Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

Readers were mostly interested in energy and apparel stocks this fortnight. Dillard’s and Gap have taken the first two positions. Dillard’s trended thanks to the announcement of a big special dividend, while Gap has posted disappointing results. The third place is taken by Chinese oil and gas major PetroChina, and the list is closed by another energy company, Clearway.

Don’t forget to read our previous edition of trends here.

Dillard’s

Department store operator Dillard’s (DDS) has taken the first position this fortnight, seeing viewership rise by 178%. This is unsurprising. The department store chain’s stock is trading at record levels as the company has been delivering strong financial results since the pandemic, even as other department store retailers have been stagnating.

Indeed, Dillard’s has been posting rising sales and profit margins over the past few quarters, taking analysts and market observers by surprise. While sales are still recovering, retail gross margins are well above pre-pandemic levels at nearly 47%. Its net profit margin has expanded from 3% in the third quarter of 2020 to 13% in the same period this year.

Shares have skyrocketed more than 630% over the past 12 months, reaching a record market capitalization of $7 billion. In addition to the strong stock performance, Dillard’s recently announced a special dividend of $15 per share payable on December 15 to shareholders of record as of November 29. This represents a yield of nearly 5%. In addition, the company declared a regular dividend of $0.20 per share, which currently yields just 0.24%.

Gap

Gap (GPS) is second in the list with an advance in viewership of 142%.

In contrast with Dillard’s, Gap has continued to suffer from poor results and its stock has been reflecting that. The company’s third-quarter sales were slightly down compared with the same period last year, while it switched to a $152 million loss versus a $95 million gain. Demand for Gap products was strong apparently, but the company had trouble fulfilling orders due to supply chain issues.

Shares in Gap tumbled 30% in one day after it reported third-quarter results that disappointed analysts, extending losses to 50% since a post-pandemic peak was reached in May 2021.

However, this might prove a good entry point, especially if supply chain headwinds abate and demand remains strong. Gap pays a dividend of $0.48 per share, resulting in a yield of 2.9%.

Check out our recently launched Best Dividend Stocks Model Portfolio.

PetroChina

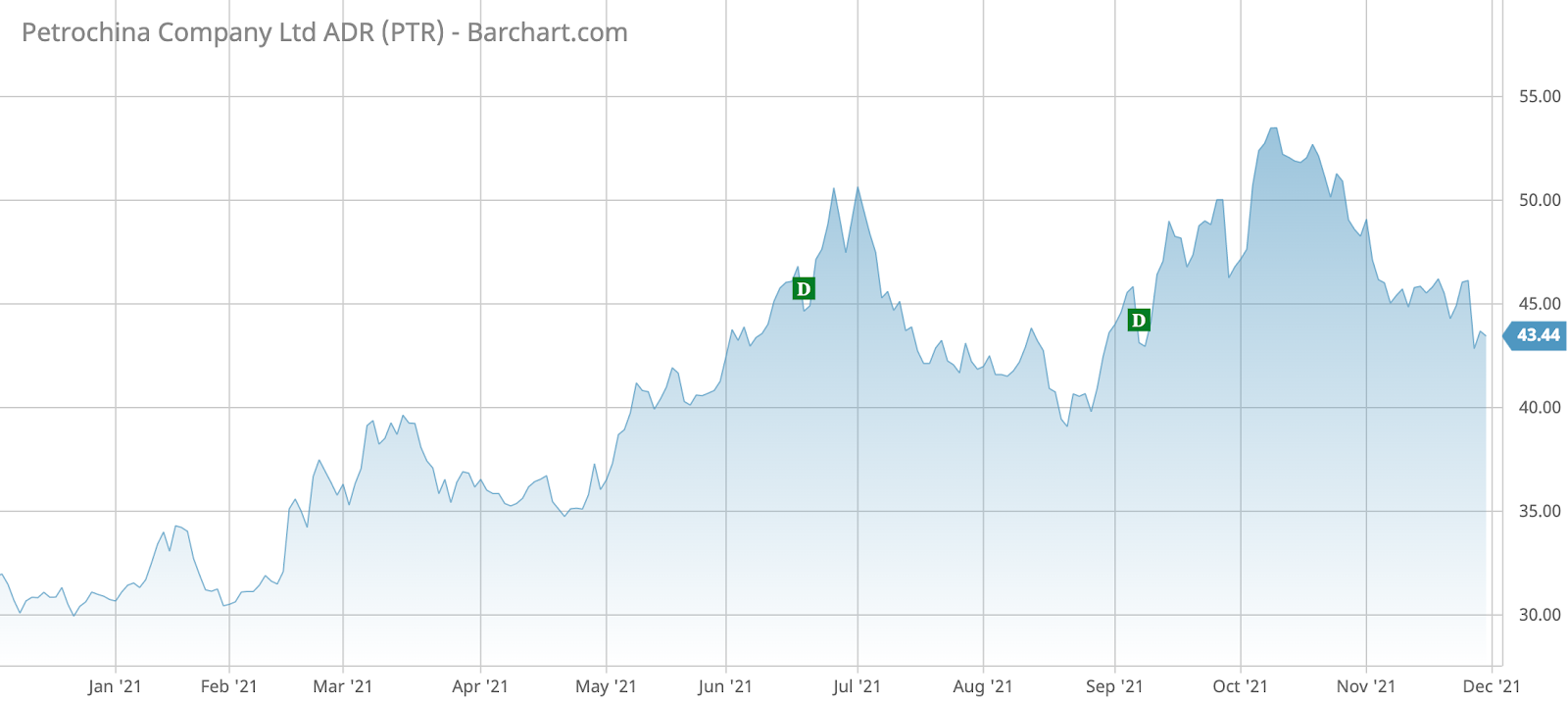

PetroChina (PTR) is third in the list with an advance in traffic of 100%. PetroChina, Asia’s largest oil and gas company, reported solid results in the first three quarters of 2021 thanks to rising oil and gas prices. PetroChina reported a net profit of RMB 75 billion ($11.8 billion) on revenues of $295 billion.

PetroChina is controlled by the Chinese government but its stock seems undervalued given its growth prospects in Asia. It currently trades at a price-to-earnings ratio of just 10. Meanwhile, its stock also trades well below book value, another measure of valuation.

PetroChina shares are up 36% year-to-date, but remain down over 38% for the past five years.

On top of a strong performance this year, investors should also expect a bumper dividend. The company pays a dividend of $4.02 per share, representing a yield of 9.2%.

Be sure to check out Dividend.com’s News section for next week’s Market Wrap and other great dividend investing news.

Clearway

Clearway Energy (CWEN) has taken the last position in the list with a strong increase in traffic of 91%. Clearway, a solid dividend stock, was in the news after it boosted its cash coffers by selling its thermal business to private equity firm KKR for $1.9 billion.

In addition to this strategic move, Clearway reported strong results for the third quarter and management noted it is on track to meet its financial objectives. As a result, the company increased its quarterly dividend by 1.6% to $0.34 per share or an annualized dividend of $1.36. This dividend currently yields 3.6%, but the company aims to continue the increases. By 2026, it targets annual dividend increases in the range of 5%-8%.

The Bottom Line

Dillard’s reported blockbuster results and its stock has outperformed most department store operators. At the other end of the spectrum is Gap, which has struggled to meet growing demand for its products due to supply chain issues and its stock suffered. Chinese government-owned PetroChina appears undervalued, especially since it has benefitted from strong oil and gas prices and its growth prospects in Asia are strong. Finally, Clearway sold a business unit to KKR and has increased its dividend.

Don’t forget to explore our recently launched model portfolios here.