Toward the end of each year, Dividend.com analyzes the search patterns of our visitors on a year-to-date basis. By sharing these trends with our readers, we hope to provide insights into stocks significantly impacted due to various events, including COVID-19, happening throughout 2020.

Telecommunications company AT&T was the most popular this year as the telecom firm reshaped its strategy and changed leadership. Apple was second on the list, as the company’s stock led the gains in the technology sector, which was boosted by the coronavirus pandemic. Real estate company Realty Income suffered following the COVID-19 crisis, along with many other real estate companies in the office and retail sector. Oil major Exxon Mobil took the last spot, as the giant failed to adapt its strategy away from crude and is now facing pressure from an activist investor.

Don’t forget to read our previous edition of trends here.

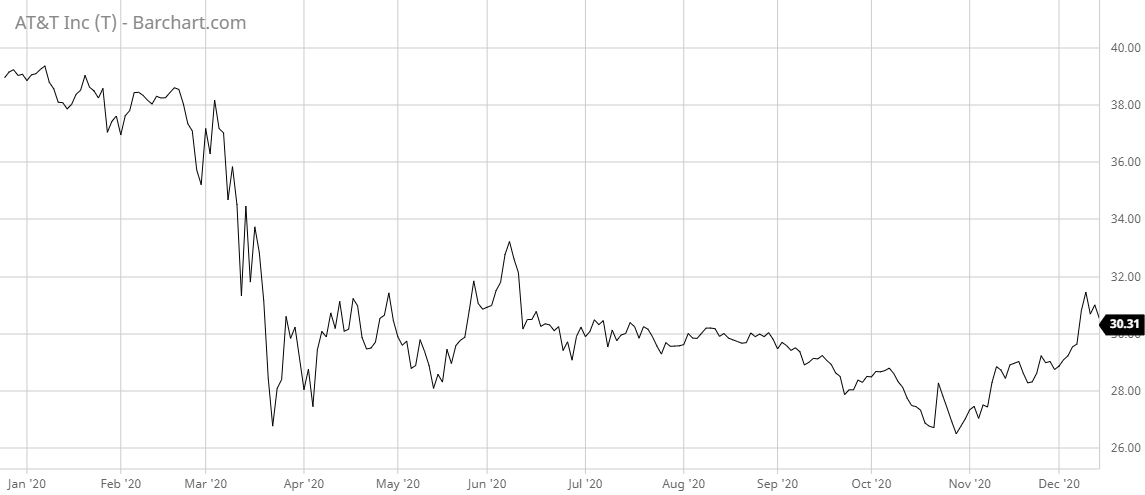

AT&T

Telecommunications company AT&T (T) is the most popular stock this year. The company has undergone massive changes following pressure from activist investor Elliott Management, which is believed to have exited the stock.

The company’s long-time CEO Randall Stephenson resigned in the spring of this year and was replaced by John Stankey, who had previously served as chief operating officer. Stankey was meant to continue Stephenson’s strategy of creating a modern media and telecom company.

However, in 2020, AT&T was forced to temper its ambitions. The company is now trying to undo the 2015 acquisition of DirecTV for $67 billion and put the division up for sale to reduce its debt. It is likely to receive something in the region of $15 billion, as the broadcast satellite service provider has seen a massive decline in subscribers since it was acquired.

At the same time, the acquisition of Time Warner for $108 billion in 2018 does not seem very inspiring. The WarnerMedia division has suffered from the coronavirus pandemic, while its promising streaming service HBO Max is falling behind competitors like Netflix (NFLX) and Disney (DIS).

As a result of its indebtedness and unclear strategy, AT&T shares have continued to suffer. This year, the stock has lost 21%, underperforming more focused rival Verizon Communications (VZ), which saw its stock lose 2.5% during the same period. On the contrary, the S&P 500 Index has gained 14% this year.

Use the Dividend Screener to find high-quality dividend stocks based upon 16 parameters. Stocks with the highest Dividend.com Ratings are Dividend.com’s current recommendations to investors.

