Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

A takeover battle between oil major Chevron and Occidental Petroleum for peer Anadarko made the headlines of late and enraged some shareholders. Meanwhile, 3M hopes to boost its growth prospects with the acquisition of Acelity. Industrial real estate firm Stag is third in the list, followed by Apple, which reported mixed results and a share repurchase program.

Click here to see our previous edition of trends.

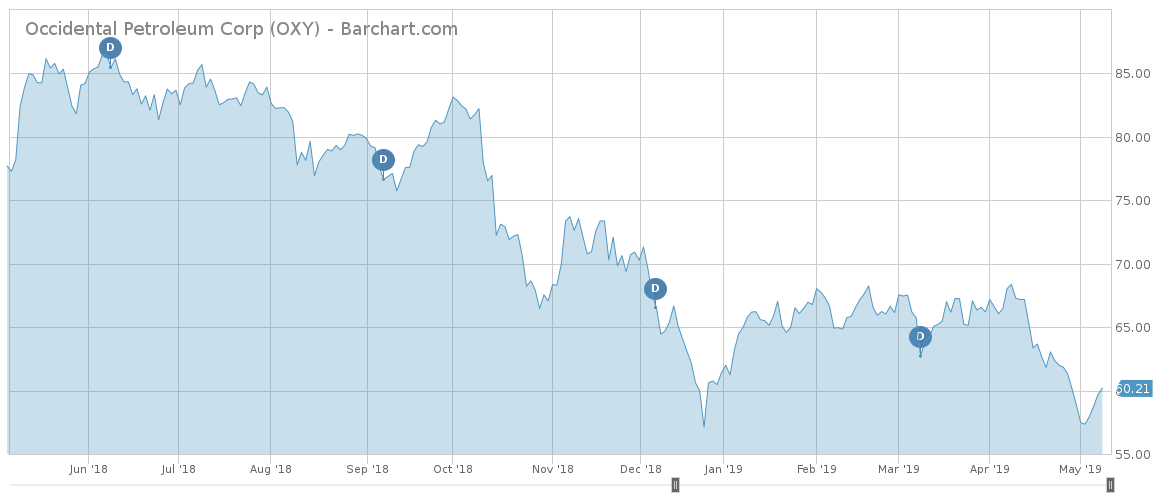

Occidental Petroleum

Anadarko accepted a sweetened cash-and-stock deal advanced by Occidental, walking away from a transaction agreement signed with Chevron. The victory, however, displeased a host of shareholders, who complained that it was structured in a way to avoid a shareholder vote.

With Warren Buffett’s Berkshire Hathaway providing financing to the tune of $10 billion, Occidental will be issuing only a little less than 20% of new shares to give Anadarko shareholders to close the deal, compared with 40% previously. As a result, Occidental does not need to put the deal to a vote because it is not crossing the 20% threshold that forces it to consult its own shareholders. Occidental said the Buffett deal was not meant to avoid a shareholder vote, but rather to provide certainty to Anadarko that the deal will go through.

However, some shareholders see it differently, particularly since Buffett’s terms are much more onerous than the company could have received in the open market. Under the agreement, Buffett will receive 100,000 preferred shares with an 8% yield and warrants to purchase more than 10% of the company for $62.50 per share in exchange for $10 billion. Chevron said it will not be increasing its offer.

Shareholders such as T. Rowe Price (TROW ) said they would be voting against management at the next annual meeting if Occidental fails to give a say to shareholders on the transaction. South Texas Money Management, another shareholder, said the increased cash offer was just a ploy to avoid a shareholder vote.

