Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

Semiconductor company Nvidia has taken the first position after reporting rare blockbuster results on the back of strong sales of AI chips. Second in the list is Bank of America, the bank that recently increased its dividend after passing a stress test. Cigarette producer Altria, third in the list, also increased its dividend. Last in the list is beverage producer Pepsico.

Don’t forget to read our previous edition of trends here.

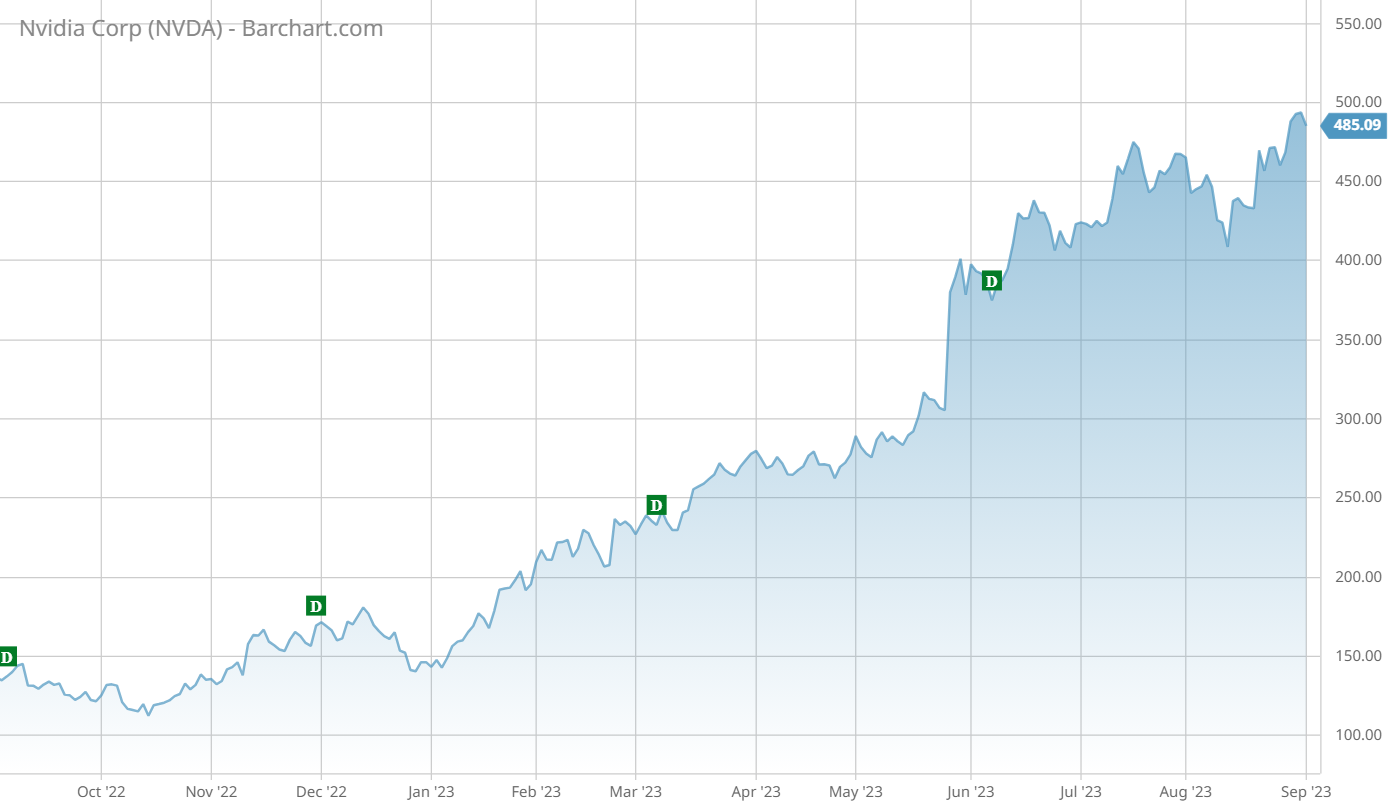

Nvidia Doubles Business on Strong Demand for AI chips

Nvidia (NVDA) has placed first in the list with an increase in viewership of 56%. The chipmaker reported blowout third quarter results, with revenues rising more than 100% to $13.5 billion and net income surging 843% to $6.2 billion.

Nvidia is riding strong demand for GPU chips that are used for artificial intelligence applications. Nvidia’s chips are so far the best and it has more than 90% of the AI market. Shortages of AI chips have allowed the company to increase prices and volumes. Following the results, the stock has reached a new record high, and is up 240% year-to-date.

Demand for AI chips is unlikely to abate soon, as startups and large companies are finding themselves in an epic race to secure a place in a nascent market. Compute power provided by Nvidia is essential to be able to compete. Over time, competition for chips could increase, especially since chipmakers and cloud providers are working diligently on finding an alternative to Nvidia. For now, however, Nvidia’s market position seems secure. Given the epic run in the stock price, Nvidia’s dividend yields just 0.03%.

