Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

Broadcom was in the spotlight these past two weeks after it signaled a further focus on software by indicating its wireless assets were non-core. Walgreens Boots Alliance stock has underperformed and the company attracted a buyout offer from a private equity fund. AbbVie has tapped the debt market as it seeks to finance a massive acquisition, while Bristol Myers Squibb recently won a big patent case.

Don’t forget to read our previous edition of trends here.

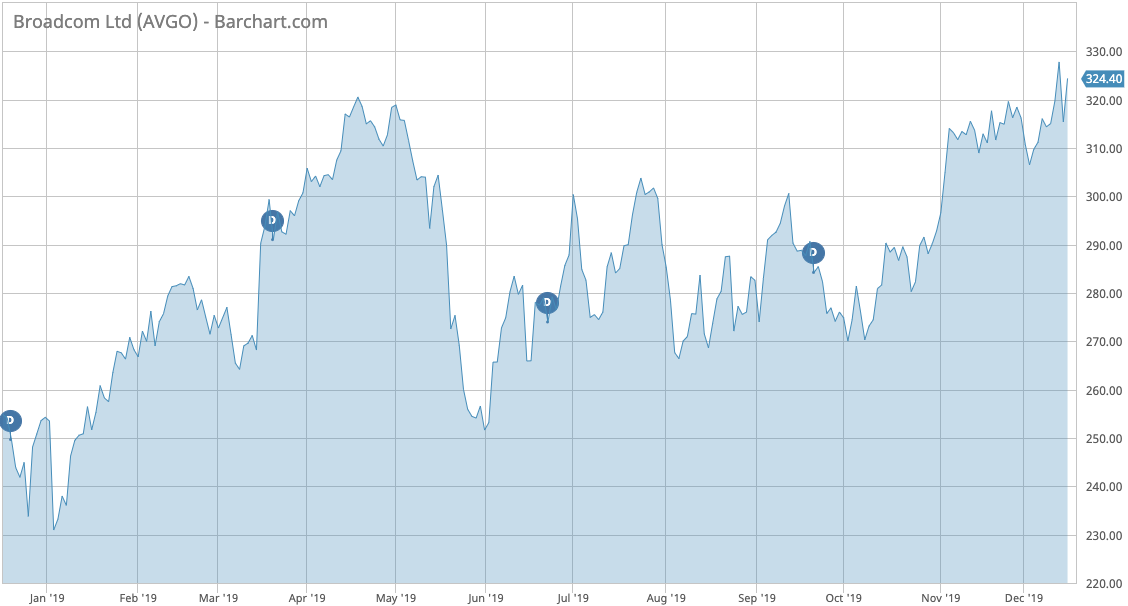

Broadcom

Broadcom (AVGO) has taken the first spot in the list this week with a rise in viewership of 112%, nearly double the runner-up. Broadcom’s stock has increased 24% over the past year, although that performance was well below the S&P Semiconductor Index (PHLX), which surged 55%.

Broadcom stock has lost some of its value after CEO Hock Tan signaled a deeper focus on software, with the legacy wireless-chip business now considered non-core. The wireless business has gradually become a smaller driver of revenues as the company made a string of software acquisitions, including CA Technologies for $19 billion and Symantec’s enterprise software unit for $10.7 billion. In 2019, a fourth of revenues were from wireless, compared with 40% in 2014. Wireless sales steadily increased from 2014 to 2018 but fell in 2019 due to weakening demand for smartphones.

With the company now focusing on software, the wireless unit may be put on the auction block, analysts have speculated. Tan said on a conference call that he views non-core businesses such as wireless “more as financial assets, especially in terms of capital allocation, balance sheet optimization, and how we choose to leverage resources and manage the company.”

Selling the unit would allow the firm to reduce some of its huge debt load, which nearly doubled compared to last year to $32.8 billion.

Broadcom yields a dividend of nearly 4% per year and its payout ratio is 61%. Broadcom has been increasing its dividend for the past nine years. The company will pay its next dividend on December 31 to shareholders of record on December 23.

Use the Dividend Screener to find high-quality dividend stocks based upon 16 parameters. Stocks with the highest DARS ratings are Dividend.com’s current recommendations to investors.

