Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

Qualcomm has made headlines of late after an unexpected deal with Apple to drop all legal battles around the world, triggering a surge in its stock price. Second on the list is UnitedHealth Group due to jitters regarding changes to the U.S. health system. Blackstone Group, the publicly-listed private equity firm, is third on the list as the firm converted into a corporation, while Kinder Morgan posted strong results for the first quarter.

Don’t forget to check out our previous edition of trends here.

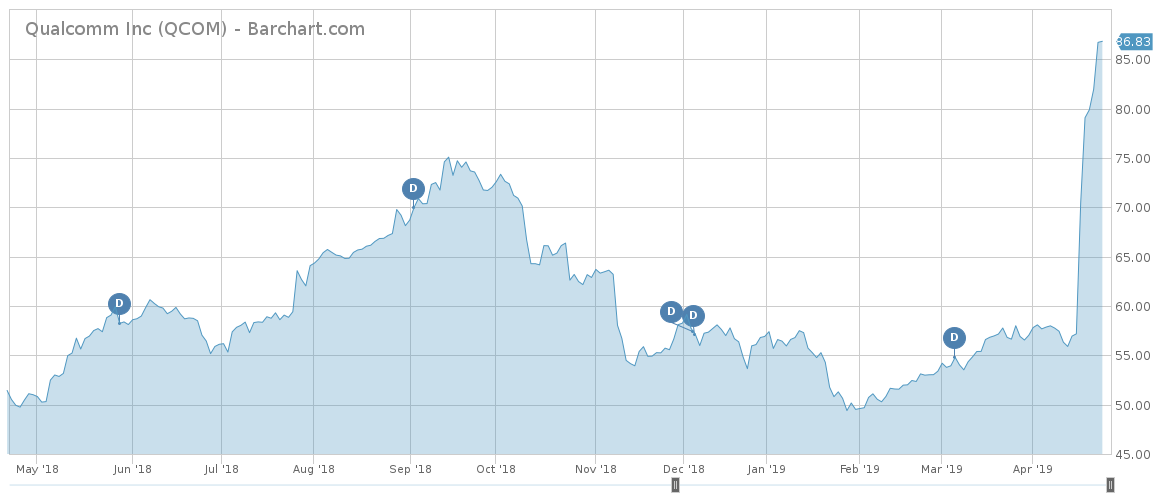

Qualcomm Reaches Deal With Apple

Qualcomm (QCOM ) has taken the first spot on the list this week with a rise in viewership of 185%. That is unsurprising given that the chipmaker struck an agreement with smartphone-maker Apple to end the expensive legal battle over its royalty business. As a result, Qualcomm stock has surged more than 50% over the past month, as investors expect the company will recover the cash flow from royalties.

The settlement is perceived as a huge victory for Qualcomm, which, just a few weeks ago, faced an uncertain future. Apple (AAPL ) clinched a six-year deal with the modem maker, which can be extended by another two years. The deal came shortly after Intel (INTC) dropped from the race to produce 5G modems, which Apple hoped would have powered its next generation of smartphones in 2020.

Apple agreed to once again license Qualcomm’s patents and buy its modems, walking away from Intel, which indicated that it would not be able to develop a 5G modem in time.

Although the agreement was light on details, Qualcomm will reportedly receive $2.4 billion from Apple, while its forecasts indicated that its earnings will recover to where they were before the legal battle surfaced in 2016.

Apple had complained that Qualcomm had been receiving unfair royalties from its patents, which were calculated as a percentage of the entire device sold instead of the value of its modems. However, Intel’s exit and news that Huawei may be far from developing the 5G technology put pressure on Apple to reach an agreement as soon as possible, as the risk of not being able to launch 5G iPhones in 2020 was too high.

Qualcomm pays a dividend of around 2.9% and its payout ratio is nearly 80%.

Use the Dividend Screener to find high-quality dividend stocks based upon 16 parameters. Stocks with the highest DARS ratings are Dividend.com’s current recommendations to investors.

