Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

Retail company Dick’s Sporting Goods has taken the first position in the list after it doubled its dividend thanks to blockbuster results. Bank of America is second as the entire banking system has been experiencing shivers following the collapse of Silicon Valley Bank. Third in the list is Zim Integrated Shipping Services, as its forward dividend of nearly 75% attracted readership. Last in the list is Ares Capital, a business development company paying a dividend of more than 10%.

Don’t forget to read our previous edition of trends here.

Dick’s Sporting Goods Hikes Dividend by More Than 100%

Dick’s Sporting Goods (DKS) has placed first this fortnight, seeing its viewership surge a staggering 1,433%. Dick’s Sporting Goods’ popularity is far from surprising. The company raised its dividend by 105% to $4 per share annually. The dividend now yields 2.8%.

The dividend hike was made after the company posted blockbuster results, with same-store sales increasing 5.3% in the first fiscal quarter, smashing analysts’ estimates. The company’s stock is up 11% since then, trading near record highs.

The sporting goods retailer has received a boost from the pandemic, as shoppers started prioritizing health and fitness. Demand for fitness equipment has remained strong even as inflation has diminished consumers’ buying capacity. In light of rising demand, the company said it would continue its expansion in the coming years, especially in Dick’s House of Sport.

Bank of America Sees Deposit Inflow After SVB Collapse

Bank of America (BAC) has taken the second position in the list this fortnight, seeing its viewership increase by 53%. The bank has benefitted from the collapse of Silicon Valley Bank (SVB). It received an inflow of more than $15 billion as depositors took money out of the failing California-based bank and put them into Bank of America, the second-largest bank in the U.S. that currently has more than $3 trillion in assets.

SVB was saved by the Federal Deposit Insurance Corporation (FDIC), after experiencing a bank run from its customers, most of which were tech startups in Silicon Valley. The company’s fatal mistake was to invest a good chunk of its deposits in 10-year Treasuries at a 2% yield. As the price of Treasuries fell and its yield rose to 4%, Silicon Valley Bank’s mark-to-market losses increased.

Bank of America pays an annual dividend of $0.88 per share, equaling a yield of 3.2%. Shares in the bank fell 19% over the past 30 days, as investors sold off banking stocks across the board, especially those that hold long-term Treasuries.

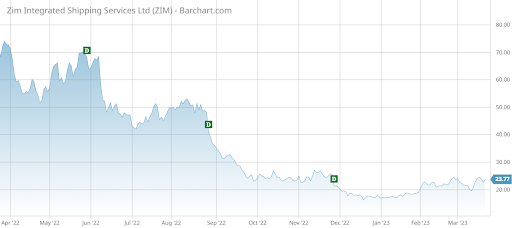

Zim Integrated Shipping Revenues Plunges on Falling Freight Rates

Zim Integrated Shipping Services (ZIM) is third in the list with an advance in viewership of 47%. Zim, a freight shipping company, has said net income fell from $1.71 billion in the fourth quarter of 2021 to just $417 million in the same period in 2022, as freight rates declined dramatically by year-end while volumes decreased slightly.

However, thanks to higher rates in the previous quarters, full-year net income was down only slightly to $4.65 billion. This has allowed the company to declare a blockbuster dividend of $6.40 per share, representing a quarterly dividend yield of 28% based on the stock’s closing on Friday.

Given the dropping freight rates, the company is unlikely to sustain the high dividend, unless there is a shock that sends freight rates high again.

Ares Capital

Business development company Ares Capital (ARCC) closes the list with a small increase in traffic of 14%. Ares is lending to mid-market companies and has benefitted in recent years from the withdrawal of credit from many banks. However, the company’s stock has fallen more than 10% over the past month, as investors sold off any financial institutions that provide credit.

But Ares’ performance over the long term is enviable, with its stock outperforming the broad market. Because it is structured like a real estate investment trust, Ares pays out 90% of its earnings to shareholders. Its current dividend yields a strong 10%, which seems to be on solid footing.

Check out our latest Best Dividend Stocks Model Portfolio.

The Bottom Line

Dick’s Sporting Goods raised its dividend by more than 100% as shoppers continued buying sporting equipment. Second in the list is Bank of America, which has benefitted from the collapse of Silicon Valley Bank by seeing an inflow of deposits. Zim Integrated announced a high dividend, although its results for the fourth quarter were relatively weak. Ares Capital has seen its stock decline, even though the business development company appears to be on solid footing.

Be sure to check out Dividend.com’s News section for the most trending news around income investing.