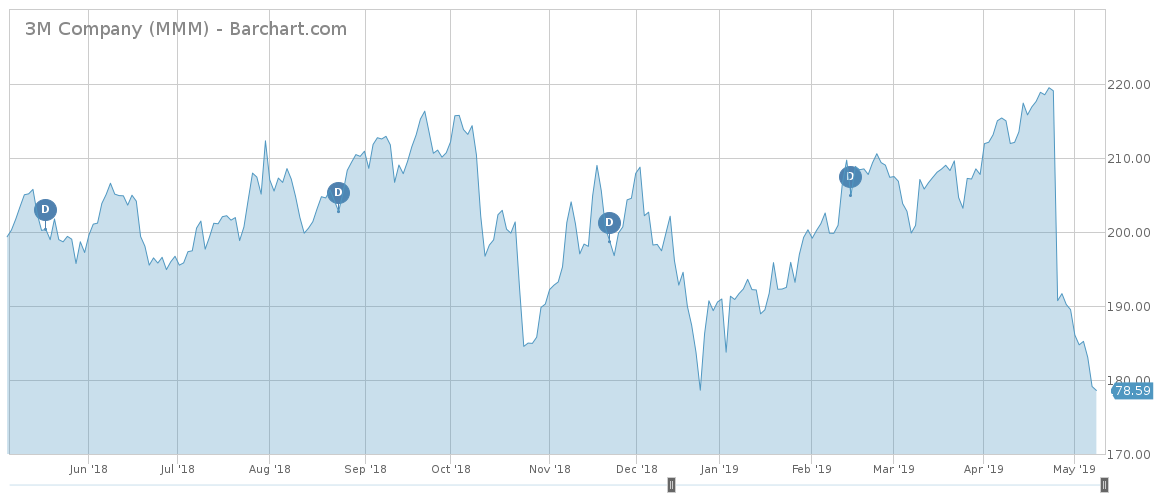

3M

3M (MMM ), the industrial conglomerate that makes everything from Scotch tape to Post-it notes, is typically a boring stock, but it has recently made the headlines with a thoroughly bad earnings report and a huge subsequent acquisition.

3M stock plunged more than 10% on April 25 when the company lowered its full-year earnings guidance to a range of $9.25 to $9.75 per share compared with $10.45 to $10.90 per share previously. Sales have stagnated across the board, with only its healthcare sector managing to post an advance of 0.3%. The rest of the units, industrial, safety and graphics, electronics and energy, and consumer, reported sales declines ranging from 1.9% to 11.8%. In part due to litigation costs and slowing sales, the company said it would reduce the number of its reportable segments from five to four through a combination of units and cut 2,000 jobs worldwide.

Not long after the weak report, the company announced its biggest acquisition ever, Acelity, for about $4.4 billion, which adds bandages to its most-profitable division of surgical-wound care products. The news has not helped the stock price, however, as it has declined more than 3% since the deal was announced on May 2.

Shares in 3M are now down 5% since the start of the year. 3M pays out more than half of its earnings to shareholders via dividends, which yield 3.2% per annum. The company has been growing its dividend for the past 60 years.

Use the Dividend Screener to find high-quality dividend stocks based upon 16 parameters. Stocks with the highest DARS ratings are Dividend.com’s current recommendations to investors.

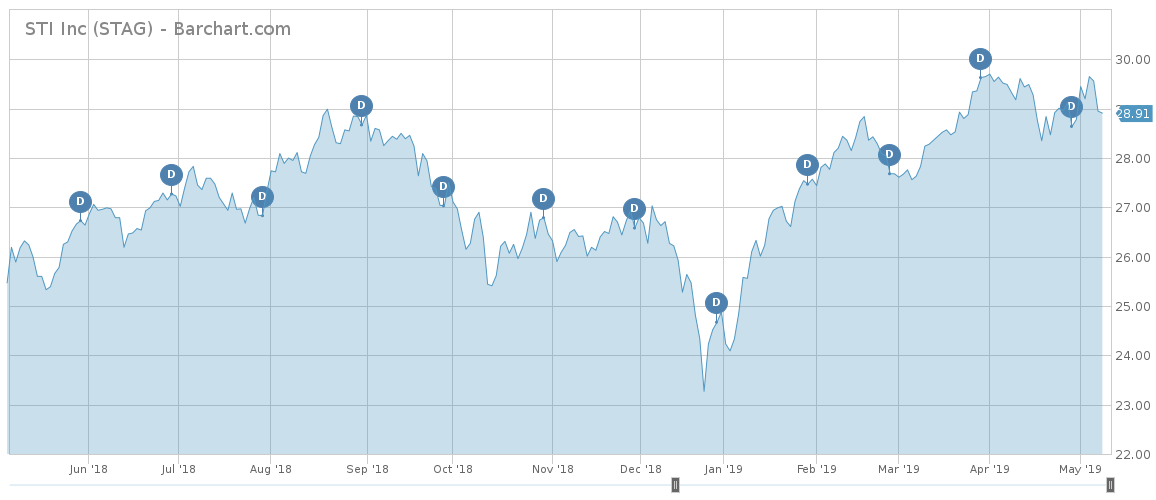

Stag Industrial

Specialty real estate operator Stag Industrial (STAG ) has taken the third spot in the list with a 60% advance in viewership. The $3.7 billion single-tenant real estate company has seen its stock price rise more than 17% over the past year, as investors cheered its string of positive results on the back of acquisitions and bright prospects.

