Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

This week saw some landmark developments in the M&A market. The merger between T-Mobile US and Sprint has finally been approved by the U.S. government, while Pfizer agreed to combine its off-patent business with Mylan. Meanwhile, the earnings season kept investors busy, with Starbucks and Enterprise Product Partners delivering strong results.

Click here to see our previous edition of Trends.

T-Mobile US

T-Mobile US (TMUS) has seen its viewership rise 236% over the past two weeks, as the telecommunications company drew readers’ interest after its combination with Sprint (S) was approved by the U.S. government. The U.S. Department of Justice made clear it would not attempt to block the transaction after Sprint agreed to divest $5 billion worth of assets to Dish Network, which will now aim to become the fourth competitor in the field.

The approval did not come without opposition. 14 Democratic state attorneys claimed the deal hampers competition and hurts consumers. However, the Justice Department said the deal under the current format in fact increases competition. Under the agreement, Dish will have to meet certain targets for the rollout of its 5G broadband network or face penalties.

T-Mobile and Sprint had been attempting a merger since 2014. Both companies said the merger was necessary to be able to effectively compete in 5G with clear leaders Verizon Communications (VZ) and AT&T (T). However, critics pointed to Europe, where regulators thwarted any deal that reduced the number of telecom operators from four to three.

The deal has proved a boon for T-Mobile’s stock price. Although shares are down slightly over the past five days, they remain up 26% year-to-date. Neither T-Mobile nor Sprint pays a dividend to its shareholders.

Pfizer

Pfizer (PFE) has experienced a 132% increase in traffic over the past two weeks, as the company hit the news after the merger of its generic drugs unit with Mylan.

Pfizer will first spin off its off-patent unit called Upjohn, which contains such renowned drugs as Viagra and Lipitor, and then merge this company with Mylan. The deal will create a generics powerhouse with $20 billion in sales that will rival Israeli drugmaker Teva (TEVA). The companies’ executives said they expected synergies of up to $1 billion per year by 2023.

Shares in Pfizer have declined nearly 10% following the news, while rating agency S&P downgraded the company’s debt on the grounds that its business will become less diversified with the spinoff. The stock also suffered due to Pfizer lowering its revenue guidance for 2019 from $52-$54 billion to $50.5-$52.5 billion.

The remaining company will focus on higher-margin innovative drugs, which are also riskier. In a further step in that direction, the company recently bought clinical stage cancer specialist Array Biopharma for $11.4 billion while it hived off its consumer unit into a partnership with GlaxoSmithKline.

Pfizer’s dividend yields 3.8% on a payout ratio of 48.2%. The company has been growing its dividend since 2010.

Use the Dividend Screener to find high-quality dividend stocks based upon 16 parameters. Stocks with the highest DARS ratings are Dividend.com’s current recommendations to investors.

