Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

Telecommunications giants and competitors Verizon and AT&T have trended first and second, respectively, these past two weeks, as both companies made headlines for exiting their media businesses. Third in the list is midstream oil and gas operator Enbridge, and the list is closed by Coca Cola.

Don’t forget to read our previous edition of trends here.

Verizon Communications

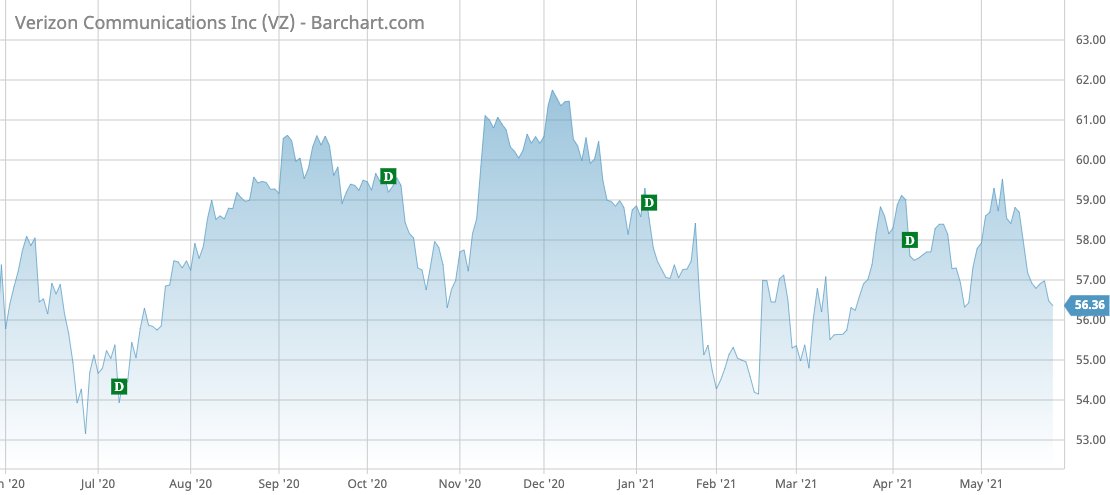

Telecommunications giant Verizon (VZ) has taken the first spot in the list with an advance in viewership of 11%. Verizon was in the news after it recently shed its media unit that contained AOL and Yahoo! to focus on investments in network infrastructure as the 5G race is heating up.

Verizon sold 90% of the unit, bringing in $7 billion in revenues (or 5% of total) for $4.25 billion in cash to private equity firm Apollo Global Management. The price tag was half of what Verizon paid when it acquired the companies. Verizon bought AOL for $4.4 billion in 2015 and Yahoo! for $4.5 billion in 2017.

Venturing into the media has not delivered Verizon the promised benefits and it is now exiting as it needs to spend more capital on its core network infrastructure business. The company’s shares are largely flat over the past 12 months, although the stock is undervalued at a price-to-earnings ratio of 12.3.

The benefits of the divestment might surface over the long term, as this allows management to improve focus on wireless and 5G.

Verizon pays an annual dividend of $2.50 per share, amounting to a dividend yield of 4.39%.

Use the Dividend Screener to find high-quality dividend stocks based upon 16 parameters. Stocks with the highest Dividend.com Ratings are Dividend.com’s current recommendations to investors.

AT&T

AT&T (T), Verizon’s arch competitor, is second in the list with a rise in viewership of 8%. AT&T has also undone a media deal that it made just a few years ago, as it seeks to focus its efforts on network infrastructure and 5G.

The company agreed to spin off Warner Media, a collection of entertainment assets that includes HBO that it bought for $85 billion. The spun off Warner Media will then merge with lifestyle television company Discovery. The combined company will have a better competitive position in the ongoing streaming war with Netflix (NFLX) and Disney+. Amazon (AMZN) agreed to buy MGM Studios, making the competition tougher.

The existing AT&T shareholders will own a large stake in the combination between Warner Media and Discovery, although the combined debt will be very high, throwing into doubt whether the company will be able to make large investments in content to compete effectively.

Indeed, AT&T shares have declined more than 8% since the deal was announced. Investor disappointment was likely amplified by AT&T’s announcement that it will cut its dividend payout from an annual $15 billion to $8 billion.

AT&T’s dividend currently yields an impressive 7%; the company has been increasing its dividend every year since 1974.

Enbridge

Oil and gas pipeline operator Enbridge (ENB) has taken the third place in the list, seeing its traffic jump 4%.

Enbridge is currently in the middle of a court dispute with the State of Michigan, which ordered the company to shut its Line 5 pipeline that carries around 540,000 barrels of oil per day from Western Canada to Ontario, Michigan, and Ohio, among others. The line is running under Lake Michigan-Huron and the State is worried that it could spill fuel into the lake.

The Canadian government intervened on behalf of Enbridge, saying that the shutdown threatens Canada’s energy stability and the U.S. does not have the right to act alone. The U.S. government has decided not to intervene for now, leaving the matter to be settled in courts.

Enbridge said it will not close the pipeline unless it receives an order from the court or its own regulator.

Shares in Enbridge are up 14.5% since the start of the year. Enbridge pays its shareholders an annualized dividend of $2.76 per share, equivalent to a yield of 7.09%.

Check out our latest Best Dividend Stocks List here.

Coca Cola

Coca Cola (KO) has seen its viewership advance 2%, taking fourth place in the list.

Coca Cola shares have yet to recover to their pre-pandemic levels, as its sales suffered from the closure of restaurants and bars, although some of that was offset by rising demand from households. Shares in Coca Cola trade around $5 below their $60 level reached just before the pandemic.

Sales, however, appear to be picking up. For the first quarter of the year, Coca Cola reported revenues of $9 billion, up from $8.61 billion in the prior quarter.

Coca Cola has been increasing its dividend for the past 59 years, yielding an annual 3.07%. The company’s payout ratio is 77%.

The Bottom Line

Verizon and AT&T have both divested their media assets as the two companies need to dedicate more management attention and capital to network infrastructure investments. Enbridge is continuing its court fight with the State of Michigan over the shutdown of a key pipeline, with the Canadian government intervening on behalf of the company. Coca Cola shares have yet to recover to their pre-pandemic levels, although sales have been picking up.

Be sure to check out Dividend.com’s News section for next week’s Market Wrap and other great dividend investing news.