The COVID-19 outbreak has had a significant impact on the economy, but that impact hasn’t been evenly spread. For example, some grocery stores, biotech firms and tech companies have outperformed the market, while oil and gas companies, and casino operators have been especially hard hit.

The same is true for the REITs that own the real estate underneath many of these businesses.

Let’s take a look at how the crisis has impacted shopping center REITs, recent dividend cuts and the takeaways for income investors in the space.

Use the Dividend Screener to find high-quality dividend stocks and REITs. You can even screen stocks with DARS ratings above a certain threshold.

How COVID-19 Impacts REITs

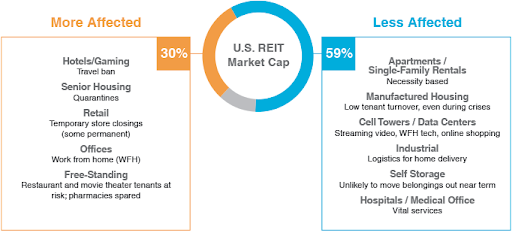

Hotels and gaming, senior housing, and retail tenant (shopping center) REITs have experienced the greatest impact from the COVID-19 outbreak. Hotels, casinos and shopping malls have been largely shut down and senior housing has become a major source of COVID-19 outbreaks throughout the nation.

Source: Cohen & Steers

On the other hand, rental housing and self storage have been relatively healthy on the consumer side. Industrial REITs focused on logistics, technology and healthcare (excluding senior housing) have relatively low risk on the business side compared to some of the other REIT sub-sectors mentioned earlier.

Don’t forget to check our Casinos and Resorts industry page to explore more stocks.

Strong Balance Sheets

The COVID-19 outbreak has sparked liquidity concerns for the real estate sector. According to a recent report by Cohen and Steers, while income may certainly dry up in the short term, balance sheets remain very strong with average leverage of just 32%, which has staggered across maturities to limit short-term breaches of covenants.

In addition, record-low interest rates have made it extremely cheap for REITs to borrow capital. REIT bond yields were just 3.6% in February 2020, representing a modest spread over 1.1% 10-year Treasury yields. The Federal Reserve has also promised ample liquidity to weather short-term commercial debt issues.

There are two caveats to this relatively positive outlook:

1. The COVID-19 crisis is exacerbating problems for REITs that were already under pressure, such as shopping malls, and could push many vulnerable players operating in this space into choppy water.

2. REITs may be able to service debt without any issue, but without income, they may have to lower distributions to shareholders until income returns.

The result has been dividend cuts in weaker REIT sub-sectors and those suffering from lower demand due to the pandemic.

Follow Dividend.com’s Education section to get answers to all your dividend specific questions.

Shopping Malls Cut Dividends

There have been many examples of recent dividend cuts and suspensions among key shopping mall REITs as they shore up liquidity to maintain a safe buffer for missed rents.

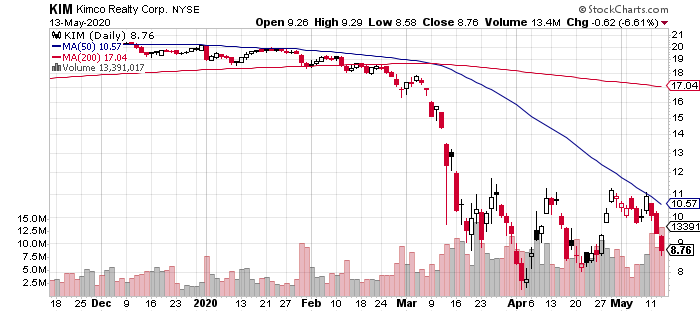

1. Kimco Realty Corp. (KIM) – Kimco’s Board of Directors temporarily suspended the company’s dividend based on its common shares, but intends to reinstate it during 2020 for at least the amount required to remain compliant. The REIT has one of the strongest liquidity positions and longest debt maturity profiles in its sector, with 96% occupancy rates going into the crisis.

Source: StockCharts.com

2. Weingarten Realty (WRI) – Weingarten experienced large gains across its 2019 portfolio and intended to issue a special dividend, but it opted to pay those dividends throughout 2020 instead. However, that amount would represent a drop of nearly 50% from its previously declared dividend in February 2020. The REIT set aside $9 million for bad debt and collected more than 60% of its April rents, while it maintains a strong 6.1x net debt to EBITDA ratio.

3. Retail Properties of America (RPAI) – RPA suspended its dividend for common shares after collecting just over half of its April rents. The REIT also drew down $850 million from its line of credit and reduced 2020 development spending by up to $100 million.

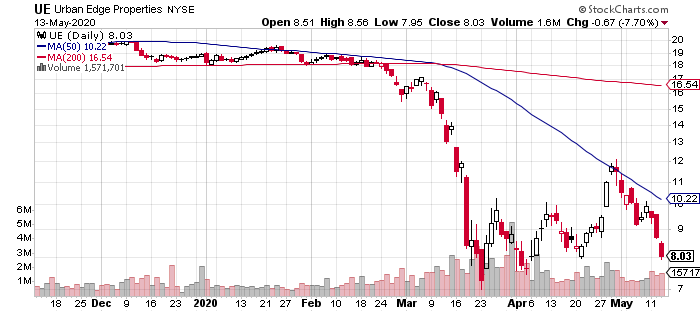

4. Urban Edge Properties (UE) – Urban Edge temporarily suspended its quarterly dividend to preserve capital after collecting about 56% of its April rents. The REIT maintains one of the strongest liquidity positions in the sector with $1 billion in liquid assets and a low leverage structure consisting of single asset non-recourse mortgages on most properties.

Source: StockCharts.com

5. Retail Opportunity Investments (ROIC) – ROIC suspended its quarterly dividend in response to COVID-19, impacting tenants at many of its shopping centers. While all 88 of its shopping centers are open (primarily grocery store anchor tenants) nearly 30% of tenants are temporarily closed. The REIT drew down $130 million of its $600 million credit facility and has $133.5 million in cash on its balance sheet.

6. Cedar Realty Trust (CDR) – Cedar Realty reduced its dividend to one-cent per share to preserve capital. The REIT also drew down $75 million from its credit facility and has $20 million in remaining borrowing capacity. Management has also begun reducing near-term redevelopment and other non-essential capital expenditures.

Implications for Investors

Income investors may see less income coming from REITs in the current environment but most will be able to weather a short-term crisis without any issues. There are few comparisons to be made with 2008 when the problems were much more structural in nature (e.g. excessive debt).

If COVID-19 cases peak over the coming months and monetary and fiscal policies remain accommodating, there’s no reason to believe that these investments will suffer a catastrophic downturn and any panic selling is unwarranted. The only catch is that there could be less income during that time.

That said, REITs have historically recovered faster and stronger than the broad equity market during the past six market corrections of 10% or more. If conservative REITs trade at a discount, it could be an opportunity for investors to build up their stake at an attractive cost basis.

The Bottom Line

The COVID-19 outbreak has had a mixed effect on REITs. While some remain unscathed, it has exacerbated problems in others, such as shopping malls. The good news is that most REITs are well capitalized to weather a short-term crisis, and any rebound could produce outsized returns.

Be sure to visit our complete recommended list of the Best Dividend Stocks.