Dividend.com analyzes the search patterns of our visitors every two weeks. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

Walgreens Boots Alliance has continued its downward spiral after announcing worse-than-expected financial results. The pharmacy retailer is followed in the list by DowDuPont, the chemicals conglomerate, which recently completed a spinoff. Advanced Micro Devices was third in the list for no apparent reason, while Cisco Systems trended after it brought in a new chief information officer.

Don’t forget to check out our previous edition of trends here.

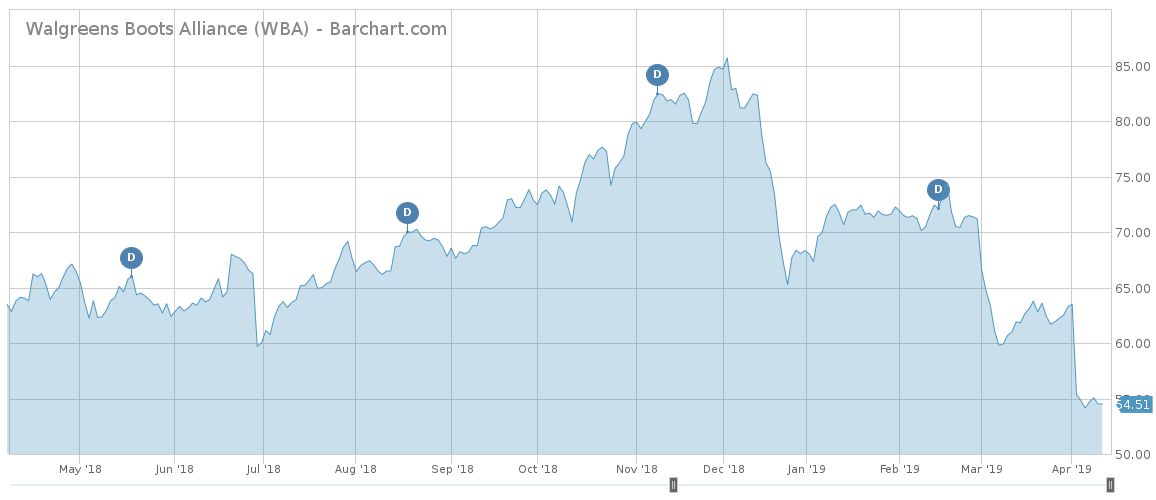

Walgreens Boots Alliance

Walgreens Boots Alliance (WBA ) has taken the first place in the list with an impressive 248% rise in viewership after the company cut its outlook for the full year amid slower sales due to a challenging environment.

The company has two brands: Walgreens, which operates in the U.S., and Boots, active in the U.K. Both faced a challenging quarter due to competition from generic drugs and online retailers such as Amazon (AMZN) . It was the most difficult quarter in the five years since the merger closed, Stefano Pessina, the company’s CEO said, adding that the response to the ongoing pressures was not fast enough.

Instead of increasing between 7% and 12%, the company said its profits would be flat for 2019. Although U.S. prescription drug sales rose nearly 10% in the second quarter, gross profit declined by 3.2%, as drug inflation has slowed. Sales in the U.K. dropped more than 7% year-on-year to $3.1 billion, while margins were hit by National Health Service’s cuts in reimbursements.

As a result of slowing sales, Walgreens added another $500 million to its $1 billion cost-cutting effort in a bid to improve profitability.

Shares in Walgreens shed around 13% on the day of the announcement, extending 3-month losses to 24%. At the moment, the company’s stock trades at half of its peak value reached in mid-2015.

Use the Dividend Screener to find high-quality dividend stocks based upon 16 parameters. Stocks with the highest DARS ratings are Dividend.com’s current recommendations to investors.