Starbucks

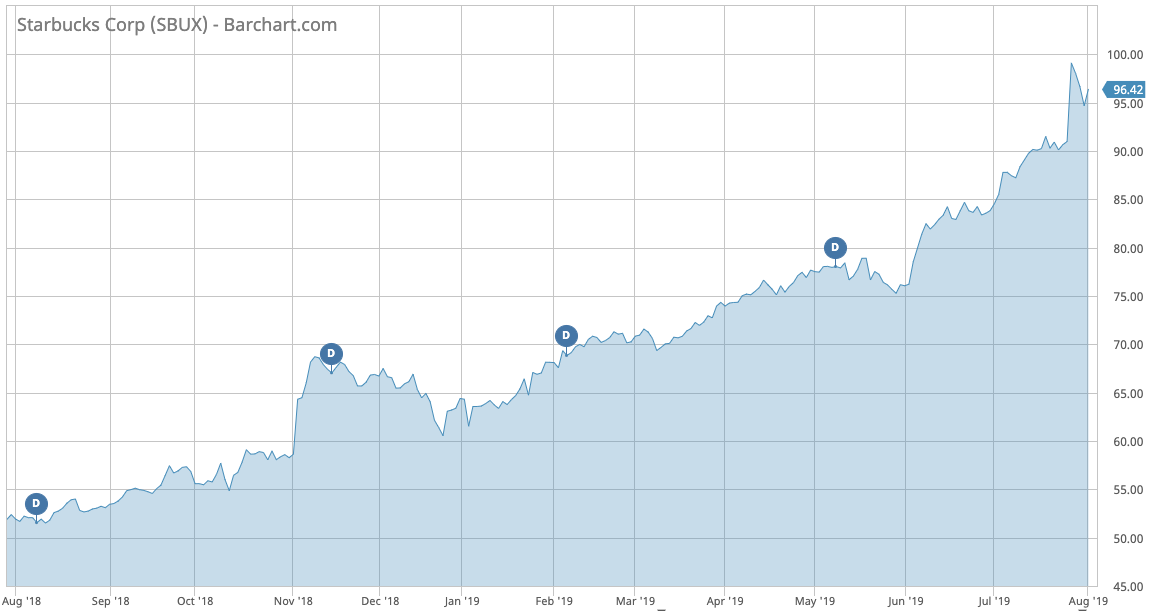

Starbucks (SBUX) has seen its traffic more than double over the past two weeks, as the coffee chain giant reported outstanding third-quarter results, triggering a rise in the stock price.

The company reported net income of $1.37 billion for the fiscal third-quarter, or $1.12 per share, compared with $853 million a year earlier. At the same time, it raised its guidance for earnings and revenue, now expecting earnings per share in the range of $2.80 to $2.82, up from $2.75 to $2.79 per share previously. The results were boosted by the markets in the U.S. and China, where customers increasingly bought pricier offerings and paid more visits in the afternoon.

In China, same-store sales grew by 6% and the number of transactions by 3%, despite strong competition from Luckin Coffee. Starbucks is continuing its aggressive expansion in the Chinese market, with a third of the newly opened stores located in China.

In the U.S., the company’s loyalty program added 400,000 new members to reach a total of 17.2 million. The strong foot traffic means the company’s promotions like ‘Happy Hour’ have paid off. Same-store sales in the U.S. advanced by 4.4%.

Starbucks has a dividend yield of 1.50% and a payout ratio of 60%. Year-to-date, Starbucks shares rose 47%.

Check out our latest Best Dividend Stocks List here.

Enterprise Products Partners

Pipeline operator Enterprise Products Partners (EPD) has taken the last spot in the list this week, with a rise in viewership of 44%.

Enterprise Products, which pays a dividend of 5.85% and has a near 100% payout ratio, recently signed an agreement with oil major Chevron (CVX) to help develop its offshore crude project in the U.S. Gulf of Mexico. The pipeline is expected to export oil from the region’s shale fields and is likely to compete with other similar projects under development by Trafigura and private equity firm Carlyle Group (CG), among others. It remains unclear, however, if Chevron will take a stake in the project or push its own oil through the pipeline.

On Wednesday, Enterprise Products released an impressive set of financial results, beating earnings estimates for the second-quarter and reporting a doubling of profits. Adjusted EBITDA rose 18% to $2.1 billion for the quarter, while distributable cash flow surged 21% to a record of $1.7 billion.

Shares in Enterprise Products have jumped more than 26% since the start of the year.

The Bottom Line

The merger between T-Mobile US and Spring has been approved by the U.S. government, although some factions still showed opposition. Pfizer is getting rid of its generics business to focus on the higher-end market by merging its off-patent unit with Mylan. Starbucks is on a tear as its strategy to increase foot traffic during the afternoon has paid off, while Enterprise Products Partners reported record results as well as an agreement with oil major Chevron.

Be sure to check out Dividend.com’s News section for next week’s Market Wrap and other great dividend investing news.