Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

Intel is first in the list this week as the chipmaker is on a tear following a strong earnings report. IBM has finally delivered a quarter of growth, earning the second spot in the list this week. Meanwhile, Boeing’s travails have also attracted a great deal of interest, with investors watching the unfolding corporate drama closely. Last in the list is Exxon Mobil, the oil giant that had a terrible start to the year.

Don’t forget to read our annual edition of trends here.

Intel

Intel (INTC) has seen its viewership advance as much as 143% for the past two weeks as the chipmaker has finally received a batch of good news in the form of a strong earnings report. The company crushed analyst estimates for its data-center sales, as tech giants ranging from Amazon (AMZN), Google (GOOG), and Microsoft (MSFT) increased their capital spending to build out their cloud capabilities. Sales in this segment rose 19% in the fourth quarter, around 13% higher than Wall Street analysts were expecting to $7.2 billion.

Although the stock rallied on the news and is now up more than 12% year-to-date, investors would be right to temper their enthusiasm. Intel will increase its capital spending dramatically as it plays catch up with Taiwanese rival Taiwan Semiconductor Manufacturing (TSM) and domestic competitor Advanced Micro Devices (AMD). The company said its capital outlays will amount to $17 billion in 2020, an increase of 5%. This will represent around 23% of its revenues, compared with an average of 18% between 2010 and 2015.

The increased capital spending is needed for the firm to build factories that would produce its next 7-nanometer processor. The company just recently started shipping 10-nanometer processors, something Taiwan Semiconductor, which serves clients such as AMD, has been doing for years. Taiwan Semiconductor is already shipping 7-nanometer processors and is working on the next generation of 5-nanometer processors.

While Intel’s capital spending is expected to remain at elevated levels over the coming years, demand for data-center products is expected to be more volatile. Demand from tech giants could decline substantially over the next quarters, as they need time to chew up their acquisitions made in the last quarter.

Use the Dividend Screener to find high-quality dividend stocks based upon 16 parameters. Stocks with the highest DARS ratings are Dividend.com’s current recommendations to investors.

