Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

This week, hotel chain Marriott International was first in the list after the company raised its dividend by 30% due to strong financial results. Black Stone Minerals, an oil and gas mineral rights owner, is second in the list as the company’s dividend yield nears 12%. Third in the list is apparel footwear company VF Corp, which has struggled with weak sales and decreased its dividend. The list is closed by large U.S. retailer Home Depot, which recently reported weak results and guidance.

Don’t forget to read our previous edition of trends here.

Marriott International Ups Dividend After Strong Results

Hotel chain Marriott International (MAR) has taken the first position in the list with a whopping advance in viewership of 426%, surpassing the other three popular tickers by a great margin. Marriott declared a quarterly dividend of 52 cents per share, an increase of about 30%. The new dividend, which yields about 1.3% as of May 29, will be paid on June 30 to shareholders of record on May 26.

Marriott reported solid results that beat analysts’ expectations. Revenue rose 33.7% in the March quarter, while net income doubled. While the U.S. economy has been softening with demand for travel slowing down, Marriott was boosted by its international business. China’s reopening of the economy unleashed pent-up demand for travel. The company said its revenue per room in China grew to 95% of pre-pandemic levels. Guidance was also strong, with Marriott expecting growth in the following quarters.

Marriott’s stock is up 17% this year, comfortably beating the broad market. The stock currently trades near record highs.

Source: Barchart.com

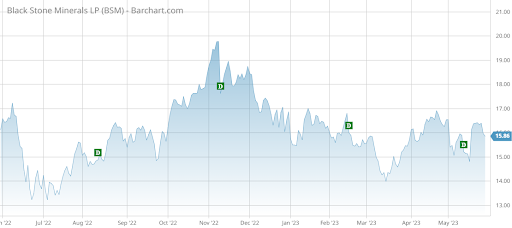

Black Stone Minerals Boosted by Rising Oil Prices but High Interest Rates Pose Risk

Black Stone Minerals (BSM) has taken the second position in the list with an advance in viewership of 57%, far below Marriott International. Black Stone, an oil and gas mineral rights owner, has a high dividend yielding about 12%, with the company increasing the payout as recently as last October.

The stock is a play on oil and gas prices. Shares in the company have appreciated by 266% since reaching a pandemic low in 2020. However, they are still about 17% lower than their record highs.

Black Stone’s business model is fairly simple. It acquires land that is rich in oil and gas and then sells the exploration rights in exchange for royalties. In times of rising production, the company gets higher royalties and vice versa. In the last reporting quarter, the firm said royalty production increased by 7% versus the prior quarter, with EBITDA hitting a record of $131.7 million.

Because it uses debt to make land acquisitions, the stock could be risky in times of rising interest rates and falling production levels. Interest rates are high but oil and gas demand remains strong, so the company is in a good position. The high dividend yield also offers a cushion.

Source: Barchart.com

VF Corp Shares Drop After Weak Results

VF Corp (VFC) is third in the list with an increase in traffic of 50%. The company, which owns apparel brands like The North Face and Vans, has been in the news after it announced weak results. For the fourth quarter, the company reported a loss of $214.9 million compared with a profit of $80.8 million in the same quarter last year. The loss was largely due to a pension settlement charge.

Revenues from its Vans brand have been declining as competition from Adidas has been heating up. Meanwhile, The North Face brand has been strong, but not enough to provide a big boost to the company. VF shares have lost 35% since the start of the year, extending one-year losses to nearly 64%.

The company cut its dividend from a quarterly 51 cents to 30 cents at the beginning of 2023. Given the drop in the stock price and low confidence, the dividend yields a high 6.6%.

Source: Barchart.com

Home Depot Results Disappoint

Home Depot (HD) is last in the list with a small advance in traffic of 5%. Home Depot reported very weak results in the first fiscal quarter, with the company blaming cold weather and declining lumber prices. Home Depot said it expects comparable sales to fall by up to 5% in this fiscal year compared with flat sales previously.

Consumers appear to have diminished desire for home improvement projects, partly due to pressure from rising prices. Revenue of $37.26 billion came in about $1 billion lower than expected by analysts. The company beat on earnings per share.

Home Depot shares are down 7% so far this year. The company pays an annual dividend of $8.36 per share, representing a payout of 2.8%.

Source: Barchart.com

The Bottom Line

Marriott International increased its dividend by 30% after reporting strong results due to China’s growing demand. Black Stone Minerals has been recovering strongly with rising oil and gas prices, but the stock and the high dividend are at risk of faltering demand. VF has reported weak results, while Home Depot surprised analysts with a huge earnings miss.

Be sure to check out Dividend.com’s News section for the most trending news around income investing.