Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

With the exception of Walmart, this week’s trends were all about disappointments. The retail giant leads the pack this week, followed by Berkshire Hathaway, which made the news with the Kraft Heinz debacle. Teva Pharmaceutical slumped after the company warned of a tough 2019, while Home Depot cautioned sales will be slowing this year.

Check out our previous edition of trends here.

Walmart

Walmart (WMT ) has seen its viewership rise 97% this week, as the retail giant made the headlines with its push into advertising to boost its bottom line. Walmart said it would allow its suppliers, such as Unilever and Procter & Gamble, to advertise in its stores across America and online.

The company follows in the footsteps of Amazon (AMZN), which has seen its advertising sales nearly double in its fourth quarter to $3.4 billion. The online retail giant is now one of the biggest forces in advertising after Facebook (FB ) and Alphabet (GOOG).

Walmart CEO Doug McMillan has made clear that the company’s advertising revenue is small and could get much bigger. Forrester Research has estimated that Walmart attracts more customers than both Alphabet and Facebook, with as many as 300 million shoppers visiting its physical stores each month. In addition, millions of customers buy from its online stores.

Walmart stock has declined nearly 2% over the past five days but remains up nearly 7% since the start of the year. The retailer returns around half of its profits to shareholders via a dividend that yields 2.15%.

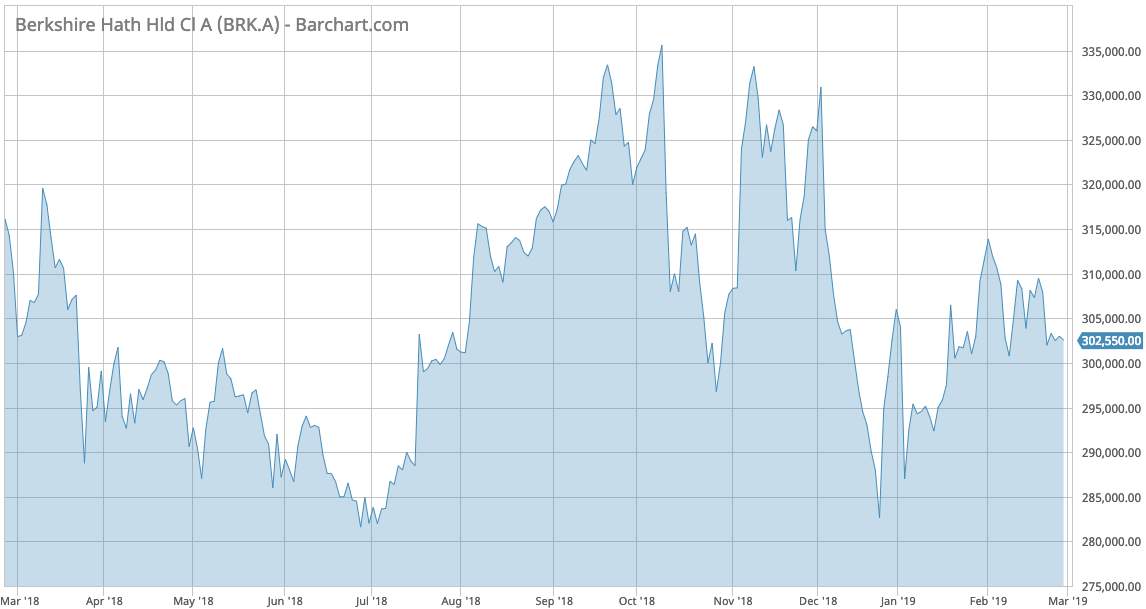

Berkshire Hathaway

Berkshire Hathaway (BRK-A) has made the headlines of late for all the wrong reasons and, as a result, saw its viewership surge 83%. The sprawling investment conglomerate led by iconic investor Warren Buffett was dragged down by food giant Kraft Heinz, which saw its stock price lose a third of its value after reporting weak progress on improving profitability and unveiling an investigation into its accounting practices by the Securities and Exchange Commission (SEC).

Buffett, who owns around 27% of the Kraft Heinz shares, admitted that Berkshire had overpaid for Kraft but not for Heinz. He praised the fact that the company has been generating $6 billion in profits with only $7 billion in tangible assets and promised to stay invested. There has also been speculation that Berkshire may buy the entire company, and Czech Republic-based investor Krupa Global Investments has been calling on Berkshire to acquire the company since September.