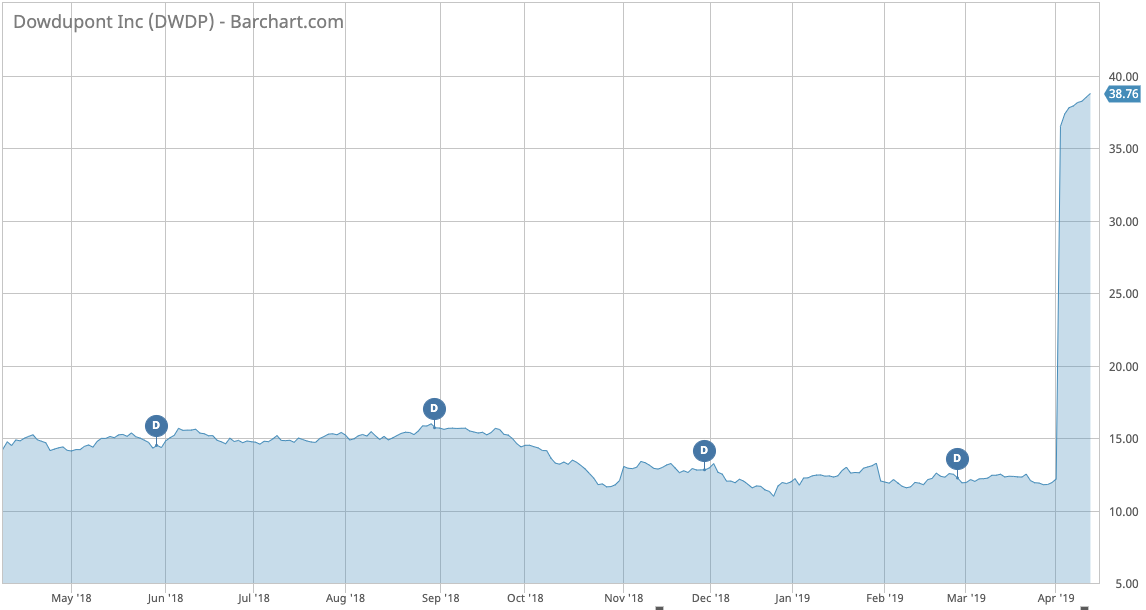

DowDuPont Warns of Earnings Drop as Split Starts

DowDuPont (DWDP) has taken the second spot this week, seeing its viewership advance 77%. Just ahead of a planned three-way split, DowDuPont said its earnings dropped by a percentage in the high teens in the first quarter of the year, largely due to flooding in the U.S. Midwest and a margin squeeze in plastics and packaging business.

In the Midwest, a key farming region in the U.S., transport disruption caused by floods halted operations. In addition, sales in the plastics and packaging unit declined by more than expected. The unit is part of Dow, which was spun off from the combined company on April 2. The spinoff of Corteva, the agriculture business, is expected to be completed in June.

Shares in DowDuPont have risen more than 3% over the past five days, trimming 12-month losses to around 10%. DowDuPont pays a quarterly dividend of 38 cents per share. Both Dow and DuPont had paid dividends every year since 1912 and 1904, respectively.

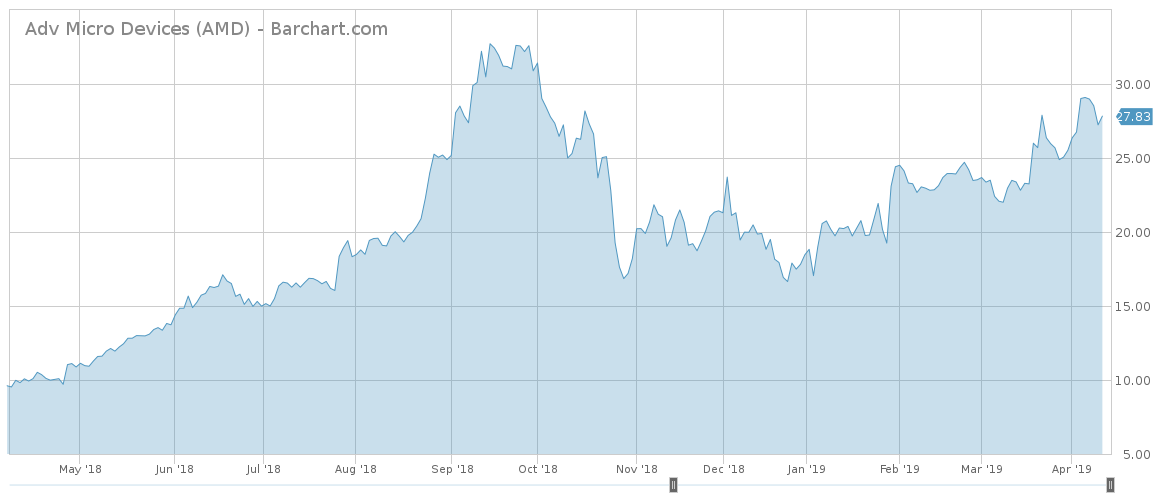

Advanced Micro Devices

Advanced Micro Devices (AMD) has experienced a traffic rise of 65% over the past week, taking the third spot in the list.

