Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

First in the list is pharmacy operator Walgreens Boots Alliance, which reported weak financial results due to slowing demand. Second is banking giant JP Morgan Chase, which is expected to increase its dividend after passing a stress test. Cisco Systems has taken the third place as the giant network equipment company has joined the AI game. Last in the list is telecom operator AT&T.

Don’t forget to read our previous edition of trends here.

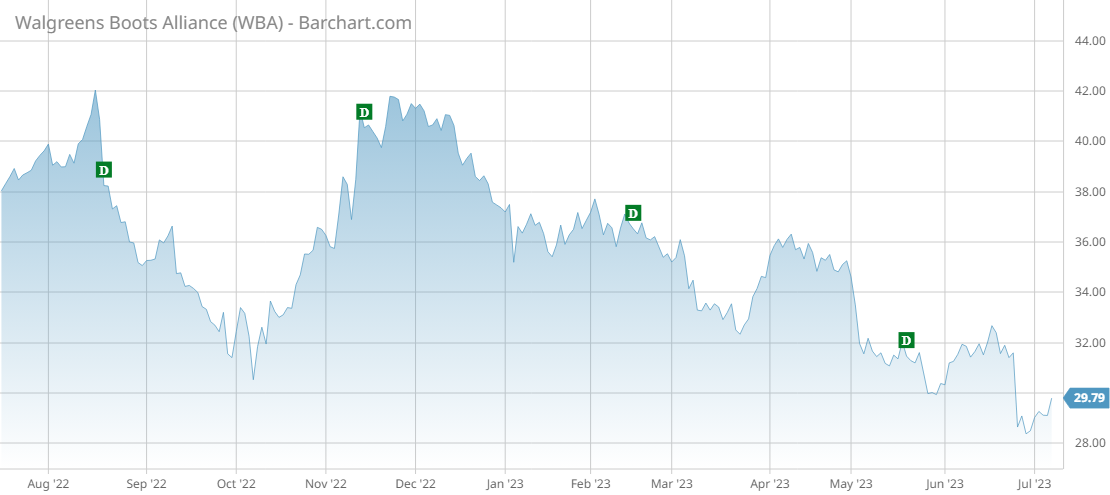

Walgreens Stock Hits Ten-year Low on Weak Guidance

Pharmacy operator Walgreens Boots Alliance (WBA) has taken the top spot this fortnight, seeing its viewership advance 57%.

Walgreens’ stock has dropped to a 10-year low after the company cut its earnings guidance due to lower expected demand from consumers. Sales of COVID-19 vaccines have been especially hit, and the resumption of student loan payments is likely to put further strain on the consumer.

Walgreens said it now expects full-year earnings of between $4 and $4.05 per share, down from a range of $4.45 to $4.65. The company also increased its cost-cutting drive in the hope of improving profitability. Walgreens pays out around half of its earnings per share in dividends to shareholders. The dividend yields a strong 6.45%, but the stock has been an underperformer.

Source: Barchart.com

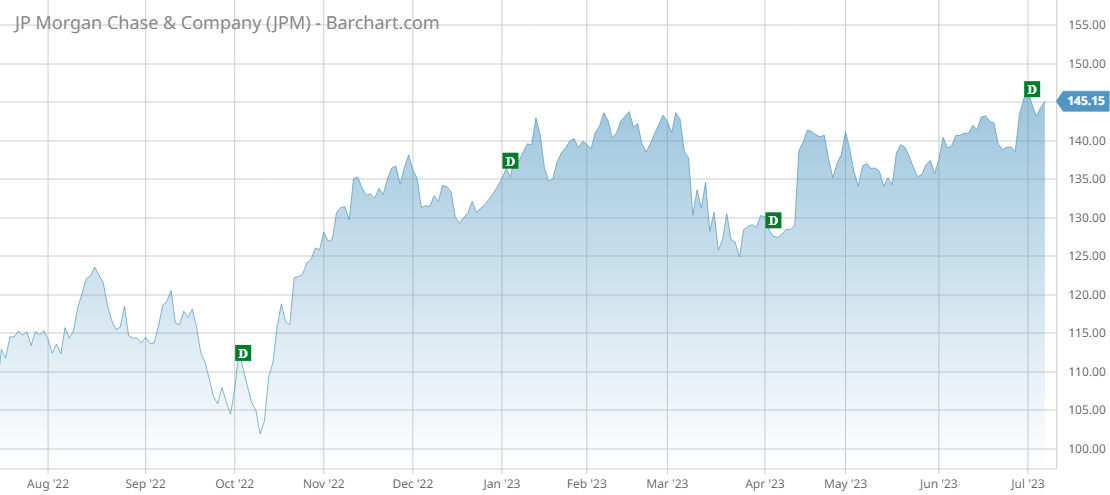

JP Morgan to Raise Dividend After Passing the Stress Test

JP Morgan Chase (JPM) has seen its viewership advance 52% this fortnight, not far from Walgreens. The company delivered good news to its shareholders after passing a stress test. As a result, this frees the bank to hand out more cash to shareholders. It is raising the dividend by 5% to $1.05 per quarter. This will result in a dividend yield of about 2.9% at current stock prices.

JP Morgan has been a rare oasis of stability in a global banking sector that has been rocked by several crises like the Silicon Valley Bank bankruptcy and Credit Suisse blowup. JP Morgan remains in a strong position, with its stock outperforming most large banking peers like Bank of America, Citigroup, Wells Fargo, and Goldman Sachs. The stock is up 7% so far this year, extending 12-month gains to nearly 30%.

Source: Barchart.com

Cisco Systems Launches AI Chip

Cisco Systems (CSCO) has placed third in the list this week, seeing its viewership advance 31%. The company was in the news after it launched a networking chip for AI applications.

This puts the firm in direct competition with Broadcom and Marvell Technology. Cisco said the chips are already being tested by large cloud service providers, which include Amazon Web Service, Microsoft Azure, and Google Cloud.

Cisco shares have been going up this year, as the hype around OpenAI’s ChatGPT has boosted stocks that provide AI infrastructure. Demand for AI applications is rising and companies are in a race to make more efficient chips. If Cisco’s chips prove to be successful, it would be a good source of growth going forward.

Source: Barchart.com

AT&T's Big Dividend Might Be at Risk

AT&T (T) is last in the list with an advance in traffic of 18%.

AT&T shares have continued to underperform this year, even as the company is undoing a set of bad deals, like the acquisition of DirecTV and Time Warner. Revenues are stagnating, profitability is weak, and long-term debt remains worryingly high at around $128 billion. The dividend is yielding a whopping 7.3% given the poor stock performance, but it might be at risk. AT&T may decide that paying down debt is a better use of cash than returning it to shareholders.

Shares in AT&T are down 20% so far this year.

Source: Barchart.com

The Bottom Line

Walgreens Boots Alliance has delivered very weak guidance, triggering a drop in the stock price. JP Morgan is raising its dividend after it passed a stress test. Cisco is launching an artificial intelligence chip, putting it in direct competition with Broadcom and Marvell Technology. Rounding up this week’s list is AT&T, whose dividend could be at risk.

Be sure to check out Dividend.com’s News section for the most trending news around income investing.