This is the annual edition of Dividend.com trends, analyzing the search patterns of our visitors for the past year. This list will help you gain insight into what the most popular dividend stocks were in 2019. For the purpose of this article, the most popular ticker pages on Dividend.com have been based on page views between January 1, 2019 and November 29, 2019.

Telecommunications giant AT&T has had a rough year as its strategy of vertical integration has been questioned by an activist investor. Apple, second spot in the list, witnessed growing demand for its services, although it remained embroiled for the better part of the year in the trade war between the U.S. and China. Johnson & Johnson has been under pressure due to its contribution to the opioid crisis. And AbbVie made a splash this year with its acquisition of peer Allergan, while Microsoft closes the list.

AT&T

AT&T (T) has been the most popular dividend stock for our readers this year. This is not surprising. In addition to yielding a strong 5% dividend, the telecommunications firm made headlines due to a short-lived battle with one of the most feared activist investors on Wall Street, Elliott Management.

The investor questioned the company’s acquisition strategy, blaming expensive DirecTV and Time Warner deals for stealing focus away from the core business of providing telecommunications services. It called on the firm to stop its deal-making initiatives and focus on integrating current buyouts amid intense competition in 5G and streaming services.

A public proxy fight was avoided, with the firm committing to certain changes and without inviting the activist to serve on its board. AT&T committed to pursuing no more acquisitions, making divestments of non-core businesses to pay off debt, and keeping CEO Randal Stephenson at the helm at least through the end of 2020. The agreement has certainly bought the company time, but also put pressure on it to improve stock price performance quickly. AT&T is certainly a stock to watch in 2020.

AT&T had largely outperformed its key rival Verizon Communications (VZ), which stayed focused and did not make expensive bets on media, between 2015 and mid-2018. Then performance started to diverge dramatically – AT&T gained 13% from mid-2018 to November 30, while Verizon rose 25%. However, AT&T’s performance started to turn around when Elliott got involved, signaling investor confidence in the campaign.

Use the Dividend Screener to find high-quality dividend stocks based upon 16 parameters. Stocks with the highest DARS ratings are Dividend.com’s current recommendations to investors.

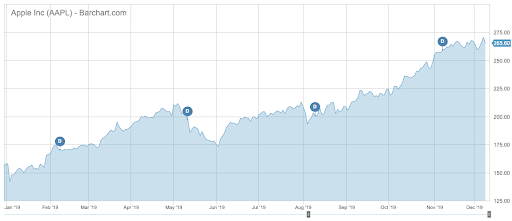

Apple

Apple (AAPL), which pays a dividend of a little more than 1%, is the second most popular stock this year, as the technology giant has rallied this year on the back of strong growth in services. The company’s stock gained an impressive 64% between the start of the year and November 30, giving it a market capitalization in excess of $1 trillion and the title of the largest publicly traded company in the world by market capitalization.

While sales of Apple’s flagship product iPhone have slowed along with Macbooks, rising revenues from adjacent services and other products, such as Apple Watch, helped push revenues and the stock higher. Even at such a price, Apple stock is still valued below the information technology index and a little higher than the S&P 500.

With a large part of its production in China, Apple has been at the center stage of the U.S-China trade war. It is believed that administration officials are discussing the possibility of exempting tariffs on iPhones in order to avoid backlash from consumers due to potential price increases. The rationale behind the exclusion is that Apple cannot move its manufacturing from China overnight and would give South Korean competitor Samsung a big advantage in the U.S. market.

It remains to be seen whether Apple will be able to deliver similar returns in 2020.

Check out our latest Best Dividend Stocks List here.

