Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

Morgan Stanley has taken the first position in the list this fortnight, as the bank is on track to announce its latest quarterly earnings. Private equity firm Blackstone Group is second in the list, as the company acquired a large casino resort in Australia. Walgreens Boots Alliance, third in the list, again posted disappointing results. Cisco Systems closes the list.

Don’t forget to read our previous edition of trends here.

Morgan Stanley

Morgan Stanley (MS) has taken the first position this fortnight with an advance in viewership of 138%. Morgan Stanley is expected to announce its results this Thursday along with other large banks like J.P. Morgan (JPM).

The banking sector, which has long suffered from low interest rates, might finally be on track to benefit from rising rates. Banks already started to charge higher interest rates, while they are still paying little for deposits.

Morgan Stanley makes a good chunk of its money from investment banking as opposed to lending. Just this week, Morgan Stanley announced a reshuffling of the investment bank, with current heads Mark Eichorn and Susia Huang transitioning to executive chairs, while Eli Gross and Simon Smith took the roles of co-heads of the division.

Morgan Stanley pays a dividend of $2.80 per share, resulting in a yield of 3.7%, somewhat higher than financial’s average yield of 3.2%.

Shares in Morgan Stanley have declined more than 24% so far this year.

Check out our latest Best Dividend Stocks Model Portfolio.

Blackstone Group

Blackstone Group (BX) has taken the second position in the list with an advance in viewership of 58%. The publicly-listed private equity firm completed the acquisition of Australia-based Crown Resorts for $6.3 billion, in a bet on the long-term recovery of the tourism industry.

Crown, Australia’s largest gaming and entertainment group, has been in hot water in recent years after regulators’ investigations found that the company abetted money laundering through its casinos. The buyout is backed by shareholders but still has to be approved by the federal court.

Blackstone shares moved sideways in the year up until June when the stock fell abruptly by about 22%. The stock appears cheap, trading at a price-to-earnings ratio of 13, while its dividend yield of 5.6% is quite solid.

Walgreens Boots Alliance

Walgreens Boots Alliance (WBA) has taken the third position in the list, seeing its viewership rise 57%, close to Blackstone. Walgreens again reported weak earnings in the third quarter, leading to a further drop in the stock price.

For the three months ended May 31, Walgreens reported sales of $32.5 billion compared with $34 billion in the same period last year. However, for the past nine months, sales were up from $98.2 billion to $100.2 billion. Net quarterly earnings came in at $289 million, down from $1.2 billion.

Walgreens had wanted to sell its U.K. pharmacy unit but ditched these plans, citing a lack of adequate offers amid a tough M&A market.

The company’s stock continued to decline in recent weeks, bringing year-to-date losses to more than 27%.

Cisco Systems

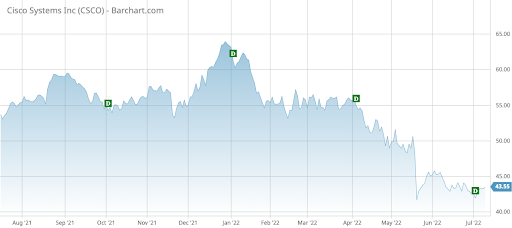

Cisco Systems (CSCO) has taken the fourth position in the list this week, seeing its viewership rise 16%.

Cisco appears to be a good value stock. Its dividend yields 3.50%, higher than the technology average of 1.4%. And the company has been increasing shareholder payouts in each of the last 13 years. Cisco stock trades at a price-to-earnings ratio of 15, compared with north of 20 for the S&P 500 index.

The company’s sales growth has been patchy over the past five years. Sales fell 5% in 2020, but recovered slightly in 2021. Net income declined in both 2020 and 2021, although the company remains highly profitable.

The Bottom Line

Morgan Stanley and the entire U.S. banking sector is expected to benefit from rising interest rates. Blackstone Group made a big bet on the revival of the global tourism industry. Walgreens Boots reported another set of poor results as the company shelved plans to sell U.K. pharmacy chain Boots due to weak market conditions. Cisco Systems appears to be a good value stock.

Be sure to check out Dividend.com’s News section for the most trending news around income investing.