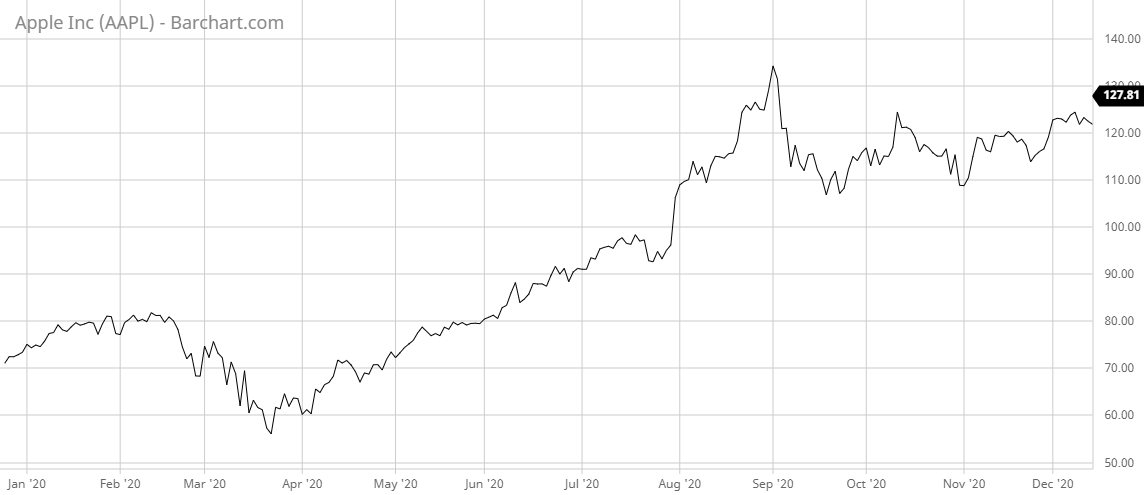

Apple

Apple (AAPL) has trended second this year, as the technology juggernaut pleased investors with a host of milestones. Firstly, Apple crossed the $2 trillion-mark valuation, just around a year after it reached the stunning $1 trillion-market capitalization. Shares in Apple have appreciated by around 74% this year, extending five-year gains to nearly 360%. Apple continues to be the world’s most valuable company.

Secondly, Apple made history when it dropped long-time partner Intel (INTC) for the supply of its chips in favor of an in-house model based on the technology of Arm, a chip designer owned by Softbank Group and currently in the process of being acquired by Nvidia (NVDA), a high-growth Intel challenger.

Thirdly, this year Apple revealed brand new flagship phones – iPhone 12 and iPhone 12 Pro – both of which boast 5G, the fifth generation technology standard that promises extremely high speeds. The new launch has boosted the company’s sales, despite the coronavirus pandemic wreaking havoc on global economies.

The technology sector has been one of the few sectors this year that has benefitted from the pandemic, with companies like Apple, Amazon (AMZN) and Zoom Communications, all profiting off the stay-at-home economy.

Check out our latest Best Dividend Stocks List here.