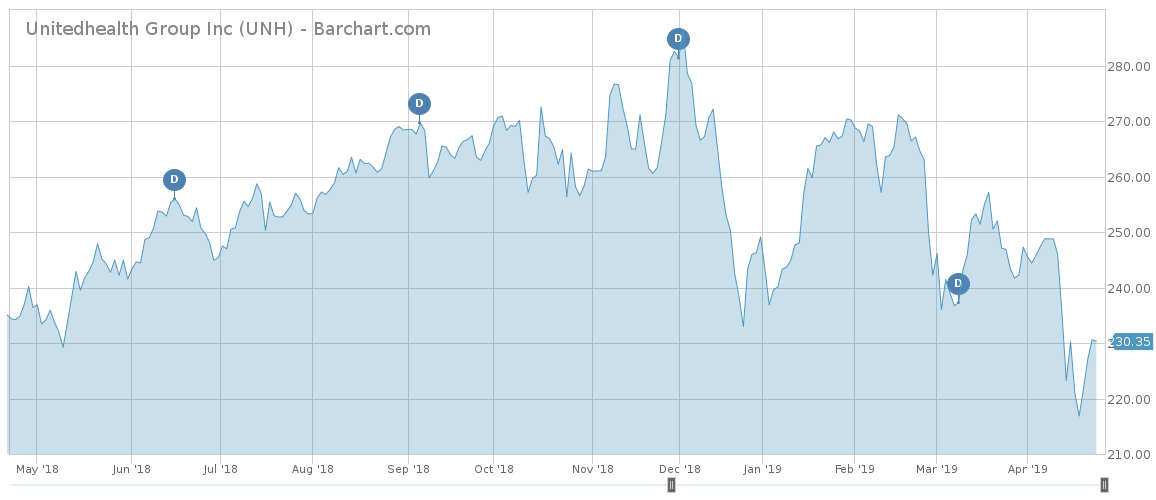

UnitedHealth

Healthcare products provider UnitedHealth Group (UNH ) has experienced a rough ride of late, with the stock weighed down by concerns over potential changes to the U.S. healthcare system. The company has seen its viewership increase by 92% over the past weeks, as a result. Senator Bernie Sanders has unveiled a bill that would eliminate private health insurance and replace it with a universal Medicare plan. A similar plan is advanced by the U.S. Representative of New York Alexandria Ocasio-Cortez.

Although UnitedHealth’s CEO rarely engages in politics, he took a swipe at the proposed plan, saying it would “surely jeopardize the relationship people have with their doctors, destabilize the nation’s health system and limit the ability of clinicians to practice medicine at their best.” However, a large part of Americans seem to back such a plan, with 56% of respondents from a survey by the Kaiser Family Foundation expressing positive views on a potential universal healthcare plan.

The possibility of the bill’s implementation is slim at the moment, but the stock is likely to remain under pressure if the discussions are maintained.

Shares in UnitedHealth have fallen more than 7% over the past month and are down by the same amount since the start of the year. The S&P 500, meanwhile, has advanced 17% this year. UnitedHealth pays out a third of its earnings to shareholders via dividends, amounting to a yield of 1.6%.

