Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

U.K.-based oil major BP has reported blockbuster earnings for the second quarter, taking first place in the list this fortnight. Brazil’s Petrobras is second in the list as the oil company substantially hiked its dividend following a government request. Mortgage real estate investment trust Annaly Capital is third in the list, as the company slightly bumped its dividend. Apple has trended fourth after the iPhone-maker raised more than $5 billion in debt.

Don’t forget to read our previous edition of trends here.

BP

Oil major BP (BP) has taken the first position in the list this fortnight, with a viewership increase of 279%. BP’s popularity is unsurprising. The U.K.-based oil company reported a net profit of $8.5 billion for the second quarter, up from $6.8 billion in the previous quarter and $2.8 billion during the comparable period last year.

Oil companies like BP, ExxonMobil (XOM) and Shell Plc (SHEL) have reported record earnings in recent quarters thanks to high oil prices triggered by the Russian invasion of Ukraine, at a time when the broader stock market has been declining due to rising inflation and interest rates.

BP will share some of the windfall with shareholders. The company said it will increase its quarterly dividend by 10% to 25 cents per share, resulting in a dividend yield of 4.35%. The current dividend is still lower than the 62 cents per share the company was paying before the pandemic. BP will also increase its share repurchases, which is expected to further pepper the stock.

Shares in BP have risen 11.7% since the start of the year but are still 80% down from its record high achieved in 2007.

Source: Barchart.com

Petrobras

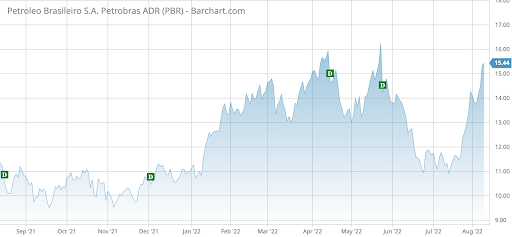

Petrobras (PBR) has taken the second position in the list these past two weeks, seeing its viewership surge 237%. Petrobras too has benefited from high oil prices, prompting the government led by Jair Bolsonaro to call for a record dividend payout. The Brazilian government, as the largest shareholder with 54%, will see its budget boosted by the payouts.

Petrobras will splash $17 billion on dividends, which is about 60% more than the company’s reported profit of $10.5 billion. The company said it affords to pay the dividend as its cash position remains strong and it will be able to finance investments.

Petrobras declared a dividend of $1.12 per share, more than double its previous payout. Shares in Petrobras are up 38% so far this year.

Source: Barchart.com

Check out our latest Best Dividend Stocks Model Portfolio.

Annaly Capital

Annaly Capital (NLY) is third in the list with an advance in traffic of 44%. The mortgage real estate investment trust has had a difficult time in recent quarters as the economic environment deteriorated, with widening spreads and interest rate volatility hitting the company’s performance.

Annaly’s book value per common share declined from $8.4 in the second quarter of 2021 to $5.9 in the second quarter of 2022. However, net income per share improved from negative $0.23 to $0.55.

Despite the weak results, the company managed to increase its earnings available for distribution by 2 cents to 30 cents per share. The company, which focuses on relatively safe agency mortgage-backed securities, said its dividend coverage during the quarter was 135%.

Source: Barchart.com

Apple

Apple (AAPL) is last in the list with an advance in viewership of 40%. The iPhone-maker again posted strong results, despite weakening consumer sentiment. Apple’s revenues of $83 billion for the second quarter were $1.6 billion higher than the same period last year. However, net quarterly profit declined from $21.7 billion to $19.4 billion.

Shortly after its results, Apple issued a bond worth $5.5 billion. According to media reports, the bond is likely to yield between 90 and 150 basis points above the risk-free Treasury rate.

Apple said it will use the proceeds for things like share repurchases and dividends. Apple pays an annual dividend of $0.92 per share, resulting in a yield of 0.56%.

Shares in Apple are down 9% since the start of the year.

Source: Barchart.com

The Bottom Line

Oil major BP reported blockbuster results and increased its dividend by 10%. Petrobras, another oil company, doubled its dividend after the prodding from Brazil’s government, which is a majority shareholder. Annaly Capital has seen its book value decline, although the company still increased its dividend. Apple has reported strong results and tapped the debt market.

Be sure to check out Dividend.com’s News section for the most trending news around income investing.