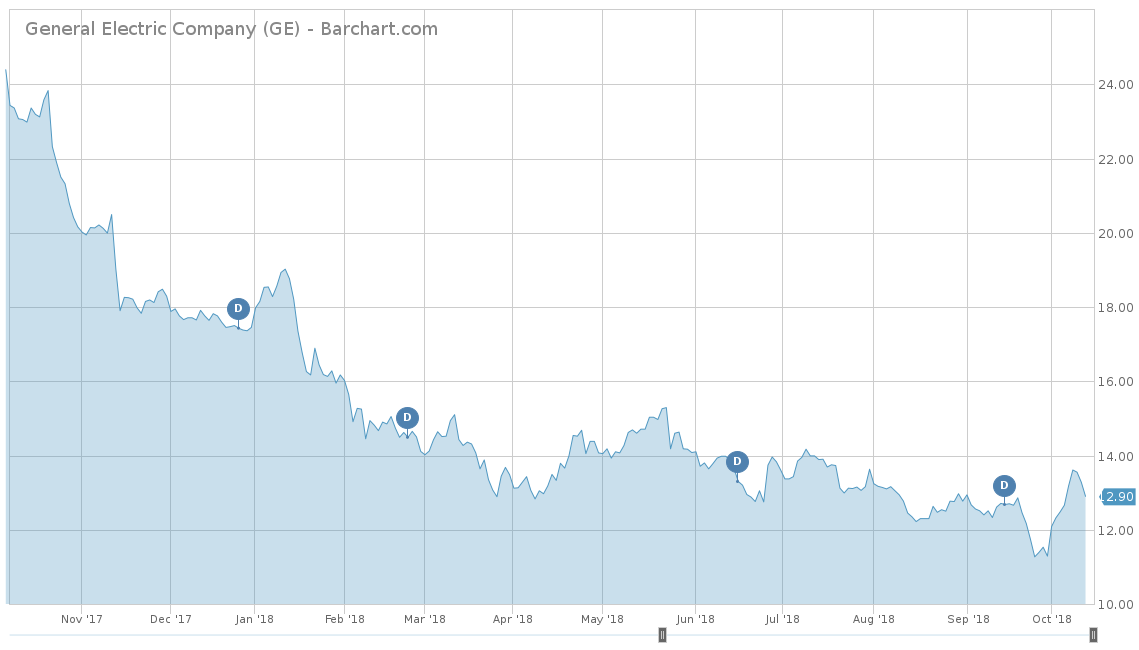

General Electric (GE ) has taken the third place in the list this week with 15% rise in viewership, as the storied industrial conglomerate is starting over with a clean slate by overhauling the leadership. CEO and Chairman John Flannery was replaced at the beginning of this month with Lawrence Culp, former CEO at Danaher. Flannery served a little more than a year in the CEO shoes, with the stock price falling further under his watch and the company losing its cherished place in the Dow Jones index.

It appears that the company’s board was not happy with the pace of change under Flannery. And the markets were excited about the news of his departure. Shares in GE have risen 5% over the past five days, trimming year-to-date losses to 24%. During Flannery’s tenure, the stock price lost nearly half of its value and now the company has a market valuation of $115 billion.

Under Culp, the company is expected to increase the pace of its restructuring process by ditching non-core businesses, such as its financial arm, and focusing fully on its industrial unit.

J.P. Morgan Chase

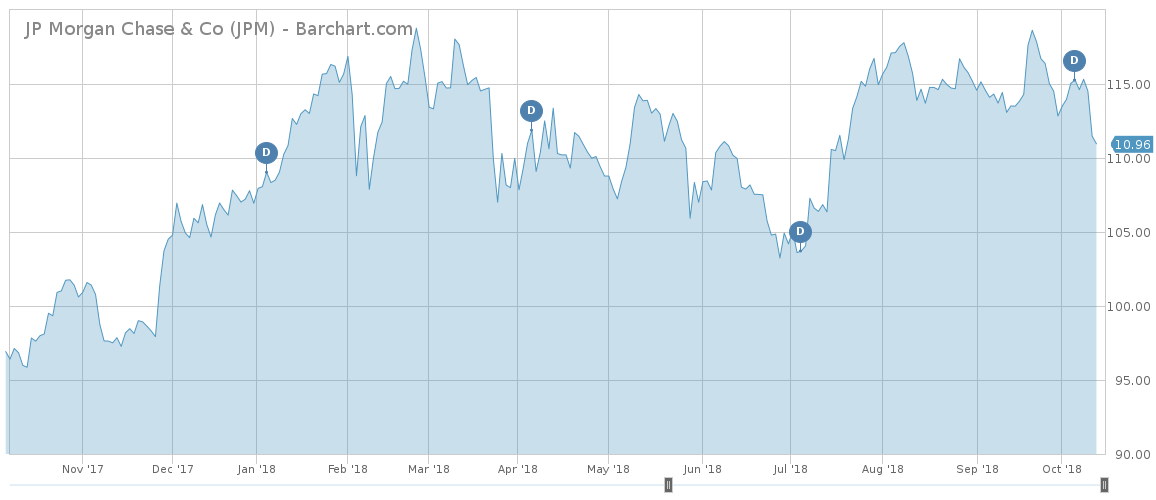

J.P.Morgan Chase (JPM ), one of the largest U.S. banks, is last in the list with an 11% advance in viewership. J.P.Morgan, which provides a dividend yield of nearly 3% on a payout ratio of 35%, is expected to announce its earnings results on October 12. Analysts expect earnings per share between $2.25 and $2.33, but the company has beaten expectations in the past 11 quarters.

J.P.Morgan is one of the few banks that is expanding its brick-and-mortar operations, while many others are in retreat. The bank believes there is still need for physical branches to meet consumers’ various needs.

Shares in the bank are down more than 3% over the past five days amid a broad market sell-off. The S&P 500 had declined over 4% during the same period.

The Bottom Line

Beer giant Anheuser-Busch Inbev may be forced to slash its dividend as it struggles in a highly competitive market and is plagued by a mountain of debt. Tesla stock has been whipsawing after CEO Elon Musk announced he was taking the company private only to retract the commitment days later. General Electric replaced its CEO again as it looks for a fresh start amid a tumbling stock price. J.P.Morgan, which pays a strong dividend, is on track to announce its earnings results for the latest quarter.