Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

U.S. retailer Kohl’s Corporation has taken first spot on the list, as the company has been struggling with poor earnings. Another retailer, Home Depot, is second on the list, in part because the company recently declared a dividend. McDonald’s is third, as the fast-food giant hit the news with the abrupt departure of its CEO, while real estate investment firm Washington Prime Group closes the list.

Don’t forget to read our previous edition of trends here.

Kohl’s

Kohl’s (KSS) has seen its viewership advance 48% this week, nearly double that of the runner-up. The boost in traffic was likely the result of the retailer posting a set of very weak third-quarter results, which led to a dramatic fall in the stock price.

Shares in Kohl’s tumbled more than 16% on November 19, when it announced its earnings, and failed to recover much ground since then. Kohl’s stock has lost nearly a third of its value since the start of the year, compared with the S&P 500’s gain of 25%.

To be fair, the entire department store sector has been under pressure recently, as many brands, such as Nike (NKE), are building their own stores in a bid to cut out the middleman. The company had a weak September in terms of sales, as many of its competitors launched aggressive promotions. This has prompted Kohl’s to respond with price cuts, leading to a rise in sales in October.

The company earned $0.74 for the third quarter, versus analyst expectations of $0.86 per share. Meanwhile, revenue of $4.36 billion fell short of expectations by around $40 million, and same-store sales growth of 0.4% came in way lower than forecasted.

One potential boost for the company in the upcoming quarter is a partnership with Amazon (AMZN). The company teamed up with the online retail giant to receive Amazon returns in its stores and will have the feature for the first time nationwide this holiday season. This could drive foot traffic in its stores and boost sales.

Use the Dividend Screener to find high-quality dividend stocks based upon 16 parameters. Stocks with the highest DARS ratings are Dividend.com’s current recommendations to investors.

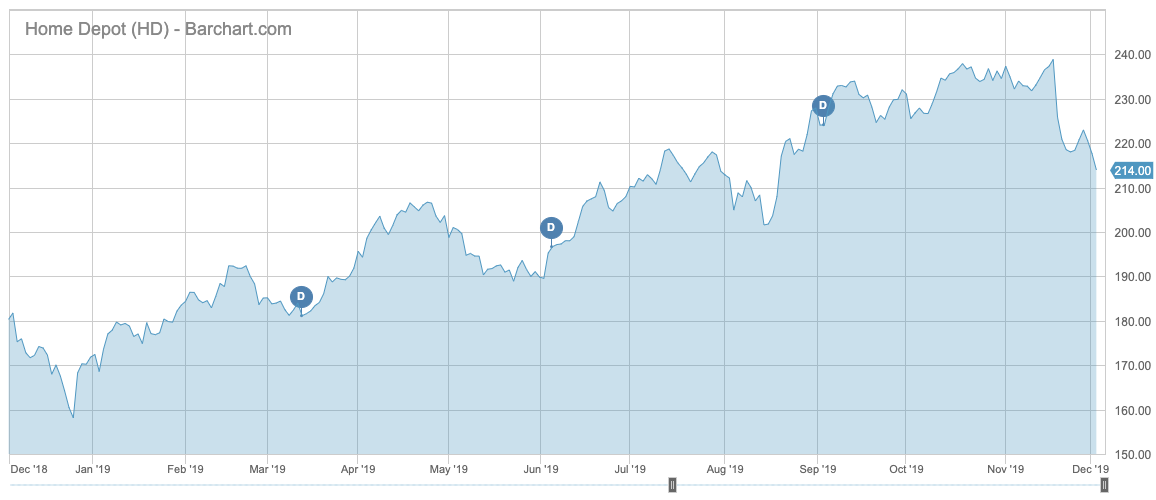

Home Depot

Home Depot (HD) is second on the list this week, with an advance in viewership of 26%. After an impressive run this year, Home Depot shares tumbled in mid-November after the company posted disappointing results for the third quarter.

Although revenue grew by 3.5% year-over-year to $27.2 billion, it missed expectations by $291 million. Meanwhile, earnings per share of $2.53 were in line with forecasts. The company said the lower-than-expected sales were due to the timing of certain strategic investments related to One Home Depot, an initiative to integrate its digital retail operations with brick-and-mortar.

The company downwardly revised its 2019 guidance, and now expects comparable sales growth of 3.5% versus 4% previously. Its earnings-per-share guidance for 2019 remains unchanged at $10.03.

On November 21, Home Depot announced a third-quarter cash dividend of $1.36 per share, payable on December 19 to shareholders of record on December 5. The company has been increasing its dividend for the past six years.

