Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

Ford has concluded a volatile year on a pessimistic note with the stock continuing its poor performance in the last month amid heightened volatility. J.P.Morgan Chase, one of the stars in the banking sector in 2018, was in the news for settling a Securities and Exchange Commission case. Cisco Systems trended third this week, while telecommunications giant Verizon closes the list.

Be sure to check out our recently published edition of annual trends here.

Ford Motor

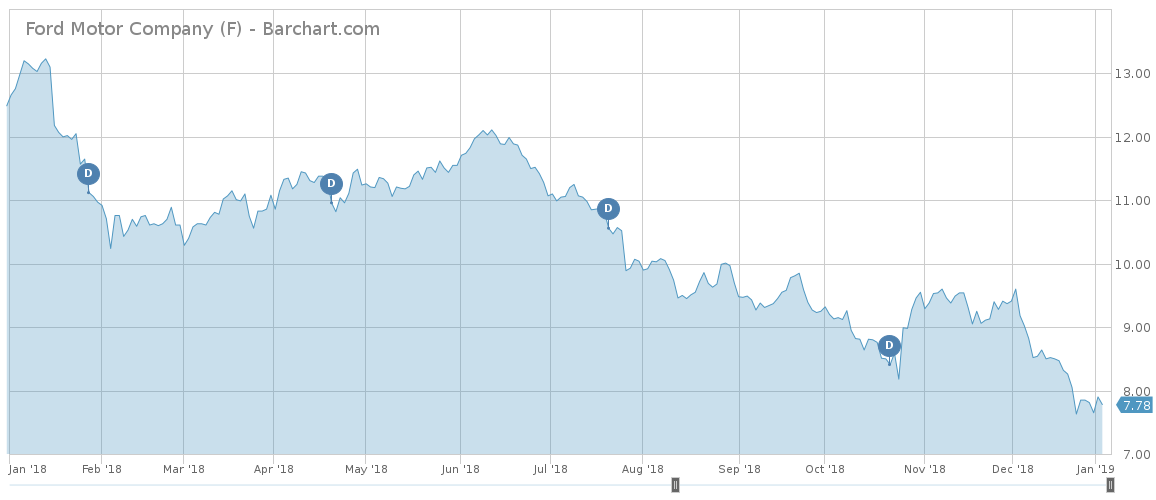

Ford Motor (F ) had one of its worst years in 2018 since the decade-ago financial crisis pushed it to the brink of bankruptcy. Although the stock yields a strong dividend of nearly 8%, the gains have been more than offset by a poor-performing stock price. In December alone, one of the most volatile months of the year, Ford lost around 22% of its value, bringing yearly performance to negative 37%. As such, Ford was one the most viewed topics over the past week with an increase in viewership of 31%.

Investors are rightly worried, although some may see an opportunity given the stock is trading at a P/E ratio of just 5. Bankruptcy concerns are still vivid although the consensus is that the company is better-positioned to withstand turbulence.

The trade war between the U.S. and China is likely to hit the company’s sales targets. Indeed, sales in China have already dropped lamentably in 2018 in part due to shifting customer tastes. To return to sustainable profitability, the company needs to significantly overhaul its operations.

Although the company is faring relatively well in Europe, rising interest in the U.S. is likely to dent demand at home. General Motors already announced plans to cut 14,000 jobs in preparation for potential macroeconomic headwinds. Investors fear Ford will share a similar fate.

Ford itself does not expect to see significant improvements in profitability until 2020, but the company may have to push back the achievement of its targets if an eventual economic calamity hits.

You can use the Dividend Screener tool to explore dividend-paying securities that fit your investment criteria.

J.P.Morgan Chase

J.P.Morgan Chase (JPM ), which saw an increase in viewership of 31%, is likely one of the best examples of a company doing all the right things and still getting punished by investors.

In 2018, the company’s bottom line and its assets under management continued to expand under the leadership of Jamie Dimon. However, the consistent earnings beat failed to translate into strong returns for investors. Quite the opposite, the stock ended the year down more than 8%, with most of the losses taking place in December. Indeed, at the beginning of last month, (JPM ) was up nearly 5%, a performance that was in line with the S&P 500. It ended the year around 3 percentage points below the benchmark.

J.P.Morgan’s poor performance came as the bank agreed to settle claims of improperly handling thousands of transactions involving shares in foreign companies. The bank will pay a fine of $135 million to the Securities and Exchange Commission to settle the charges, but did not admit or deny any wrongdoing.