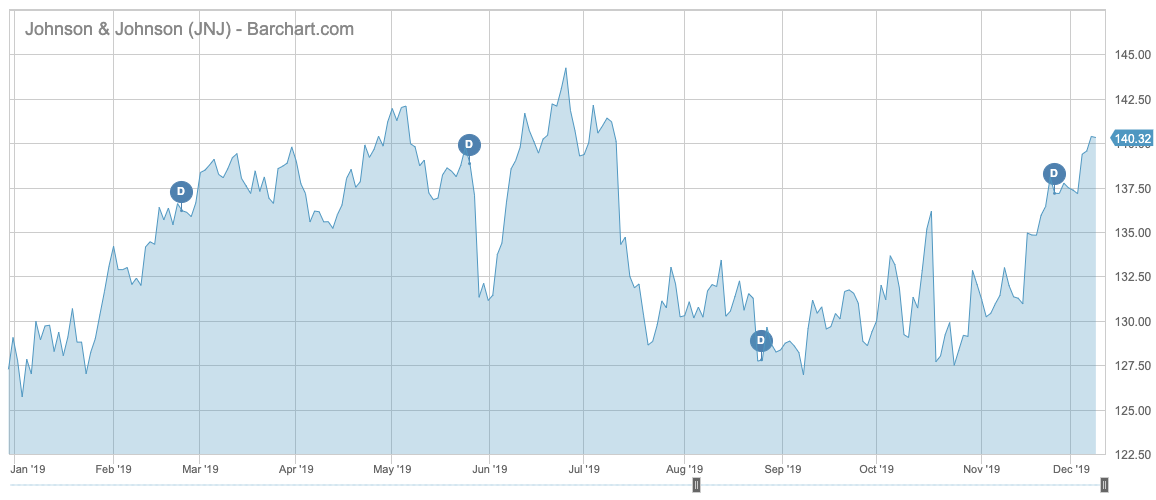

Johnson & Johnson

Johnson & Johnson (JNJ), a darling of the healthcare sector, has had a rough year, as it has been facing backlash from its involvement in the opioid crisis and faces a multitude of lawsuits related to its products. In part because of that, J&J is the third most popular on our platform.

J&J, which yields 2.8% and has been growing its dividend for the past 56 years, has seen its stock underperform the S&P 500 Index by around 14 percentage points so far this year, due to uncertainty regarding the impending lawsuits. As of September, around 30,000 plaintiffs sought damages related to the use of its baby powder and its drug Risperdal. In addition, federal prosecutors started a criminal probe against J&J and five other pharmaceutical companies for their role in contributing to the opioid epidemic.

These issues have caused investors to tread carefully and resulted in an undervalued stock, despite the company’s strong cash flows and a healthy balance sheet.

J&J has said that its investigation into its baby powder found no trace of asbestos, as the Federal Drug Administration claimed. Whether this is enough to assuage consumers and prompt higher demand for its stock from investors remains to be seen in 2020.

AbbVie

AbbVie (ABBV) has made waves this year with one of the largest acquisitions in the healthcare sectors, namely Allergan. In desperate search of growth, AbbVie agreed to buy Allergan for $129.57 per share in cash and stock, in a bid to expand its reach into cosmetic medicine, such as Botox and other beauty drugs, as it braces for the end of patent protection for its best-seller, Humira.

Investors were initially skeptical about the deal reached this June, punishing AbbVie stock. However, shares started to recover strongly in September, diminishing year-to-date losses from 31% at the peak in mid-August to 5% at the end of November.

One reason for the recovery could be an improvement in the company’s earnings guidance in the third quarter. However, a favorable interest rate environment allowing the Federal Reserve to cut its benchmark rates has also helped lift investor sentiment. AbbVie sold $30 billion in bonds in mid-November at advantageous rates.

Microsoft

Similar to Apple, Microsoft (MSFT) has had a strong year owing to its booming cloud computing business. Microsoft stock has gained around 47% this year, giving it a market capitalization of more $1 trillion, although a little lower than Apple’s.

One of the biggest victories for Microsoft this year was a government contract worth $10 billion, despite a widespread belief that Amazon’s AWS would win the competition because it is the clear leader in cloud computing. Although Amazon challenged the government’s decisions on grounds that it may have been fueled by President Donald Trump’s beef with founder Jeff Bezos, some argue that Microsoft won fair and square.

Microsoft is the leader in hybrid cloud offerings, which allows clients to also use their own servers, something that may be more attractive for the Pentagon for security reasons.

The Bottom Line

AT&T promised to stop its acquisition binge and focus on integrating its multitude of different businesses as part of an agreement with activist investor Elliott Management. Both technology giants Apple and Microsoft had a strong year, with the former boosted by growing revenues from services and the latter benefiting from strong demand for its cloud computing services. Healthcare firm Johnson & Johnson had a bad year marked by continued legal troubles, while AbbVie closed a transformative acquisition of Allergan that it hopes will revive its growth.

Be sure to check out Dividend.com’s News section for next week’s Market Wrap and other great dividend investing news.