Stag is one of the real estate firms that benefit from consumers’ move away from brick and mortar stores to online, as demand from warehouses from companies such as Amazon (AMZN) increases. For the first quarter of the year, Stag’s revenues were up 15% to almost $96 million, while adjusted funds from operations (AFFO) rose 21% to over $53 million.

Stag currently pays nearly 80% of its earnings to shareholders, amounting to an annual dividend yield of around 5%. Stag has been growing its dividend since 2011.

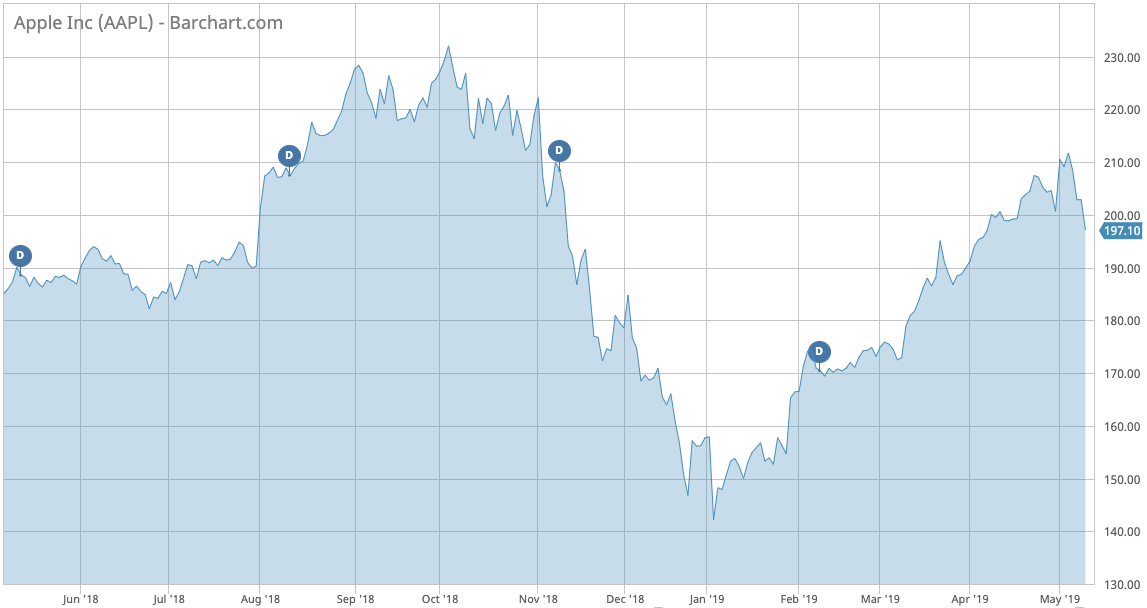

Apple

Apple (AAPL ) has experienced a 34% advance in traffic this week, as the Cupertino, California-based technology giant reported a somewhat downbeat earnings report. The company said that iPhone sales fell 17% year-over-year to $31 billion due to weak demand for its flagship product, while its overall profit declined 16% to $11.6 billion. Apple shares have declined 3% in the past five days, trimming year-to-date gains to 29%.

To soothe investors, Apple launched another $75 billion share buyback, earning the praise of legendary investor Warren Buffett, whose Berkshire Hathaway is invested heavily in the stock. Apple CEO Tim Cook visited Berkshire’s wildly popular annual meeting and said in a separate interview he is thrilled to have Buffett as an investor.

Apple has a dividend yield of 1.52% and a payout ratio of 26%. The smartphone giant has been growing the dividend for six years in a row now.

Check out our latest list of the Best Dividend Stocks here.

The Bottom Line

Occidental Petroleum is likely to win a bidding war with Chevron to acquire Anadarko Petroleum, despite shareholder backlash. 3M reported a downbeat earnings report and announced the acquisition of Acelity in a desperate bid to achieve growth. Stag Industrial has performed this year as the company is expected to benefit from the rise of online shopping. Finally, Apple released a weak earnings report, but a big share repurchase program softened the blow and earned the praise of Warren Buffett.

Be sure to check out Dividend.com’s News section for next week’s Market Wrap and other great dividend investing news.