Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

United Parcels Service is leading the trends this week, as the delivery company along with the entire delivery industry are facing threats from Amazon. Energy giant British Petroleum is slowly caving in to pressure from climate change activists. Car-maker General Motors took the third spot, and Walt Disney closes the list.

Check out our previous edition of trends here.

UPS

UPS (UPS ) has taken the first spot in the trends’ list this week, seeing a rise in viewership of 45%. UPS has recently reported strong earnings, despite a challenging environment and threats from Amazon, which is making an entrance in the delivery sector. UPS said revenues increased 4.6% to $19.85 billion in the last three months of 2018. Meanwhile, net income dropped to $453 million from $1.1 billion a year ago, although the decline was due to one-off pension charges. Adjusted profit per share came in at $1.94 compared with expectations of $1.90.

The company has been increasing investments in technology, new aircraft and automated capacity to keep up with a surge in online shopping. At the same time, its business is threatened by Amazon (AMZN), which is attacking the delivery sector as part of its effort to have more control over the delivery process. Amazon said it plans to build an air hub capable of housing 100 planes and order 20,000 vans for ground deliveries.

Morgan Stanley estimated in a recent note that Amazon’s new delivery capabilities will take away 2% of UPS’ business in 2018 and 10% by 2025. For now, Amazon is focusing on last-mile delivery as it struggles to improve delivery timing. As the technology behemoth reduces its reliance on traditional delivery companies such as UPS and FedEx (FDX ), the development poses a long-term threat to the entire industry.

For now, UPS stock is performing well. Shares in the company have risen more than 15% year-to-date. The company is also paying a dividend of 3.28% and has a payout ratio of more than 50%.

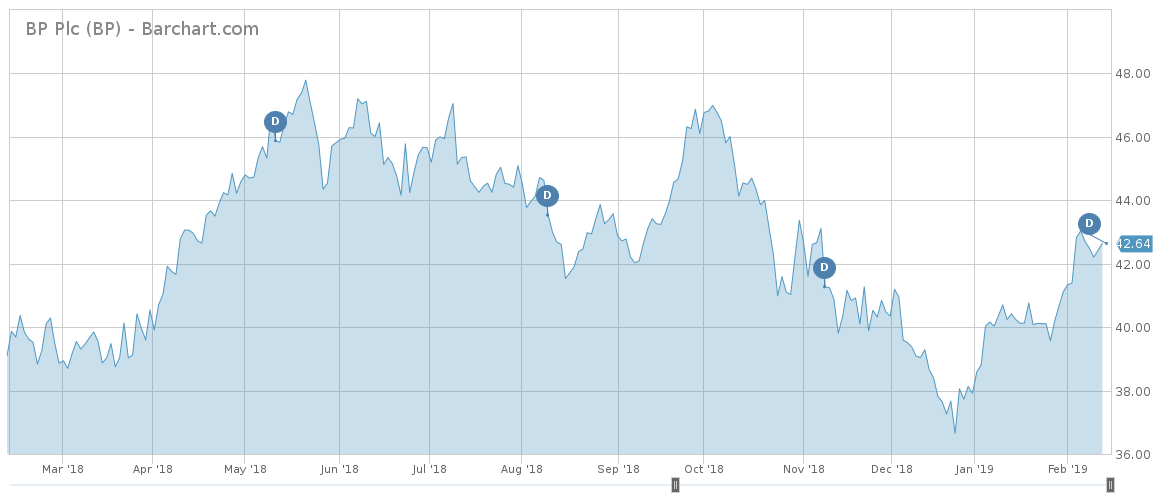

BP

Major oil and gas company BP (BP ) is slowly acknowledging the threat climate change poses and taking steps to align its business strategy accordingly. The company, which pays a juicy dividend yield of 5.71%, has seen its traffic surge as much as 40% this week, as its stock price staged an impressive recovery year-to-date. Shares in BP have risen 12% since the start of the year and is up 7% over the past 12 months.

The board of BP has said it will back a shareholder proposal that forces the company to integrate the Paris Agreement on climate change in its business strategy, meaning a commitment to contain the global warming in the current century below 2 degrees Celsius. In 2015, a resolution seeking to increase BP’s transparency regarding climate change risks was approved by shareholders. The current proposal was backed by more than 300 institutional investors, including California Public Employees’ Retirement System, HSBC Global Asset Management and Manulife Asset Management.

BP’s commitment comes after a stellar 2018 in terms of performance, with profits doubling compared to the prior year. The company reported net income of $12.7 billion as a recovery in the oil and gas markets boosted results.

You can use the Dividend Screener tool to explore dividend-paying securities that fit your investment criteria.

