Dividend.com analyzes search trends each week to discover what the financial world is concerned about and provide insights into positioning your portfolio.

Over the past two weeks, our readers were primarily interested in trending companies with attractive dividend yields. Merck & Co. commanded the most attention with an upcoming FDA review for its COVID-19 pill and its significant dividend yield. Second place on the list is Apple Inc., with its new product announcements and content-related successes. ExxonMobil Corp. and Home Depot Inc. round out the list, driven by favorable trends in both energy prices and the housing market.

Don’t forget to read our previous edition of trends here

Merck & Co.

Merck & Co. (MRK) tops the list this week with a 56% jump in search traffic after the FDA announced plans to discuss the company’s experimental COVID-19 pill, molnupiravir, on November 30.

Developed in partnership with Ridgeback Biotherapeutics, the company recently applied for Emergency Use Authorization (EUA) for the oral antiviral. While the drug cuts the risk of hospitalization and death by 50%, its efficacy will ultimately depend on how quickly it’s prescribed and whether patients comply with taking multiple pills in a single day.

The company also offers a $0.65 quarterly dividend, representing a 3.3% forward yield. While the dividend didn’t increase quarter over quarter, it reflects a significant premium over the healthcare industry’s 1.6% average yield. The company also has a ten-year history of increasing its dividends year-over-year.

Check out our latest Best Dividend Stocks List here.

Source: barchart.com

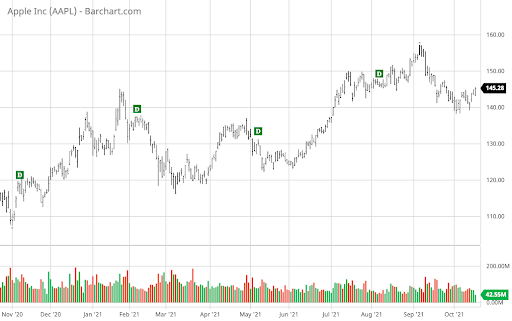

Apple Inc.

Apple Inc. (AAPL) takes second place with a 42% jump in search traffic after unveiling the Watch Series 7, which features durability improvements, more screen area, longer battery life and other benefits. The announcement comes shortly after its latest iPhone launch, and the combo could set the company up for a solid fourth-quarter holiday season.

In addition to its new hardware, the company’s Apple TV+ has become very real competition for Netflix Inc. (NFLX), Amazon.com Inc. (AMZN) and other companies in the streaming space. Apple Fitness+ has also been growing with the support of celebrity trainers, which could pair well with its new Apple Watch launch.

That said, investors should be wary of Senator Amy Klobuchar, D-Minn., the Senate’s Chairwoman of the Subcommittee on Competition Policy, Antitrust, and Consumer Rights, who plans to introduce a significant antitrust bill targeting Big Tech companies. The bill also has support from Judiciary Committee Ranking Member Chuck Grassley, R-Iowa, reflecting bipartisan support for more industry regulation.

While Apple isn’t historically known for its high dividends, the company pays a $0.22 quarterly dividend that represents a 0.61% forward yield. The dividend yield is below the tech industry’s 1.4% average yield, but the company does have a ten-year history of increasing its dividend payments year-over-year.

Source: barchart.com

ExxonMobil Corp.

ExxonMobil Corp. (XOM) comes in third place with a 31% increase in search traffic as oil and natural gas prices continue to rise. Amid the broad sector rally, investors are increasingly seeking out opportunities with high-quality assets and potential discovery value – like Exxon.

In addition to the company’s differentiated asset base, it recently announced a significant increase in its estimates for recoverable resources from the Stabroek Block off the coast of Guyana to 10 billion barrels of oil-equivalent. The company’s preliminary third-quarter estimates also indicated that higher natural gas prices could lift earnings over the second quarter.

The company pays shareholders a $0.87 quarterly dividend, representing a 5.5% forward yield that’s noticeably higher than the industry average of a 4.4% yield. While the company doesn’t have a long history of increasing dividend payments, its forward payout ratio of 75% remains well within the acceptable limits.

Use the Dividend Screener to find high-quality dividend stocks. Stocks with the highest Dividend.com Ratings are Dividend.com’s current recommendations to investors.

Source: barchart.com

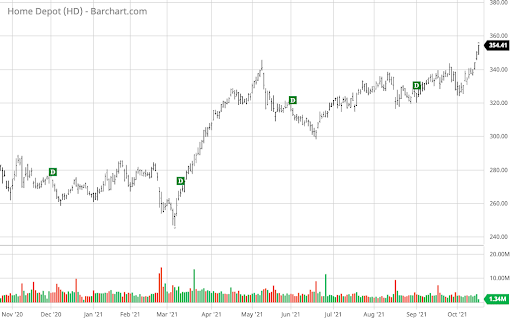

Home Depot Inc.

Home Depot Inc. (HD) rounds out the list with a 28% increase in search traffic. While the industry struggles with supply chain shortages, the company and many of its peers have been buying up containers or chartering their own ships to address the concerns. Meanwhile, Biden’s announcement of 24/7 operations at the Port of Los Angeles could ease bottlenecks.

Of course, the robust housing market is responsible for most of the company’s upside. The company dramatically increased its sales per square foot thanks to contractors that rely on the home improvement chain to complete projects. Home Depot Pro accounted for 45% of company sales during the most recent quarter but represented just 5% of customers.

The company also pays a $6.60 per share dividend, representing a 1.88% forward yield. With nine consecutive years of rising dividend payments, shareholders have come to rely on the stock as a reliable payor as well as a secular trending stock.

Source: barchart.com

The Bottom Line

Merck & Co., Apple Inc., ExxonMobil Corp. and Home Depot Inc. have all been trending on Dividend.com over the past week. In addition to their underlying narratives, Merck and ExxonMobil offer dividend yields well above their industry peers.

Want to generate high income without undertaking too much risk? Check out our complete list of Best High-Yield Stocks.