Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

With stock markets in retreat from record highs, some of the technology darlings have felt the pinch. Apple, which is first in the list, is one of them, although the company’s market capitalization remains above $2 trillion. Second in the list is Intel, which finally made an encouraging announcement after a string of downbeat reports. Walmart is third in the list as it recently introduced a subscription model for consumers. The list is closed out by Wells Fargo, which was criticized by ratings agency Moody’s.

Don’t forget to read our previous edition of trends here.

Apple

Apple (AAPL) has taken the first spot in the list this week, with a 58% increase in traffic, as the company’s stock experienced a sell-off just ahead of its much-awaited release of the iPhone 12, the first to have 5G technology embedded.

Apple, which pays a meager annual dividend of $0.76 per share or 0.6% yield, saw its stock shed $10 per share last Thursday. The sell-off came shortly after it reached a record high of $134 per share on September 1. However, despite the fall in its stock price, Apple retained its crown as the most valuable company in the world with a capitalization of more than $2 trillion. The stock is still north of 60% for the year, trading at a price-to-earnings ratio of 34.

What helped Apple’s rally was a 4-to-1 stock split, which allowed retail investors on the Robinhood application to load up on the stock. Meanwhile, expectations of a new iPhone boosted sentiment. Indeed, reports suggested that Apple ordered its suppliers to manufacture at least 75 million iPhones, as it expects high demand. Apple expects to ship around 80 million handsets this year.

Apple will release four new versions of the iPhone, two basic models and two high-end models, and all of them will have OLED screens. The display sizes will range from 5.4 to 6.7 inches.

The design of the new models was finished well before the COVID-19 pandemic, but production had been delayed by several weeks. It was initially believed that the presentation of the new products will take place in September, but the event was delayed until later this year.

Source: Barchart.com

Use the Dividend Screener to find high-quality dividend stocks based upon 16 parameters. Stocks with the highest Dividend.com Rating are Dividend.com’s current recommendations to investors.

Intel

Intel (INTC) has taken the second place in the list with a rise in viewership of 27%, as the technology company received a boost after announcing a new laptop processor that aims to integrate the CPU and the graphics processing unit. Named Iris XE, the processor will allow gamers for the first time to play triple-A games, which require most computing power at full high definition.

Intel said that more than 150 laptop designs will have this chip, with partners including Dell, HP and Samsung. Apple recently moved its Macbooks away from Intel chips, which was a hard hit to the company’s stock.

Intel has been struggling to manufacture its latest 7-nanometer model and lost out to competition from AMD and Taiwan Semiconductor. In July, it disclosed again that it will be delaying the shift by another six months. To soften the blow, the company said its new 10-nanometer processors use a so-called SuperFin technology, which it expects to boost performance by up to 20%, the same as moving to smaller transistors.

Intel shares have lost 16% year-to-date, while iShares PHLX Semiconductor Index gained 21%. Intel pays an annual dividend of $1.26 per share, the equivalent of a 2.5% yield.

Source: Barchart.com

Check out our latest Best Dividend Stocks List here.

Walmart Stores

Grocery retail giant Walmart (WMT) has taken the third spot in the list with an advance in traffic of 21%. Walmart made headlines after it launched a subscription model for free delivery for groceries and other items. As such, Walmart is taking on Amazon (AMZN), whose Amazon Prime free delivery subscription has attracted 150 million customers worldwide.

The service, called Walmart+, will be available for $98 per year, priced cheaper than Amazon’s $119 delivery service.

The challenge for Walmart is that many of its customers are already paying for Amazon’s subscription and it remains to be seen how many of them will make the switch or be willing to pay for both.

Walmart shares have risen by 10% over the past 30 days, while the S&P 500 Index is up by 3.1%. Since the beginning of the year, Walmart stock is up by 20%, versus the 7% upswing for the S&P 500. Walmart pays an annual dividend of $2.16 per share and yields 1.49%.