Check out our latest Best Dividend Stocks List here.

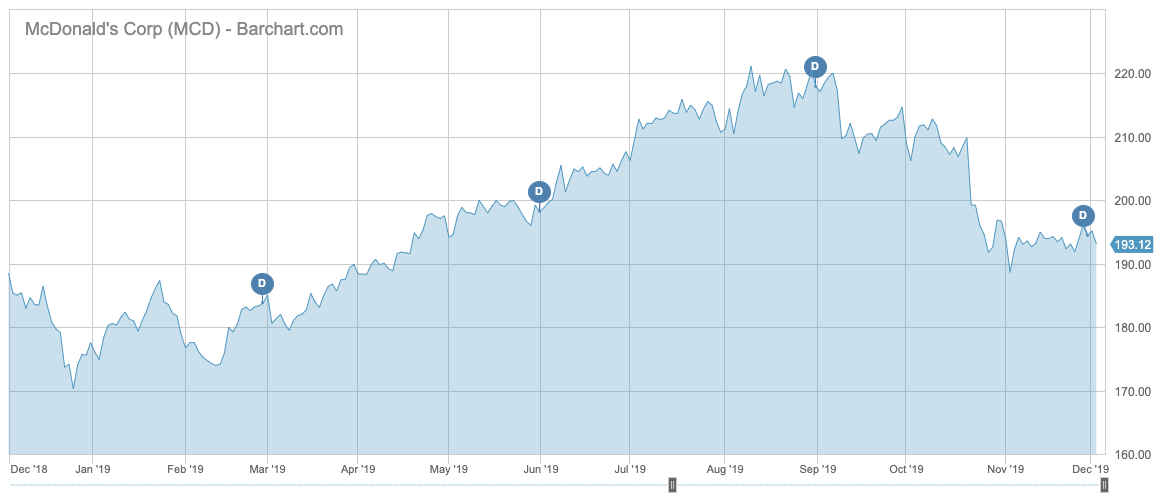

McDonald’s

McDonald’s (MCD) has taken the third spot on the list with a 24% increase in viewership.

The fast-food company has been in the news with the firing of its CEO Steve Easterbrook over a consensual relationship with an employee. Easterbrook, who was appointed in 2015 and led a successful turnaround, admitted he made a mistake and that the board was right to sack him given he violated company policy.

Former USA market President Chris Kempczinski will take over as CEO, while Joe Erlinger, president of international operations will head the company’s U.S. division.

During Easterbrook’s tenure, McDonald’s stock nearly doubled in value, as his strategy of selling off company-owned stores to franchisees boosted results. In addition, the launch of all-day breakfast and value meals boosted traffic in the early days of the turnaround, but the latest results showed its promotions were not popular. The company’s third-quarter results came in below expectations for the first time in two years.

As a result, the stock has declined more than 10% for the past 90 days. This compares with an advance of around 7% for the S&P 500.

McDonald’s yields an annual dividend of 2.5% and has grown its shareholder payout for the past 42 years.

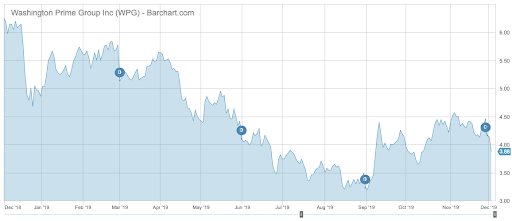

Washington Prime Group

Washington Prime Group (WPG) has attracted readers for its strong dividend yield.

Washington Prime, a real estate investment trust that has interests in malls across many U.S. states including Texas and Florida, has a dividend yield of 22.4%, although it may be at risk given that it is not covered by its earnings. On October 25, S&P Global Ratings cut the company’s credit rating further into junk territory to BB- from BB, as the firm has been plagued by tenant bankruptcies and store closures, which hurt operating metrics.

However, the company said in a recent presentation that it does not expect to change its dividend policy in 2019, although the board will evaluate it further based on cash flow projections. The company also reassured investors that its long-term debt is manageable, with 90% of its total indebtedness having a fixed rate.

The Bottom Line

Kohl’s posted a set of disappointing third-quarter results, sparking renewed fears that the entire clothing retail sector will see weak performance in the near future. Home Depot also revealed a weak earnings report in the third quarter due to higher expenses related to its digital strategy. McDonald’s fired its CEO Steve Easterbrook over a consensual relationship, while Washington Prime Group yielded a strong dividend but has been struggling with a high number of tenant bankruptcies.

Be sure to check out Dividend.com’s News section for next week’s Market Wrap and other great dividend investing news.