Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

NextEra Energy, a dividend-paying renewable energy company, has taken the first spot this week as its market capitalization recently surpassed Exxon Mobil’s. Second in the list is chipmaker Intel, which again released a set of disappointing earnings, triggering a decline in the stock price. Wells Fargo is third in the list as the U.S. bank failed to meet its own earnings targets in the third quarter. The list is closed by tobacco products maker Altria.

Don’t forget to read our previous edition of trends here.

NextEra Energy

NextEra Energy (NEE) has taken the first spot in the list this week with a 67% rise in viewership. NextEra has received investor praise in the form of a high earnings multiple for its balanced strategy under which it continues to pay a dividend while investing heavily in renewable energy.

NextEra pays an annual dividend of $1.40 per share, resulting in an annual yield of around 1.9%. However, NextEra has also rewarded investors with strong stock price performance. Year-to-date, shares have risen 24%, extending five-year gains to 192%.

This performance has led to an increase in its market capitalization to $147 billion, and recently it surpassed oil major Exxon Mobil (XOM), which has seen its market cap decline 60% over the past five years to $143 billion. The divergence in performance between the two companies shows how the results of the strategies employed by the two companies contrasted.

Exxon has largely avoided investing in renewables and doubled down on oil, while NextEra decided to invest its free cash in renewables. Despite still having a large part of its business in coal and natural gas, investors have often found refuge in the less volatile renewable energy, despite it being capital intensive and less profitable.

Further bolstering NextEra’s investment appeal is its utility unit, which caters to dividend-seeking investors.

Use the Dividend Screener to find high-quality dividend stocks based upon 16 parameters. Stocks with the highest Dividend.com Rating are Dividend.com’s current recommendations to investors.

Intel

Intel (INTC) has taken second place in the list this week with an advance in traffic of 41%. Intel has been in the news for all the wrong reasons. The microchip giant recently revealed another batch of weak results while failing to give a concrete plan to fix issues with its next-generation 7 nm production process, which has been pushed to 2022.

Intel executives said they would unveil a plan in around three months’ time, which will include a decision on whether to take the extraordinary step of outsourcing the production of 7 nm chips, like other chipmakers, including arch-rival AMD.

Intel earnings for the third quarter still beat expectations. Third-quarter net income was $4.3 billion, or $1.02 per share. Adjusted earnings, which strips out the effect of acquisitions and other factors, came in at $1.11 per share versus forecasts of $1.10 per share. Revenue of $18.3 billion fell from $19.2 billion a year ago but was still above analysts’ forecasts of $18.22 billion.

The beat has failed to soothe investors. Intel shares have dropped 15% over the past 30 days, falling for the first time below the level it reached in March during the broad market selloff. So far this year, Intel shares have fallen 25%, underperforming both iShares PHLX Semiconductor ETF, which is up 22%, and AMD, which advanced 62%.

Intel pays an annual dividend of $1.32 per share, amounting to a dividend yield of nearly 3%. Its payout ratio is around 27%.

Wells Fargo

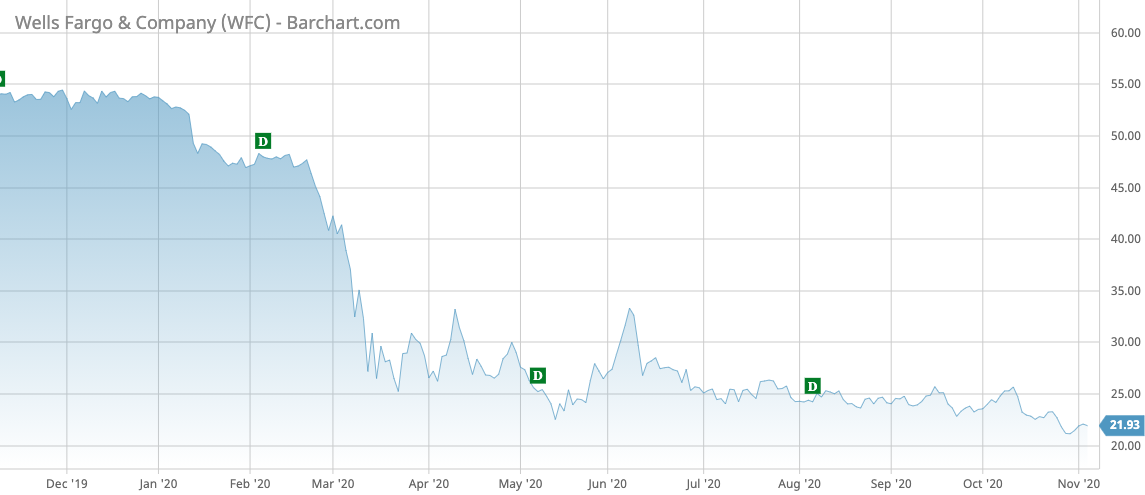

Wells Fargo (WFC) has taken the third spot in the list this week with a rise in viewership of 24%. The bank recently reported earnings that disappointed analysts’ estimates, largely due to falling interest rates and rising delinquencies stemming from the coronavirus pandemic. For the third quarter, Wells Fargo reported 42 cents per share on $9.4 billion in interest income, compared with expectations of 45 cents per share on earnings of $9.7 billion.

As the housing market is still very strong, interest generated from mortgages rose to $1.6 billion in the third quarter from $1.3 billion in the prior quarter and $1.1 billion in the same period in 2019. CEO Charles Scharf said in a company press release that the environment remains uncertain as further fiscal stimulus from the government is still in the balance. However, Scharf made clear the bank’s capital and liquidity levels are above the minimum regulatory requirements.

Wells Fargo stock is still reeling from a 2016 scandal related to the creation of millions of fake bank accounts. At the beginning of 2020, the bank agreed to pay $3 billion to settle criminal charges from its mistreatment of customers.

Banks have all underperformed over the past 12 months, but Wells Fargo in particular. SPDR S&P Bank Index is down 24% during the period, while Wells Fargo lost 58%.

Wells Fargo cut its dividend by 80% in July, and now pays an annualized dividend of $0.40, amounting to a yield of $1.86%.

Check out our latest Best Dividend Stocks List here.

Altria Group

Tobacco products maker Altria Group (MO) has seen its traffic advance 24% over the past two weeks, on par with Wells Fargo.

Altria has made headlines after it reported a net loss of $952 million for the third quarter, as it recorded an impairment charge of $2.6 billion related to its investment in vape products maker Juul. The e-cigarette maker has seen its valuation suffer due to heightened regulatory scrutiny following a rise in teenage vaping. Juul said in a memo that its value fell to $10 billion from $12 billion at the end of last year. When Altria took a 35% stake in the company, Juul was valued at $38 billion.

Shares in Altria have declined 17% so far this year. Altria pays a dividend of $3.24 per share, resulting in an annual yield of nearly 9%.

The Bottom Line

NextEra’s long-term bet on renewable energy has paid off, as the company recently surpassed oil major Exxon Mobil in market capitalization. Intel has once again disappointed investors by failing to come up with a concrete plan to fix its production issues for its next-generation chip. Wells Fargo has released a set of disappointing earnings due to lower interest rates, although the housing market was strong. Finally, Altria trended as it recorded a massive impairment charge related to its investment in Juul.

Be sure to check out Dividend.com’s News section for next week’s Market Wrap and other great dividend investing news.