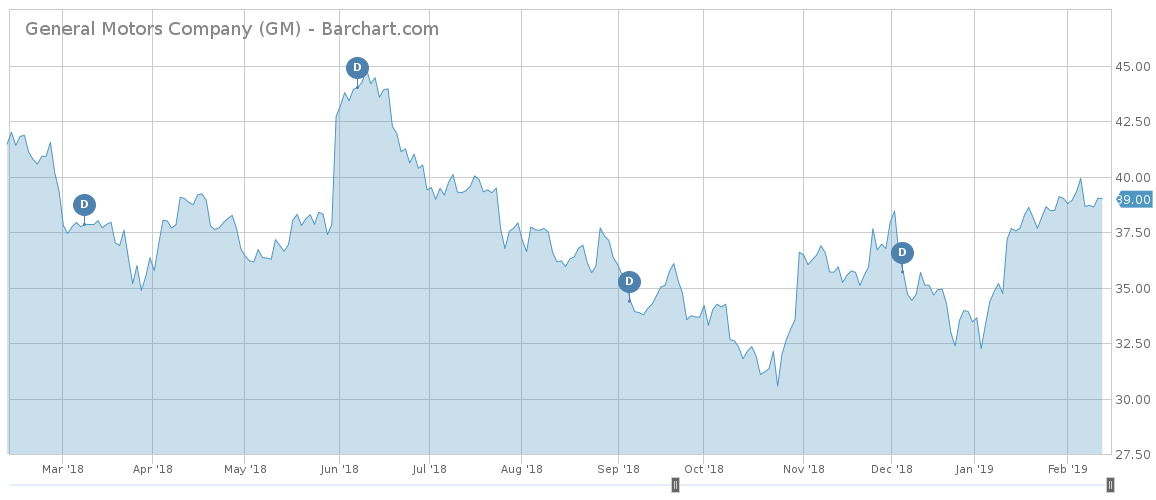

General Motors

General Motors (GM ) has made headlines in recent days on rumors the company is planning to invest in an electric pickup truck startup. The iconic car manufacturer has seen its viewership rise as much as 39% in the past two weeks, as a result of the news.

General Motors is joined by online retailer Amazon in its bid to invest in Rivian Automotive, an electric truck manufacturer that plans to hit the market in 2020. GM’s potential venture in Rivian comes at a time when the company has already acquired Cruise Automation along with Softbank Group. Cruise is working exclusively on making GM’s electric vehicle Chevy Bolt fully autonomous.

The investment will mark another challenge for Tesla (TSLA), which has been struggling to turn a consistent profit with its high-priced electric vehicles. The company led by Elon Musk indicated in the past plans to make an electric truck, but the launch is expected after 2020.

Elsewhere in the news, GM released its fourth-quarter results, reporting earnings of $1.43 per share on revenues of $38.4 billion. Analysts had expected only $1.22 per unit and revenues of $36.48 billion. Shares in GM have risen nearly 4% over the past 30 days.

Check out our complete list of Best Dividend Stocks.

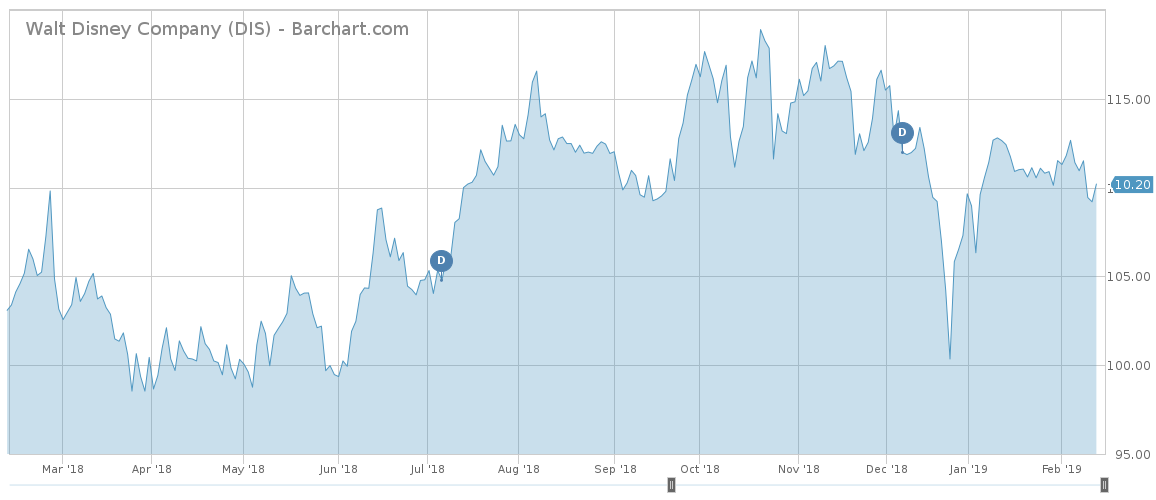

Walt Disney

Walt Disney (DIS ) takes the last spot in the trends’ list this week with a 37% rise in viewership. The media company reported fourth-quarter results this month that beat expectations, despite fears from cord-cutting and the advent of streaming companies. Adjusted net income came in at $1.84 per share, beating expectations of $1.54. Revenues declined 1% to $15.3 billion, but again was above forecasts of $15.16 billion.

Disney’s strong results come as the entertainment company prepares to launch its own streaming service by the end of 2019, joining the streaming wars in an attempt to offset falling revenues and viewership at its domestic and international channels. The Fox acquisition, expected to be complete soon, will boost the company’s offerings along with Hulu. CEO Bob Iger said the company might provide three services, Hulu, Disney and ESPN, on a single platform, although he noted it was premature to discuss plans until the combination is complete.

The Bottom Line

Be sure to visit our News section to catch the latest on dividend investing.