Source: Barchart.com

Wells Fargo

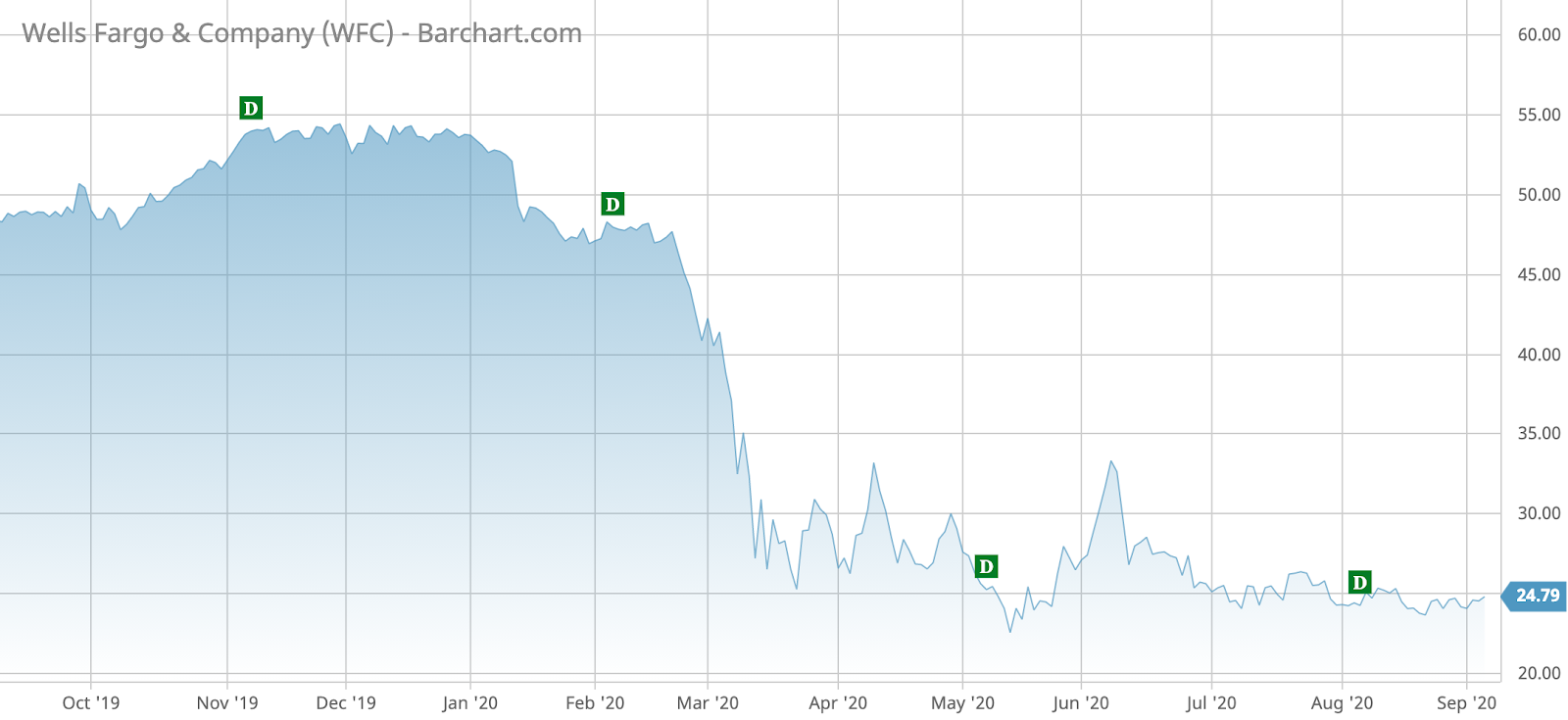

Wells Fargo (WFC) closes out the list with an advance in viewership of 19%. Wells Fargo shares have suffered from the coronavirus pandemic, and over the past few weeks it received two pieces of negative news.

For instance, Moody’s has lowered Wells Fargo’s debt rating from “stable” to “negative,” citing concerns that the bank has failed to address its governance following the account fraud scandal in late 2016. At the same time, Warren Buffett’s Berkshire Hathaway, a long-time backer, recently reduced its stake in the company to 3.3%, which is worth $3.4 billion. At its peak, Berkshire’s stake in Wells Fargo was valued at over $30 billion. Shares in Wells Fargo are down by 53% since the start of the year, giving the company a market capitalization of around $100 billion.

Wells Fargo cut its dividend by 80% in July to a quarterly $0.10 per share, representing a yield of less than 2%.

Source: Barchart.com

The Bottom Line

Apple stock has experienced a sell-off ahead of a key release of its newest iPhone, although the company remains a strong performer with a market capitalization of more than $2 trillion. Intel still faces problems producing its 7 nanometer chips, but said improvements to its existing 10-nanometer chip has boosted performance by 20%. Walmart is taking on Amazon with the launch of a new subscription model for free delivery. Finally, Wells Fargo has seen its credit outlook lowered by both Moody’s and Warren Buffett reducing his exposure to the stock.

Be sure to check out Dividend.com’s News section for next week’s Market Wrap and other great dividend investing news.