IBM

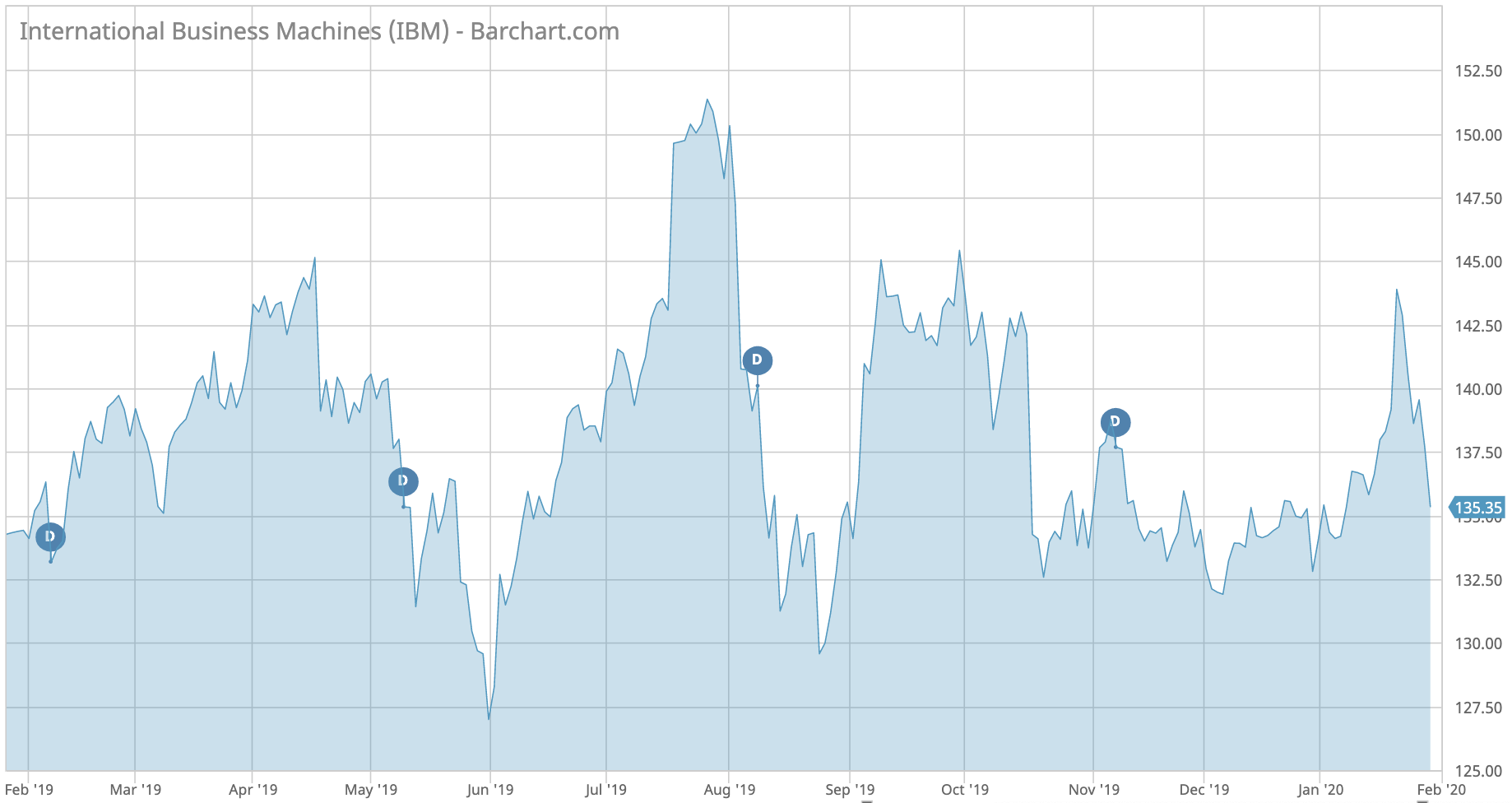

IBM (IBM) has taken second place in the list with an advance in traffic of 51%. The technology behemoth has finally posted growth after almost a decade of top line revenue declines.

Similar to Intel, IBM has received a boost from the cloud. Its cloud-related software and last year’s acquisition Red Hat have contributed to an increase in the company’s revenue in the final quarter of the year to $21.8 billion.

IBM also unveiled a strong outlook for 2020, saying that analyst expectations of 3% revenue growth was ‘reasonable’ while predicting earnings per share growth of 4% to $13.35. IBM’s revenues reached a peak in 2011 at around $107 billion and declined gradually since then. The company tried to offset falling growth by boosting earnings per share via buybacks but that strategy failed to bear fruit.

Since its all-time high in mid-March 2013, the stock has lost around a third of its value. Year-to-date, the shares are up more than 4% and it remains to be seen whether strong demand for cloud software and the Red Hat acquisition will be enough to offset falling sales in its legacy hardware business.

Big Blue has a dividend yield of 4.7% and its payout ratio is nearly 50%. The firm has been rewarding shareholders with dividend growth for the past 20 years.

Check out our latest Best Dividend Stocks List here.

Boeing

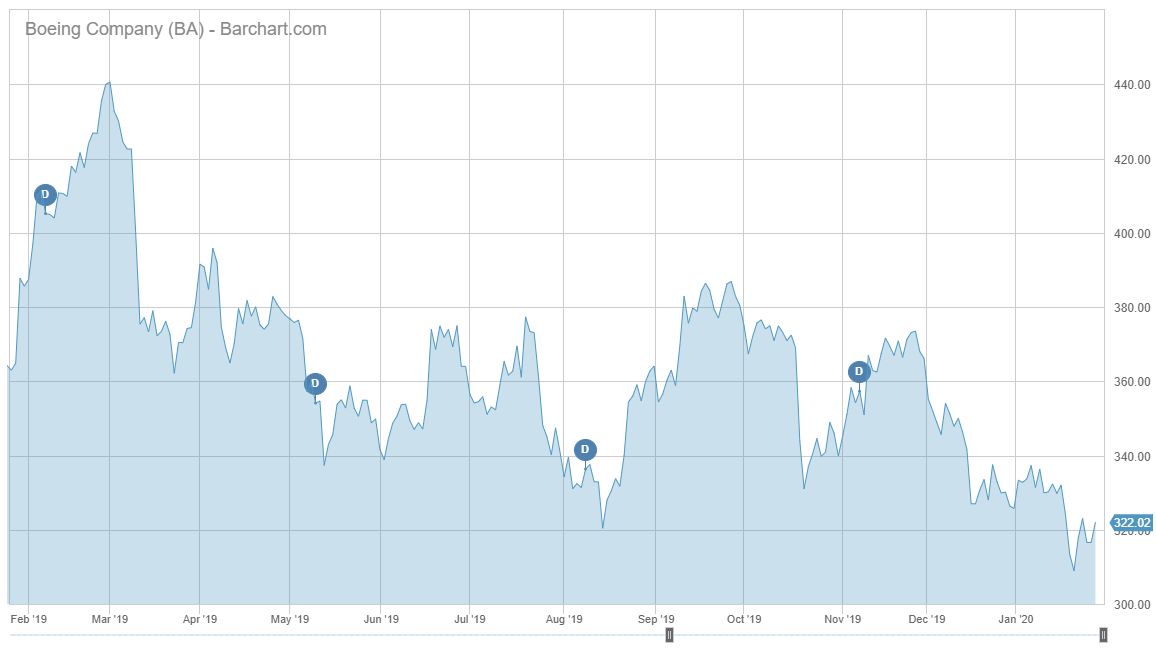

Aircraft manufacturer Boeing (BA) has seen its viewership rise 46% these past two weeks as the company reported its first loss in more than 20 years due to the fallout from its grounded 737 Max plane. Boeing said it registered a full-year loss of $636 million on revenue of $76.6 billion. In the fourth quarter, the loss was even greater, at around $1 billion.