However, Buffett may think twice before making a bid. While the company has posted consistent EBITDA growth, its operating cash flow has been rather disappointing, particularly compared to its peers. For instance, in 2017 the company reported EBITDA of $8 billion but its operating cash flow was a mere $527 million.

You can use the Dividend Screener tool to explore dividend-paying securities that fit your investment criteria.

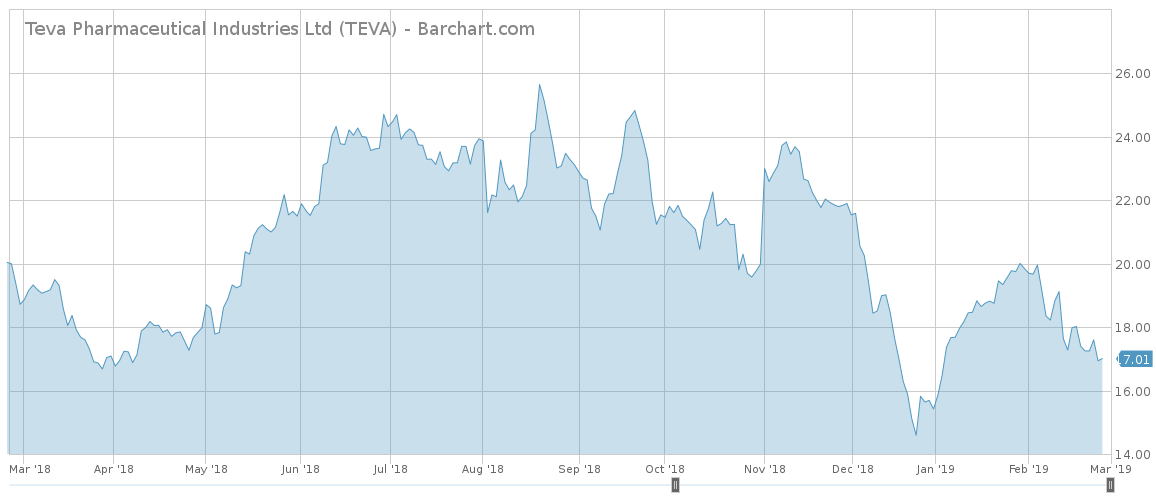

Teva Pharmaceutical

Teva Pharmaceutical (TEVA) has trended third, seeing its viewership surge 73% this week. The Israel-based pharmaceutical giant recently warned investors that 2019 will be difficult for the company but that it expected improvements the following year. The company’s results suffered in 2018 due to generic competition for its chief drug Copaxone, used to treat multiple sclerosis, and ProAir, an asthma medication.

The company forecasted revenues of $17-$17.4 billion, falling short of analyst estimates of $17.9 billion. Shares have lost more than 2% of their value over the past five days and are down more than 50% for the past 24 months.

Teva slashed $2.2 billion in costs this year alone by cutting as many as 14,000 jobs in a bid to improve profitability amid declining revenues. The company also reduced its research and development spending by 32% year-over-year to $1.2 billion.

Check out our complete list of Best Dividend Stocks.

Home Depot

Home improvement retailer Home Depot (HD ) is last in the trends’ list this week with a 64% advance in viewership. The company’s stock has shed more than 4% in the last five days, after the company cautioned investors that its like-for-like sales growth will slow this year as the home buying market starts to show signs of distress.

Existing home sales reached a three-year low of 4.94 million in January, short of analyst estimates.

Home Depot’s net sales increased 11% in the three months through February to $25.5 billion, around $100 million below estimates forecasted by analysts. Net earnings came in at $2.34 billion, up from $1.78 billion in the prior year. Comparable sales are expected to rise 5% in 2019, according to the company, slightly below the growth rate in 2018.

Home Depot yields a dividend of nearly 3% on a payout of more than 50%.

The Bottom Line

Walmart is venturing into the advertising business, potentially stealing market share from Amazon, Facebook and Google. Warren Buffett’s Berkshire Hathaway has suffered a blow after Kraft Heinz reported weak earnings and an accounting investigation by SEC. Teva Pharmaceutical is facing pressure on its top line from generic drug makers, while Home Depot warned of slower growth ahead.

Be sure to visit our News section to catch the latest on dividend investing.