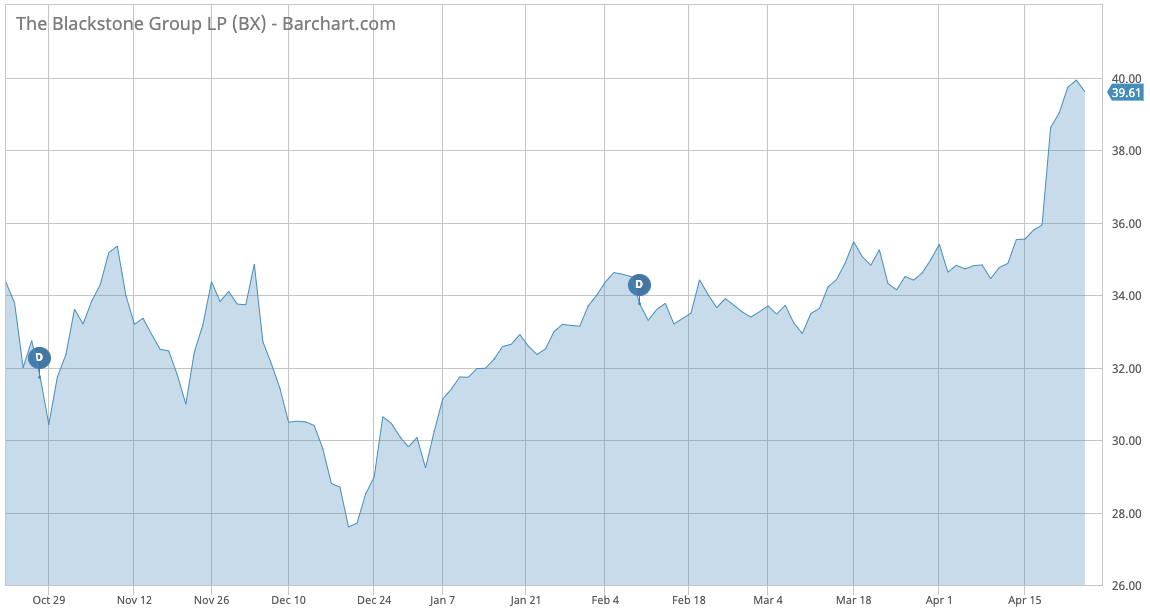

Blackstone Converts Into Corporation to Attract More Investors

Blackstone Group (BX ) has seen its traffic increase by 91% in the past two weeks, as the world’s largest private equity manager announced it would convert into a corporation from a partnership. The move would allow passive index funds to buy its stock. Investors have cheered the news, sending Blackstone’s stock price up 16% over the past 30 days. Year-to-date, Blackstone is up 32%.

Under the new structure, Blackstone will pay corporate taxes on all its revenue, although the tax burden will be less severe given that the U.S. corporate tax rate was lowered from 35% to 21%. Other private equity firms, such as KKR (KKR ) and Ares Management (ARES ), made the switch last year.

Passive mutual funds and index funds are restricted from investing in publicly-listed partnership structures by their own mandates.

Blackstone has a payout ratio of nearly 50%, with its dividend yielding 3.7%.

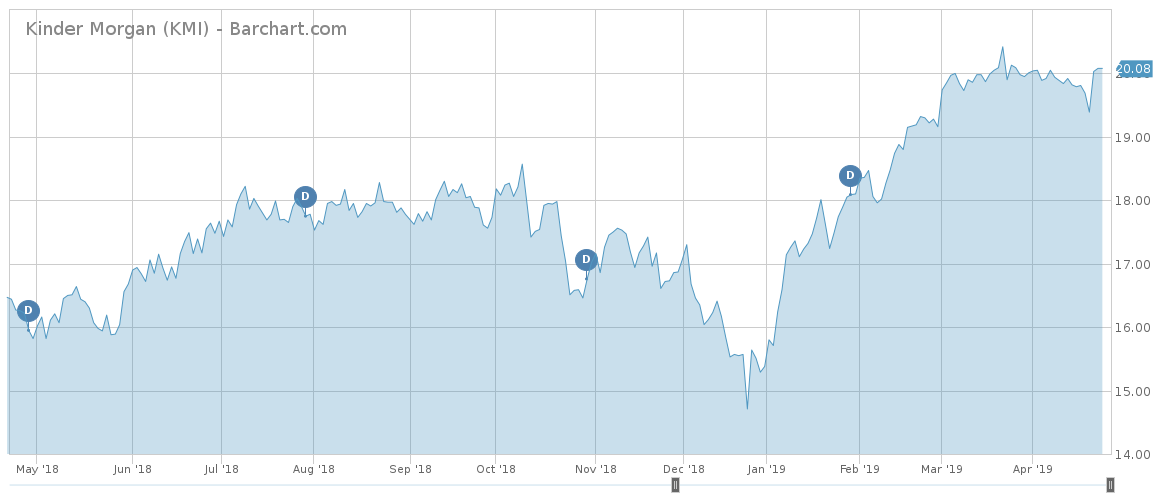

Kinder Morgan Boosts Dividend on Strong Earnings

Kinder Morgan (KMI ) has reported strong financial results for the first quarter of 2019 and increased its dividend by 25%, as the company confirmed a potential third natural gas pipeline in the Permian Basin and announced a 10% increase in its distributable cash flow. Kinder Morgan, one of the largest energy infrastructure companies in the U.S., has seen its traffic rise 66% over the past week.

Shares in Kinder Morgan have risen more than 3% since the report came out a few days ago, extending year-to-date gains to 31%.

Kinder Morgan has a payout ratio of more than 120% and its dividend yields an annual 5%. The company will pay its next dividend on April 29.

The Bottom Line

Qualcomm stock skyrocketed after the chipmaker reached a deal with Apple to end a global legal wrangle. UnitedHealth stock suffered as discussions over a potential universal healthcare system in the U.S. are heating up. Private equity Blackstone saw its stock surge after converting its legal structure from a partnership to a corporation. Finally, Kinder Morgan boosted its dividend after another strong financial report.

Be sure to check out Dividend.com’s News section for next week’s Market Wrap and other great dividend investing news.