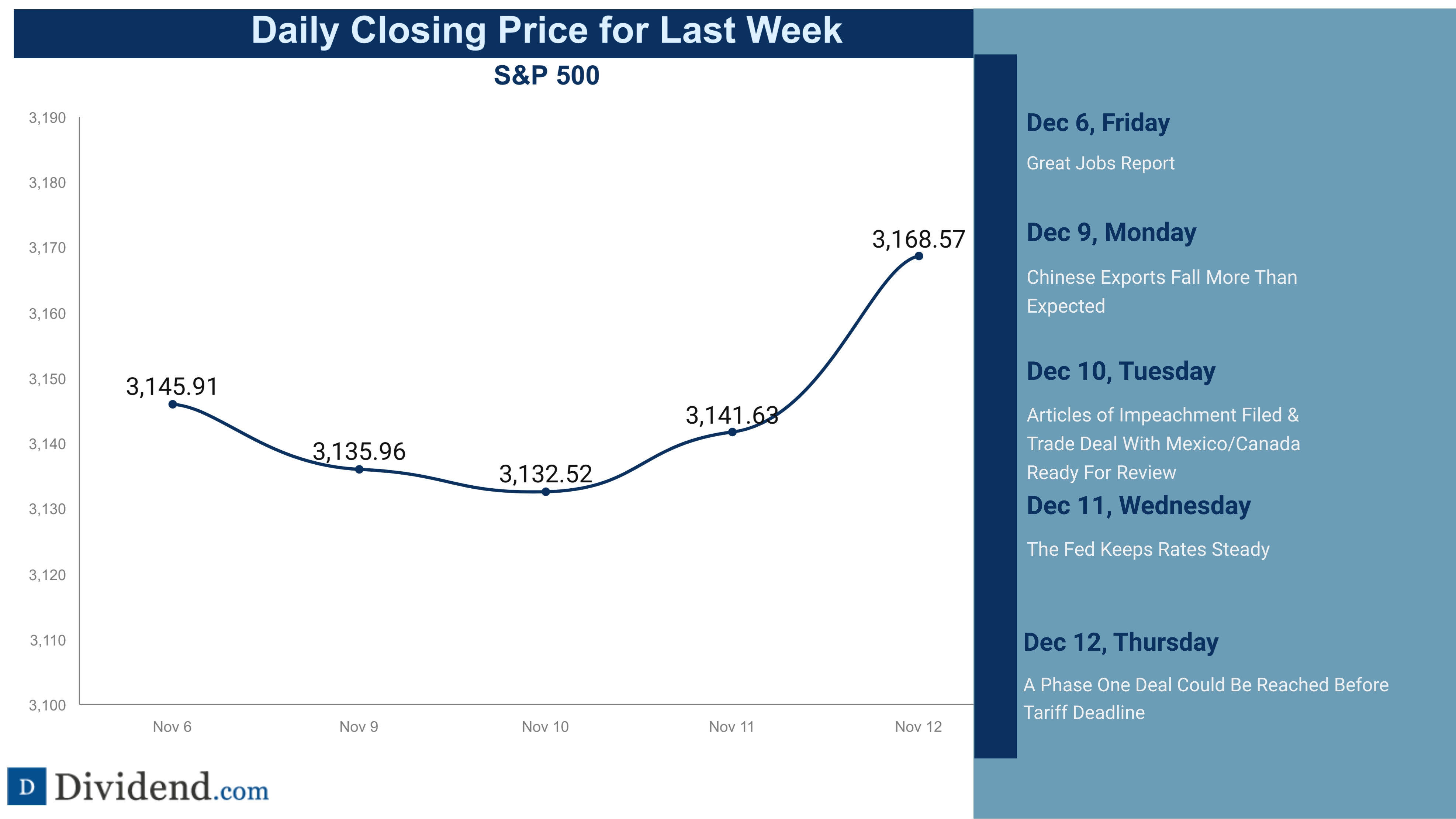

After last week’s rough turn of events and generally lower trading, this week brought better-than-expected news on several fronts. First up, we have the Federal Reserve. As expected, Powell & Company continued to keep interest rates the same. Wall Street cheered the announcement as it continued to mean cheap money would be flowing into the system. More importantly, it underscored the Fed’s new “wait-and-see” approach with regards to future rate hikes and cuts. If there’s one thing Wall Street loves, it’s consistency.

Wall Street also cheered on several trade front items. After a disastrous few trading sessions last week, optimism about trade helped push the markets higher this week. A signed deal between the U.S., Canada and Mexico was unexpected, and toward the end of the week, positive news came from the trade skirmish with China. Traders were happy that a deal could be reached before the December 15 deadline for new tariffs.

Meanwhile, there was plenty of economic data to be had as well. Inflation numbers showed a supportive economy that was growing but not too fast as to trigger worries about the Fed and interest rates. While earnings were sparse, the few reports that did come across painted a mixed picture of the economy. One being that we are still seeing signs of growth.

All in all, with the Fed and trade winning the week, the market marched higher.

Be sure to check out our previous Wrap here, when investors were hoping for Santa Claus to bring a big rally.