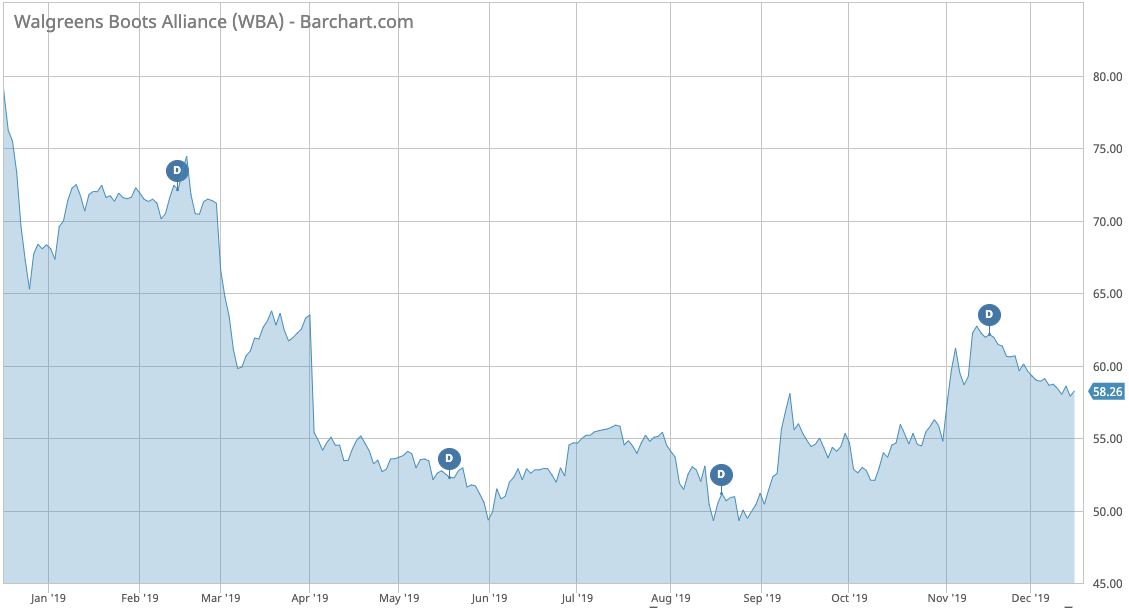

Walgreens Boots Alliance

Walgreens Boots Alliance (WBA) has taken the second place in the list with a 45% increase in traffic. Walgreens Boots, the largest retailer of beauty and pharmacy products in the U.S. and Europe, has suffered from strong competition from online retailers such as Amazon, with its stock losing 15% year-to-date versus S&P 500 Index’s gain of 22%.

In part due to these struggles, the company has become a target for private equity firms. KKR reportedly is considering mounting a bid, although the price tag might be too big for the firm to finance. Walgreens Boots has a market capitalization of $51 billion and debt of $17 billion. If a deal is clinched, it would be the biggest private equity buyout in history.

While the stock rose around 5% on the rumors in mid-November, it has given up most of the gains as the initial investor excitement withered. Walgreens has a dividend yield of 3.15% on a payout ratio of 30%. It had been increasing its dividend for the past 43 years.

Check out our latest Best Dividend Stocks List here.

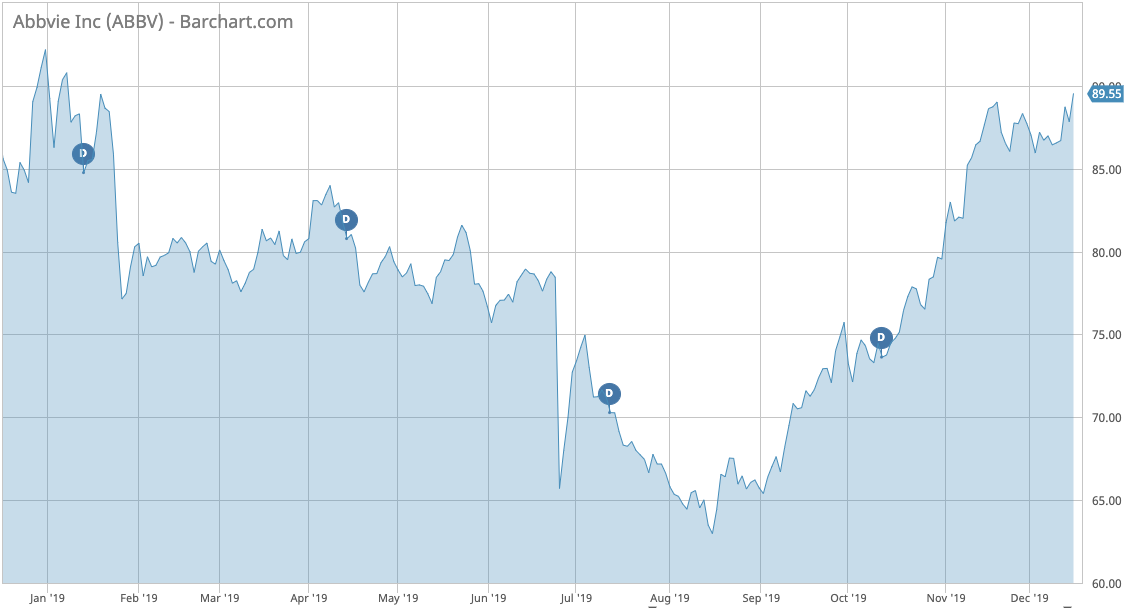

AbbVie

AbbVie (ABBV), the giant drugmaker, has taken the third place in the list, seeing an increase in viewership of 44%. AbbVie recently sold a massive pile of investment-grade bonds to finance its acquisition of Allergan, as the company looks to growth in beauty products such as Botox to offset slower sales of its key drug Humira.

