The gaming industry has always been a compelling space for income investors given its above-average high-dividend yields. With the COVID-19 outbreak, many casinos have been forced to shut their doors while still incurring a significant cash burn. They have responded by cutting dividends and suspending buybacks to preserve cash.

Let’s take a look at how COVID-19 has impacted casinos, how many companies are preserving liquidity, and the many important considerations for income investors.

Use the Dividend Screener to find high-quality dividend stocks. You can even screen stocks with DARS ratings above a certain threshold.

Gaming Industry in Limbo

All of the nearly one thousand commercial and tribal casinos in the U.S. have shut down due to the COVID-19 outbreak. These shutdowns have impacted more than 50 million gamblers, 652,000 employees and more than a million other employees in industries that rely on the gaming industry to support their livelihoods.

In addition to the tremendous human impact, the industry’s shutdown will cost the economy an estimated $43.5 billion in economic activity, according to the American Gaming Association. While some states are starting to reopen, many experts believe that the industry’s revenue isn’t likely to return to pre-crisis levels for some time.

MGM Resorts CEO Bill Hornbuckle said that most properties need to be 30 to 50% occupied to generate meaningful levels of cash flow given their overhead. Meanwhile, Bank of America analyst Shaun Kelley said that Las Vegas’s reliance on air travel and large-scale events suggest that any full reopening could take a long time.

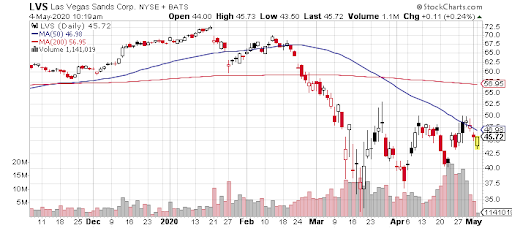

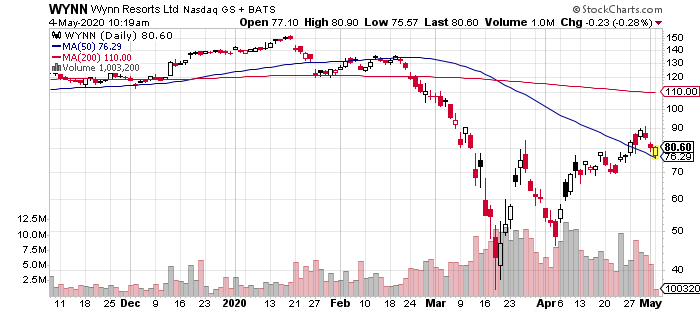

According to Numara’s analysis, casinos with the greatest exposure to Macau – China’s primary gambling destination – are likely to stay solvent for the longest period of time. This list of companies includes Las Vegas Sands Corp. (LVS), Wynn Resorts Ltd. (WYNN) and Melco Resorts and Entertainment Ltd. (MLCO).

Macau reported an expected 97% drop in revenue due to the COVID-19 outbreak earlier this month. While the region is projected to rebound sooner than the U.S., creating some cash flow for casinos, visa restrictions have hampered its comeback thus far. Chinese tourists have begun to gamble again, but Hong Kong and other countries remain locked out.

Don’t forget to check our Casinos and Resorts industry page to explore more stocks.

Cash Is King in Las Vegas

Many casinos have already suspended their dividends and share repurchase to shore up liquidity. The move also frees some companies to borrow money from the federal government under its $2+ trillion stimulus program, which may require the suspension of buybacks and dividends in order to access any funds.

Las Vegas Sands suspended its quarterly dividend in mid-April, but said it would continue with capital expenditure programs in Macau and Singapore. Despite the challenging circumstances, CEO Sheldon Adelson believes that the company will emerge from the pandemic with future growth opportunities intact.

Wynn Resorts reported about $3 billion in liquidity in early April, which gives it about one-and-a-half years of property-operating expenses and cash interest expense burn. In addition, the company secured some breathing room in mid-April with an amendment to its credit agreement with Deutsche Bank.

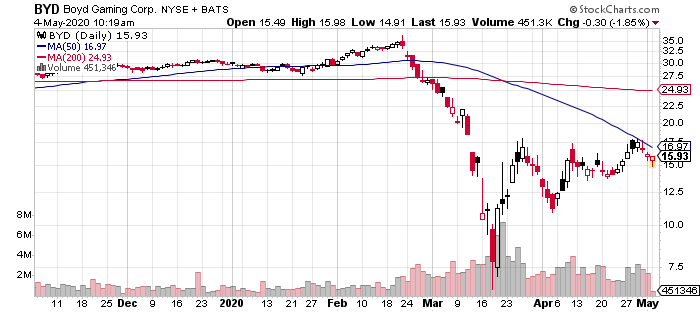

Boyd Gaming Corp. (BYD) suspended its quarterly dividend and pulled FY 2020 earnings guidance in April. In addition, the company put most of its 25,000 employees on unpaid furlough and cancelled all of its capital projects to preserve liquidity while its properties remain closed.

MGM Resorts International (MGM) will cut its dividend to a nominal $0.01,or less, per share reduce employee costs, encourage executives to accept stock in lieu of cash, and defer at least half of its planned capital expenditures in 2020 in order to reduce its cash burn.

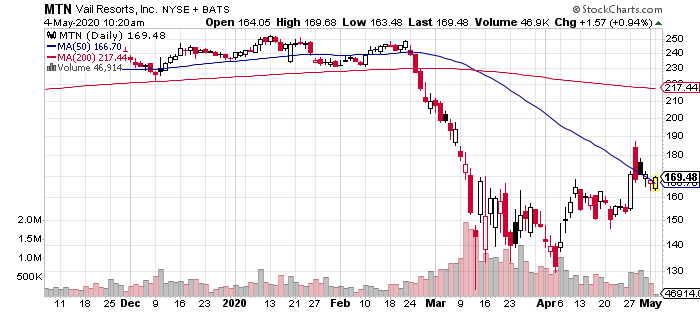

Vail Resorts Inc. (MTN) suspended its quarterly dividend for the next two quarters and plans to reduce capital expenditures by $80 million to $85 million in 2020. In addition, the company announced that it would issue $500 million of senior unsecured notes due in 2025 in late April.

Among other prominent players, Everi Holdings Inc. (EVRI) withdrew its FY 2020 guidance, drew down a $35 million line of credit and is pursuing other avenues to boost liquidity. Meanwhile, Penn National Gaming Inc. (PENN) was downgraded by Moody’s from Ba3 to B1 with a negative outlook.

Follow Dividend.com’s Education section to get answers to all your dividend-specific questions.

Implications for Income Investors

Many casinos have cut their dividends and share repurchase programs to shore up liquidity and open the door to federal aid given the no dividend and no buyback requirements. As with many other equity sectors, income investors may want to look elsewhere for yield as public companies preserve their cash at the expense of dividends.

That said, investors will be closely watching Wynn Resorts’ first-quarter earnings after the bell on May 6 to see if they will take any action to cut dividends. Wynn Resorts has one of the best cash positions in the industry and has, thus far, avoided cutting its dividend, which stands at about four percent as of May 4, 2020.

The Bottom Line

The COVID-19 outbreak has been devastating to the tourism and gambling industries. While Macau has seen signs of recovery, Las Vegas and the U.S. casino markets overall remain largely closed for business. Many companies have cut dividends and suspended buyback programs to preserve liquidity in the meantime.

Be sure to visit our complete recommended list of the Best Dividend Stocks.