AMD has received a boost after analysts at Cowen raised their price target from $28 to $33, noting their strong competitive position against Intel (INTC), the semiconductor company they have been competing neck-and-neck with for decades. Cowen believes the company could take more market share from Intel than previously thought, with the earnings on April 24 likely to show whether Cowen’s thesis holds water.

Shares in AMD, which does not pay a dividend, have dropped more than 4% over the past five days, although they remain up 56% since the start of the year. Intel is up 19% over the same period.

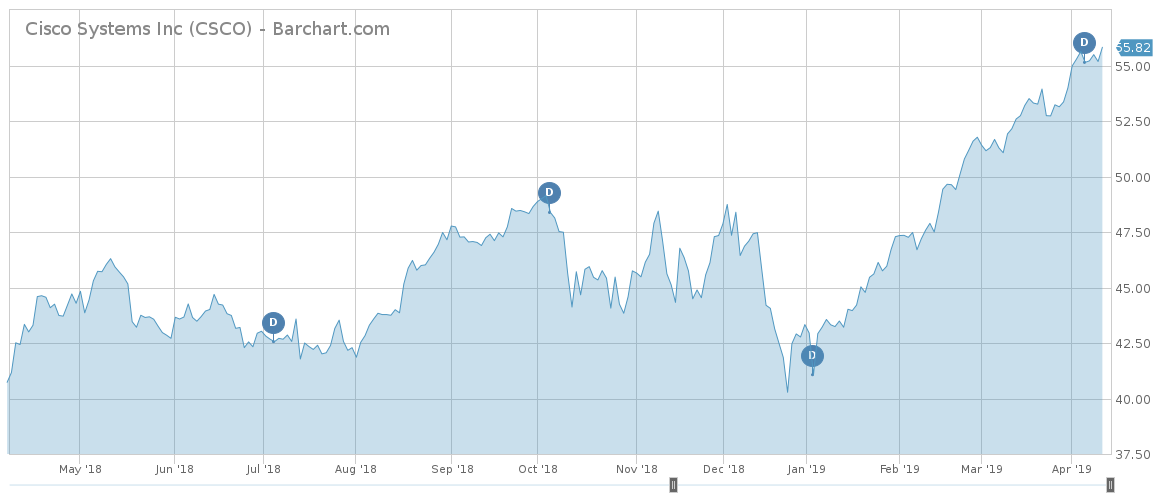

Cisco Hires New CIO as Firm Bets on Software

Cisco Systems (CSCO ) has taken the last spot in the list this week, seeing a rise in viewership of 46%.

The telecommunications behemoth was in the news after it hired a new chief information officer as it doubles down on a bet on software services. Jacqueline Guichelaar, a former group CIO at Thomson Reuters, was hired as CIO to fill the void left by the departure of Guillermo Diaz Jr., who served in the role since 2015 and will transition to the role of senior vice-president for customer transformation.

Guichelaar will oversee the company’s information technology infrastructure and application development. In recent years, Cisco has tried to shift its business from one-time sales of routers and telecommunication equipment to more recurring revenues such as software-as-a-service.

In February, the firm said it earned a net income of $2.8 billion in the second quarter ended January 26 on revenues of $12.4 billion. Non-GAAP earnings of 73 cents was up 7% compared to the same period a year ago. Cisco’s dividend yields 2.51% annually on a payout of 52%.

The Bottomline

Walgreens Boots is facing tough times ahead as the retailer faces growing competition from Amazon. DowDuPont warned of weak results ahead of a planned three-way split. Advanced Micro Devices was boosted after an analyst said it may be well-positioned to steal some market share from Intel. Finally, Cisco hired a new chief information officer as the company bets on software.

Be sure to check out Dividend.com’s News section for next week’s Market Wrap and other great dividend investing news.