AbbVie sold $30 billion worth of bonds and did not have trouble finding demand, despite its leverage increasing to a net debt-to-EBITDA of 3.4 from 1.7 previously. The company issued 10 bonds with maturities ranging from one and a half years to 30 years. Its 10-year notes yield 3.2%, around 1.3 percentage points above Treasury’s 10-year bonds, which are considered the safest.

AbbVie has recognized that its debt is very high and said that it will strive to bring the net debt/EBITDA ratio down to 2.5 by 2021 by using free cash flow. This means its dividend might be at risk. AbbVie’s dividend currently yields 5.3% and the company pays out half of its earnings. Its next dividend is expected to be paid on February 14 to shareholders of record on January 15.

Shares in AbbVie have declined nearly 5% since the start of the year.

Be sure to check out Dividend.com’s News section for next week’s Market Wrap and other great dividend investing news.

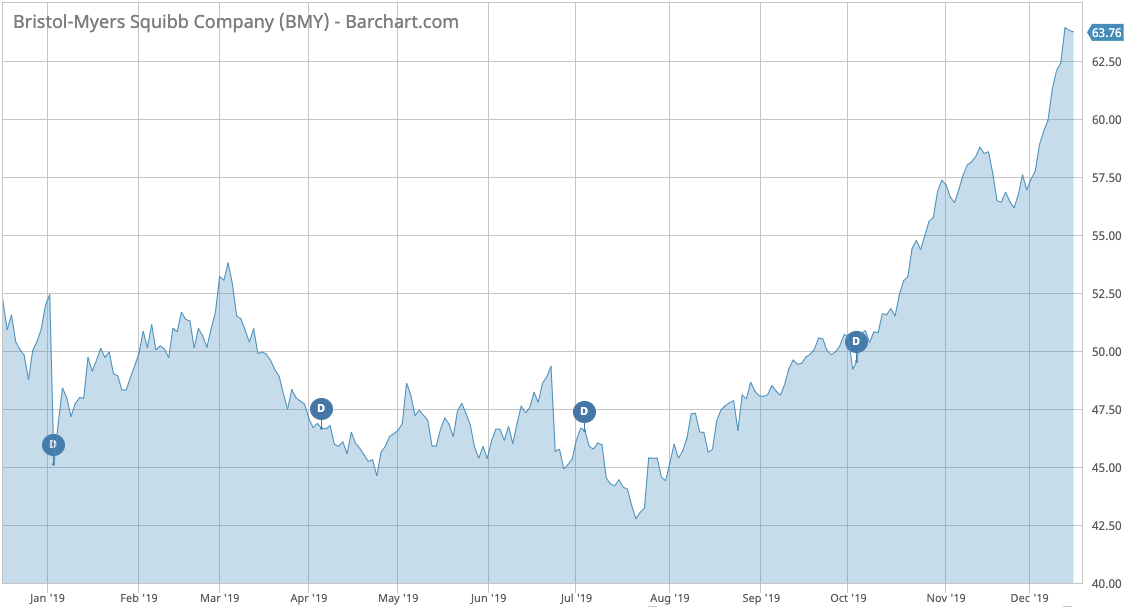

Bristol-Myers Squibb

Bristol-Myers Squibb (BMY) has seen its traffic advance 29% over the past two weeks, taking the last position.

Bristol-Myers, the $150 billion market cap biopharmaceutical company, received a boost after it won a patent case against Gilead Sciences related to technology for treating cancer. As a result, Gilead will have to pay Bristol-Myers $752 million in damages, although the former reserved the right to appeal the verdict.

Investors have taken notice. While Bristol-Myers stock was up 3.6% over the five days through December 13, Gilead declined 1.1%. Year-to-date, Bristol-Myers is up 21.7%, outperforming Gilead by 15 percentage points.

Bristol-Myers is in the process of integrating its recent acquisition of Celgene, for which it paid $74 billion. On December 13, the company announced a host of leadership changes, including the retirement of its executive vice president of corporate affairs and investor relations, John Elicker. Former CVS Health executive Kathryn Metcalfe was named executive vice president of corporate affairs, while Tim Power was appointed as head of investor relations.

Bristol-Myers has a dividend yield of 2.8% and its payout ratio is 41%. The next dividend will be paid on February 3 to shareholders of record on January 3.

The Bottom Line

Broadcom has taken investors by surprise with a strong signal that it looks to exit its legacy wireless assets to focus on software. Walgreens Boots has been struggling with competition from online and is reportedly facing a takeover bid from private equity shops. AbbVie successfully issued a massive $30 billion investment-grade bond program to finance its acquisition of Allergan, while Bristol-Myers received a boost after it won a patent case against Gilead.