Source: Barchart.com

Bank of America Raises Dividend After Passing Stress Test

Bank of America (BAC) has taken the second position in the list with an advance in viewership of 26%. The bank recently passed a stress test conducted by the Federal Reserve and increased its dividend as a result. Bank of America’s stress capital buffer is 2.5%, the bare minimum required by regulators.

The company increased its dividend by 9% to 24 cents per quarter, payable on September 29. In addition to that, it still has about $14 billion remaining from a $25 billion share repurchase program. The stock now yields 3.3%.

The stock has not performed well this year, falling by nearly 14%. Investors have seen the bank’s low capital buffers as a weakness, in the aftermath of Silicon Valley Bank’s implosion.

Source: Barchart.com

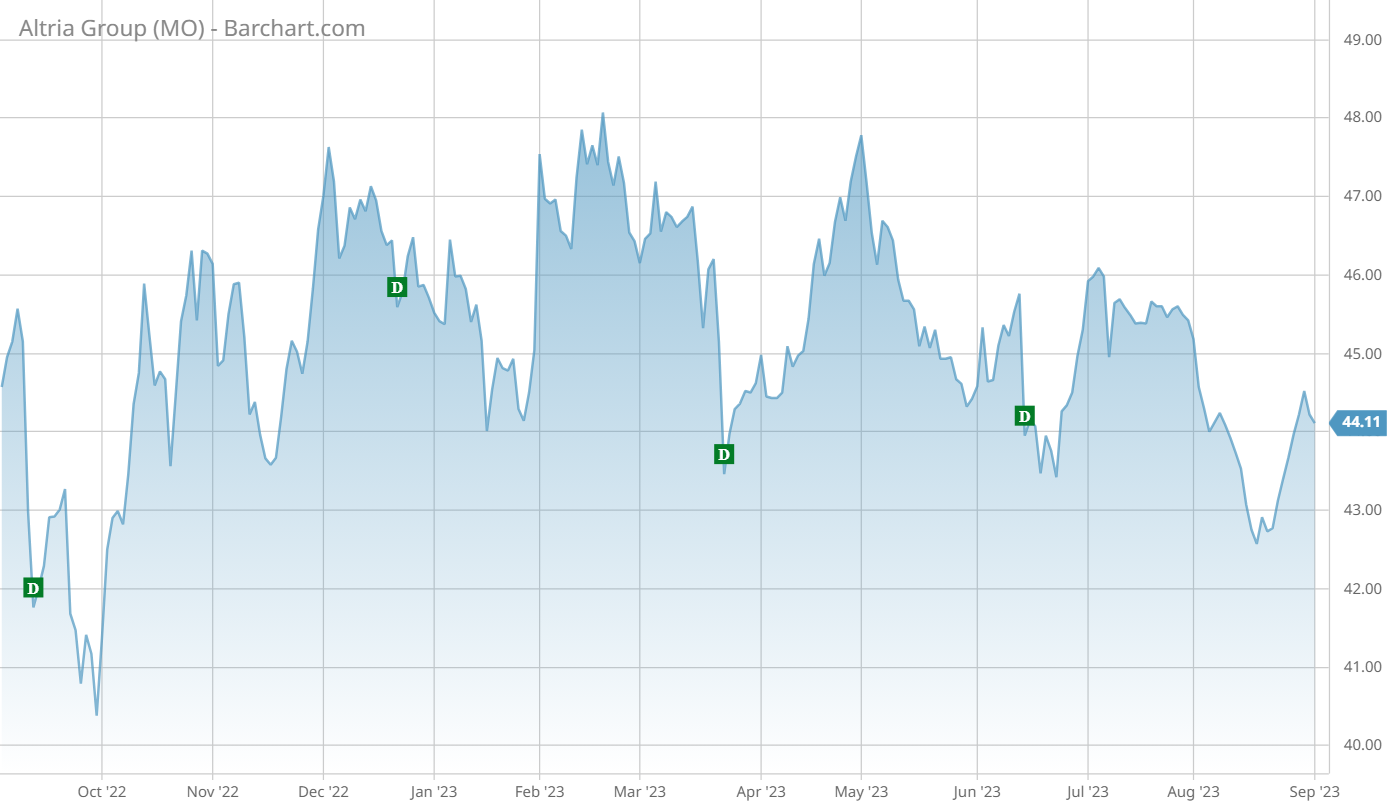

Altria Group Raises Dividend

Altria Group (MO) is third in the list, experiencing a rise in viewership of 21%. The company was in the news after it raised its dividend by 4.3% to a quarterly payout of 98 cents per share. The payout is payable on September 14.

The dividend yields a strong 9.1 on the latest stock prices. Of course, Altria faces declining sales in its smokable products as more and more people quit smoking. Still, the company’s oral tobacco products are seeing rising sales, although they remain too small to make a dent in the overall trend.