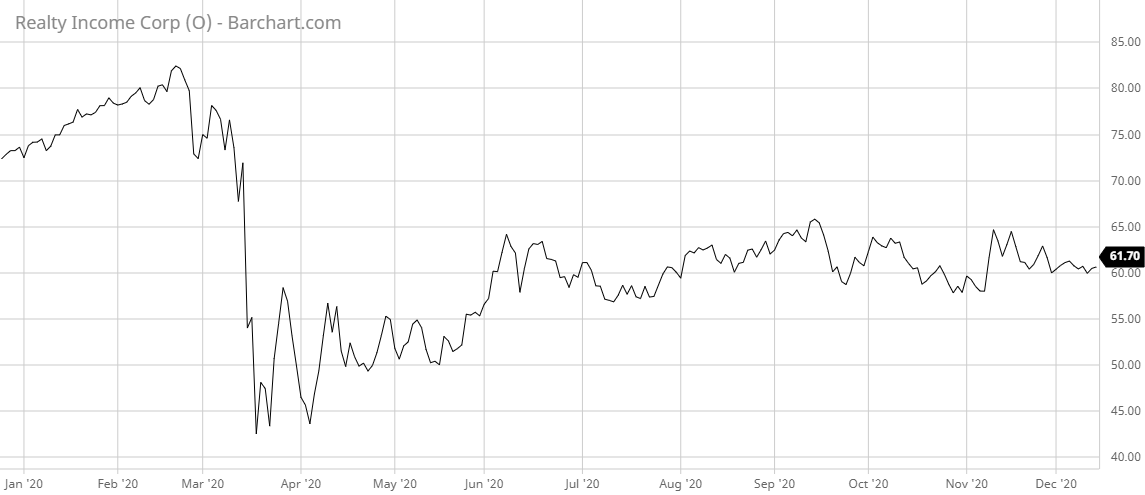

Realty Income

Realty Income (O) was the third most popular ticker this year. Realty Income, which invests in single-tenant commercial properties across the U.S. and the U.K., started the year with very good news, joining the S&P 500 Dividend Aristocrats in early February, as the company increased its dividend for 93 consecutive quarters. A few months later, as the coronavirus pandemic wreaked havoc on the global economy, Realty Income tapped a credit line to boost liquidity and withdrew its guidance.

Most of the real estate sector was in pretty bad shape, with the hospitality and office industry especially hit. Realty Income also suffered but the blow was less heavy as most of its tenants are retailers like Dollar General (DG), Walgreens (WBA) and Sainsbury’s. For the months of April and May, the company collected 84% and 82% of its contractual rent, respectively, with the percentage improving to 91% in July and 93.6% in November.

Shares in Realty Income remain down around 11% for the year. Realty Income’s dividend yields more than 4.5%.

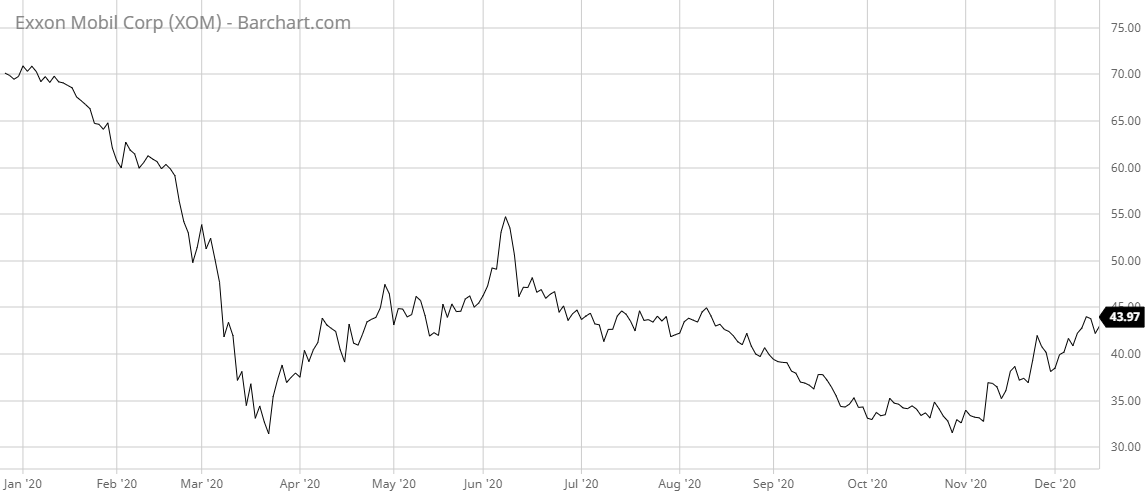

Exxon Mobil

Exxon Mobil (XOM) has trended last, as it is hard to imagine a worst year for the oil major (and the fossil fuels in general).

The coronavirus pandemic hit oil prices badly in the spring of this year, prompting Exxon to post its first loss in 30 years as it wrote down the value of some inventory. In August, Exxon received another blow when it was excluded from the prestigious Dow Jones Industrial Average.

The year is also ending on a bad note, as the once untouchable oil giant now faces pressure from new activist investor, Engine No 1, to reshuffle the board and change its strategy away from heavy investments in oil.

If oil prices recover, next year could be more merciful for Exxon, but over the longer term, the company would probably have to rethink its strategy.

The Bottom Line

AT&T has undergone leadership changes this year as the company gave up on its dream of becoming an integrated media and entertainment company. Apple became a $2 trillion market capitalization company just one year after it crossed the historic $1 trillion mark. Realty suffered from the pandemic but its dividend yield remains strong and sustainable. Exxon had one of the worst years in its history and now faces an activist investor.

Be sure to check out Dividend.com’s News section for next week’s Market Wrap and other great dividend investing news.