Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

The COVID-19 pandemic has spread across Europe and the U.S., prompting the regions to close their economies. This has led to panic selling and the markets taking a severe beating. EPR Properties, which has real estate in one of the hardest hit areas, is first in the list, perhaps due to its high dividend yield. Defense and aircraft maker Boeing has hit the skids as the firm is now likely to be bailed out by the U.S. government. McDonald’s has coped relatively well with the pandemic along with Charlotte, North Carolina-based electric utility Duke Energy.

Don’t forget to read our previous edition of trends here.

EPR Properties

Real estate operator EPR Properties (EPR) has taken the first place in the list this week with a rise in viewership of 66%. EPR invests in real estate in amusement parks, theaters, and cinemas across 44 states in the U.S., and is going to be hit as its tenants are forced to close due to the COVID-19 pandemic.

Shares in EPR have lost 70% over the past 30 days and at some point were down as much as 80%. Investor pessimism was connected to the company’s $3.3 billion in debt and its ability to repay it. The company’s current market capitalization is just half of its debt. As a result, its dividend yield spiked to more than 20% as the company pays out 167% of its net income to shareholders.

To soothe investor concerns, EPR came out with a press release and made it clear that it has a strong balance sheet and liquidity position. It has cash of $1.25 billion, and half of that was borrowed under a revolving credit facility, with no debt maturing until 2023. To support its stock price, EPR announced a share repurchase program worth $150 million, at a time when many companies scrap share repurchases to repurpose that cash toward operations.

EPR is expected to go ex-dividend on March 30.

Use the Dividend Screener to find high-quality dividend stocks based upon 16 parameters. Stocks with the highest DARS ratings are Dividend.com’s current recommendations to investors.

Boeing

Boeing (BA) has taken the second position in trends, seeing a rise in traffic of 48%. The defense and aircraft manufacturer has been hit by slow orders as the airline industry dramatically reduced capacity due to the COVID-19 pandemic. The blow came as the company was already struggling with huge losses related to its grounded 737 MAX plane, which is believed to have been the main cause of two deadly crashes.

Boeing now needs to be bailed out by the U.S. government, which could take an equity stake for cash. However, recently-installed CEO David Calhoun said the company does not need the government to intervene directly but rather provide liquidity in the credit markets. “Allow us to borrow against our future, which we all believe in very strongly and I think our creditors will too. It’s really that simple," Calhoun said in a video segment for Fox Business.

Boeing has already taken measures to save cash. It has suspended its dividend until further notice, while Calhoun and Chairman Larry Kellner will forgo pay this year. The pause in the buyback program has been extended.

Before the suspension, Boeing’s dividend had yielded nearly 7% and it had grown for the past eight years.

Check out our latest Best Dividend Stocks List here.

McDonald’s

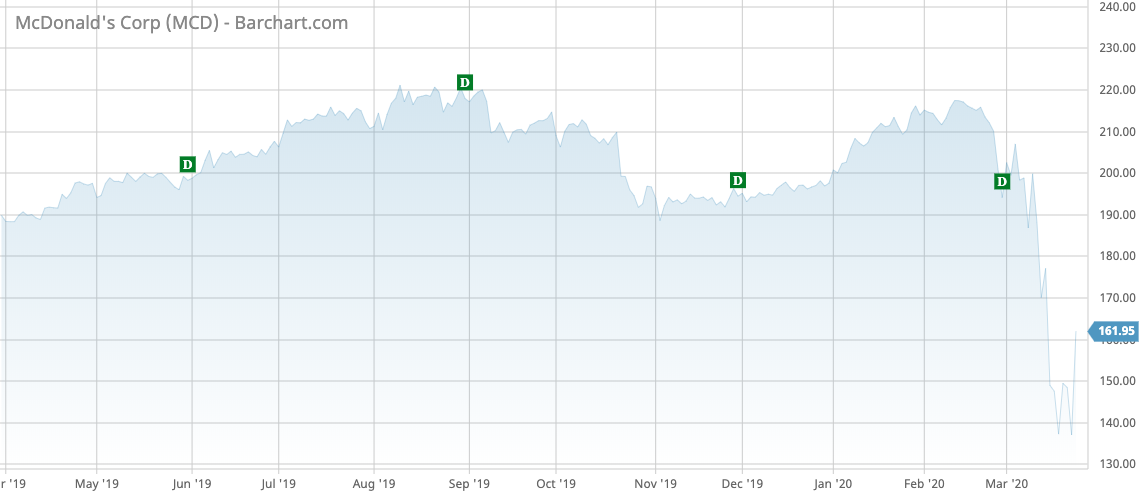

McDonald’s (MCD) is one of the few restaurant chains that has largely weathered the crisis. As such, McDonald’s has seen its viewership grow by 45% over the past two weeks.

McDonald’s is keeping all its 40,000 restaurants across the U.S. open during the pandemic, as customers are still welcomed to order via drive-through and online. As such, the company’s stock has lost 25% over the past 30 days, beating the S&P 500 Index by almost two percentage points.

While McDonald’s has kept its dividend intact, it did halt its share repurchase program to maintain financial flexibility. In 2019, the fast food giant splashed $5 billion on repurchasing shares and in December the board authorized another $15 billion with no expiration date.

While the company is doing relatively well, its franchisees are struggling and they are currently working to restructure loans. Suppliers are also extending payment terms, while the company is offering deferrals on service fees.

McDonald’s has a dividend yield of 3.4% and its payout ratio is 60%. The fast food company has been raising its dividend for the past 43 years.

Duke Energy

Duke Energy (DUK) is last in the list this week with an advance in viewership of 34%. The electric utility based in Charlotte, North Carolina, has seen its shares lose 27% of their market value, despite not being directly affected by the COVID-19 crisis. Duke has not provided an update to shareholders but reassured its customers and employees that it has taken steps to mitigate the pandemic’s effects. Among them, customers who are late paying their bills will not be disconnected, although the firm encouraged customers to not build up large balances.

As the Federal Reserve reduced interest rates to record lows, Duke may face an adverse impact over rate hikes. Given the low bond yields, regulators might not allow utilities to raise rates for customers too much.

Duke’s dividend yield stands at 5.3% and its payout ratio is 73%.

The Bottom Line

The COVID-19 pandemic has impacted global markets but not all stocks were hit in an equal manner. EPR Properties was among the chief losers as the indebted real estate operator rents out properties in the badly hit recreational sector. For Boeing, COVID-19 is the second severe blow and the company is now seeking help from the government. McDonald’s is among the least hit restaurant chains given that a majority of its U.S. restaurants are open for deliveries and drive-through. Finally, Duke Energy might suffer from low interest rates and late payments from customers.

Be sure to check out Dividend.com’s News section for next week’s Market Wrap and other great dividend investing news.