Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

This week, large U.S. retailer Target has been in the news as the company’s stock has been falling due to lower consumer demand. Second in the list is mortgage-backed securities REIT Annaly Capital. Bank of America is third as the entire banking sector has been suffering from higher interest rates, while AT&T is last as the business could take a hit from Amazon.

Don’t forget to read our previous edition of trends here.

Target Stock Hit by Controversy and Weak Demand

Target (TGT) has taken the first position in the list this fortnight, enjoying an advance in viewership of 90%. The shares in the large U.S. retailer have fallen to levels not seen since the COVID-19 pandemic. The company has been mired in controversy. Its LGBTQ+ merchandise has faced backlash from consumers and the company decided to pull its campaign. The company said the move was due to a series of incidents and threats received by its employees.

At the same time, the retailer has been losing market share to competitors like Walmart (WMT). As Target has more non-discretionary items in its stock, it is more exposed to a weakening of consumer sentiment. Consumers usually cut budgets for non-discretionary items during economic slowdowns and recessions.

Target has steadily increased its dividend payout over the past years, but it is unclear whether it will be able to continue doing so this year. The stock lost 27% year-to-date as revenues declined dramatically in the March 31 quarter compared with the previous quarter.

Source: Barchart.com

Annaly Capital Stock Suffering From High Interest Rates

Annaly Capital (NLY) has taken the second position in the list with a much smaller advance of just about 36%.

The company has taken the second position because of its impressive dividend of more than 12%. However, the dividend seems to be at risk as the owner of mortgage-backed securities has been hit by the quick rise in interest rates.

Annaly’s assets largely consists of agency MBS secuities, meaning the REIT’s holdings are guaranteed by the government. However, most of the assets on the company’s balance sheet have fallen in value as interest rates rose. At the same time, its borrowing costs have surged. The stock’s book value fell from $27.08 per share last year to $20.77 now. The stock is currently trading slightly below book value.

Source: Barchart.com

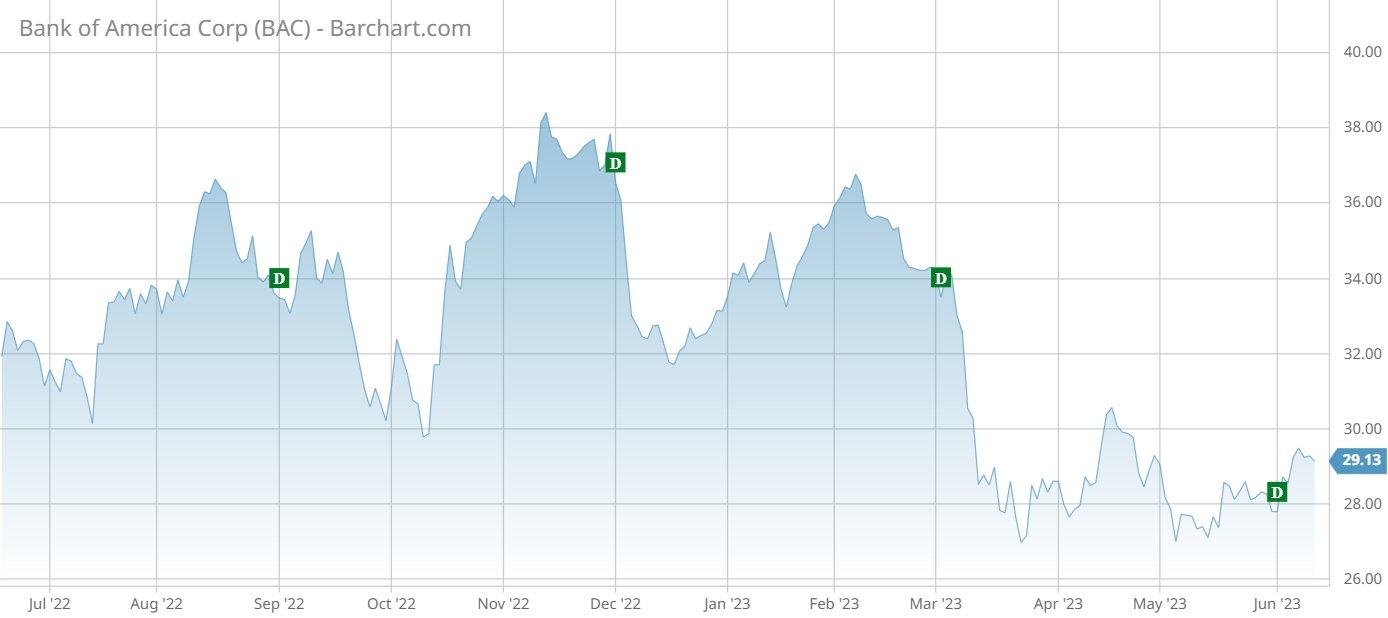

Bank of America Likely to be Impacted by New Regulation

Bank of America (BAC) has taken the third position in the list with an increase in viewership of 29%.

Just like the entire banking industry, Bank of America shares are down this year, as all banks have suffered in the aftermath of the Silicon Valley Bank collapse. U.S. regulators are preparing new rules that would require banks to put more capital aside to cover potential losses. This will impact Bank of America’s results, with CEO Brian Moynihan saying recently that up to $150 billion could be removed from the bank’s lending capacity.

The Bank of America’s most recent results were buoyed by strong consumer demand, but Moynihan expects a deterioration in consumer demand going forward.

Source: Barchart.com

AT&T and Other Telecom Stocks Face Threat From Amazon

AT&T (T) has placed last with an increase in traffic of 19%.

AT&T shares are trading near pandemic levels after its business model has received a potentially major blow. Rumors have surfaced that Amazon is looking to provide a low-cost wireless service to its Prime members. Details are still unclear but the service could be offered for free as part of Amazon’s plan to boost Prime memberships. If implemented, such a plan would inevitably increase competition in an already highly competitive wireless market.

AT&T’s revenue has remained largely stable in the most recent quarters, although the company is still dealing with big losses related to its acquisitions of DirecTV and Time Warner. The company’s dividend yields an impressive 7%, although it might be at risk.

Source: Barchart.com

The Bottom Line

Target shares have slipped recently as the retailer lost market share. Annaly Capital has suffered from high interest rates. Bank of America’s results remain good but the outlook is poor. AT&T shares are trading low as the company faces a massive threat from Amazon.

Be sure to check out Dividend.com’s News section for the most trending news around income investing.