The business is highly profitable, with net income surging 137% in the June quarter to $2.21 billion. The stock, however, is down 3% year-to-date.

Source: Barchart.com

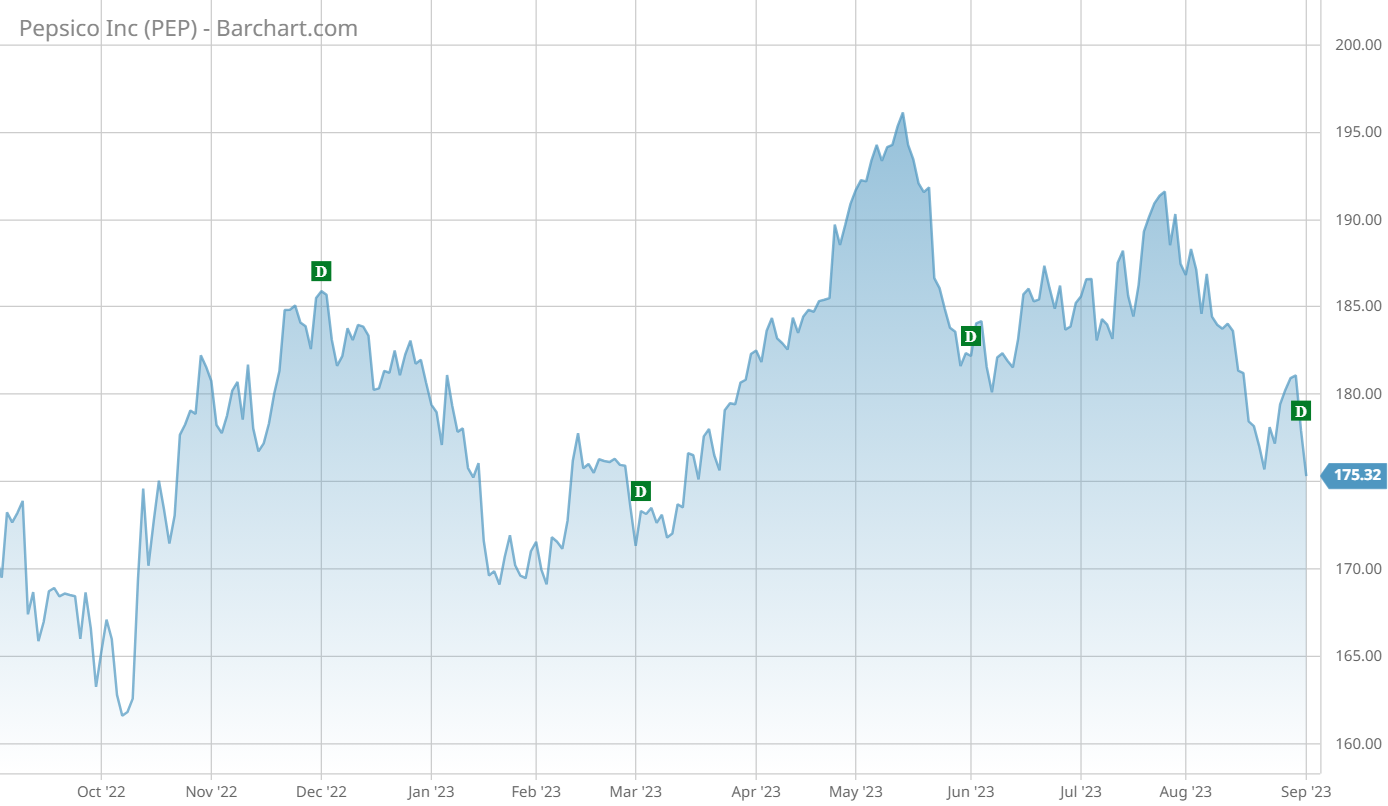

Pepsico Posts Strong Results but Stock Still Falls

Food snacks and beverage giant Pepsico (PEP) has placed last with an advance in traffic of 9%. Pepsico has reported strong results for the June quarter, with sales rising 10%. However, most of the sales are thanks to price increases rather than volumes, which continued to decline. The company’s net income also rose 92% to about $2.7 billion.

The company also issued strong guidance, expecting 10% organic growth rate from just 8% in the prior quarter.

The stock, however, continued to disappoint this year. It is down about 2.2%, versus 18% growth for the S&P 500. Some of the underperformance may have to do with the weakening consumer sentiment. Pepsico pays an annual dividend of more than $5 per share, which equals to a yield of 2.9%, well higher than consumer staples’ 1.9%.

The Bottom Line

Nvidia has doubled its business on the back of surging demand for its unique AI chips. Bank of America has raised its dividend, but the stock performance remains weak. Altria also raised its dividend, despite slowly deteriorating operational performance. Finally, Pepsico has reported strong results thanks to price hikes, but its stock has underperformed this year.

Be sure to check out Dividend.com’s News section for the most trending news around income investing.