Investors have likely punished the stock in view of the global macroeconomic headwinds. As the largest bank in the U.S., J.P.Morgan benefits when the economy is strong but also suffers when troubles occur.

Cisco Systems

Cisco Systems (CSCO ) has seen its traffic surge 31%, equaling Ford and J.P.Morgan Chase. While both Ford and J.P.Morgan disappointed in their own way, Cisco was one of the best performers this year, outperforming both the Dow Jones and the S&P 500. Indeed, Cisco stock has advanced 11% over the past 12 months, while both indices posted big losses. Add the strong dividend yield of 3% and the technology juggernaut proves an attractive investment.

Cisco, which makes telecommunication equipment, has been favored by investors thanks to its strong growth rates and operating margins. For the fiscal first quarter of 2019, the company reported revenues of $13.1 billion, up 8% compared to the same period last year. The growth was balanced across business units, with the infrastructure unit, responsible for half of the income, growing by 9%, and the applications segment up 18%, among others.

Chuck Robbins, the company’s CEO and Chairman, touted the opportunity in the applications segment, saying at the last earnings call in November that there is strong demand for automated and more secure IT infrastructure.

Check out our complete list of Best Dividend Stocks.

Verizon

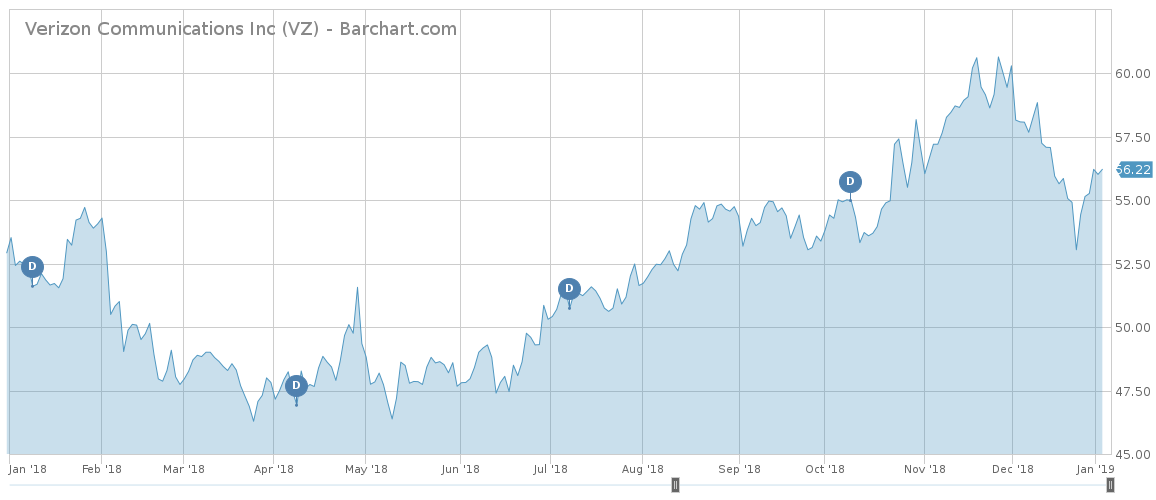

Verizon (VZ ) has seen its viewership increase 29%, as the telecommunications giant was among the best performers this past year. Indeed, Verizon stock is up 7% over the past 12 months, versus a loss of 9% for the S&P 500. The chief thing that distinguished Verizon from its competitors and other companies is that it continued to double down on its core business – network infrastructure. The strategy is bringing results, with news recently emerging that the company plans to double the speeds available through its 5G Home service.

Verizon’s arch-rival , AT&T (T ), has performed badly over the past 12 months, losing 21% of its market capitalization. Investors have become increasingly worried about AT&T’s ability to service its huge debt given the rising interest rates. Most notably, AT&T bought cable TV provider Time Warner in 2018 for $85 billion. Before that, it acquired DirecTV for nearly $50 billion.

The Bottom Line

Ford, J.P.Morgan Chase and Cisco Systems all share the first place in the list, although each for different reasons. Ford stock has been battered due to concerns over its profitability and deteriorating macroeconomic picture, while J.P.Morgan’s stock performance has been rather sluggish despite posting consistent earnings beats. Cisco and Verizon were both favored by investors thanks to their strong results and lean businesses.

Be sure to visit our News section to catch the latest on dividend investing.