Boeing was forced to ground and halt production of its best-selling jet 737 Max after two crashes were linked to a software fault that was pushing the nose of the plane down. Boeing said the crisis is expected to cost more than $18 billion and this does not include costs related to potential litigation with the families of the victims of the crashes.

Underscoring the trust of investors and creditors, Boeing recently succeeded in securing a $12 billion loan. As a result, over the next years, Boeing executives said they would prioritize debt repayment over share repurchases. Shares in the company are down 11% over the past 12 months. Airbus, Boeing’s arch-competitor in space, is up 33% during the same period.

Exxon Mobil

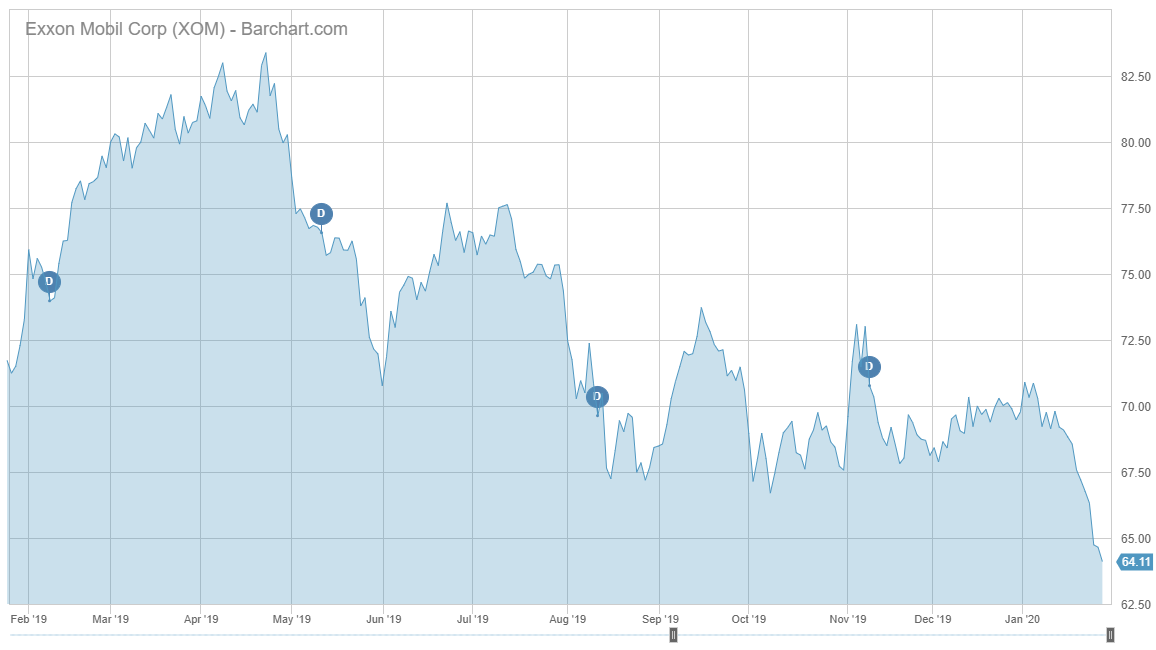

Exxon Mobil (XOM viewership is not far behind Boeing, with an increase of 43%. Exxon, which is the largest oil company by market capitalization in the world after Saudi Aramco, has been suffering from poor shareholder returns, as a lengthy slump in oil prices has hit its oil unit profitability while a trade war between the U.S. and China took a toll on its chemicals unit. The trade war could not come at a worse moment, as CEO Darren Woods ramped up capital investments at a time when rivals retreated.

As a result, Exxon put billions of dollars’ worth of assets on the auction block to improve its balance sheet, but progress has largely stalled so far.

Exxon’s dividend yields an impressive 5.3% and its payout ratio is dangerously close to 100%, meaning it might soon be forced to borrow money to maintain shareholder payouts. If it decides to cut its dividend or maintain it steady, it would be the first time in 37 years when shareholders will not see the dividend grow.

The Bottom Line

Intel has finally reported a strong quarter on growing sales of cloud-related products, although the outlook for the next year looks dim. IBM, another fading technology star, posted its first year of growth in almost a decade thanks to its Red Hat acquisition and cloud-related sales. Boeing has increased the estimate of its costs related to the grounding of its hit aircraft. Finally, Exxon’s bet on chemicals to offset falling profits in the oil business has backfired.

Be sure to check out Dividend.com’s News section for next week’s Market Wrap and other great dividend investing news.