Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

Real estate investment trust EPR Properties has taken the first position in the list, as the REIT declared an unchanged dividend. Heavy machinery maker Caterpillar is second in the list, as the stock recently reached a record high. Coffee chain Starbucks is third, as its stock has been retreating. The list is closed by Procter & Gamble, which is expected to post quarterly results on Tuesday.

Don’t forget to read our previous edition of trends here.

EPR Properties Declares Dividend

Real estate investment trust EPR Properties EPR Properties (EPR) has taken the first spot in the list with an advance in viewership of 55%.

EPR was in the news after declaring its first monthly dividend of the year, which was unchanged from the previous month. The real estate, which mostly owns entertainment venues like theaters and cinemas, was heavily hit by the COVID-19 pandemic, as stay-at-home orders grounded foot traffic to a halt. In 2021, the company suspended its dividend. It reinstated it in 2022, but it remains well below pre-pandemic levels. The stock also trades about 35% below its pre-pandemic level, so the dividend yields a strong 7.4%, which is about 3 percentage points more than the average real estate yield.

However, the dividend and the stock carry significant risk. Given EPR’s exposure to struggling cinema operators like AMC and Cineworld, it might have a hard time collecting rent. Of course, foot traffic to cinemas recovered following the pandemic, but attendance has been in decline with the rise of home theaters and streaming services like Netflix and Disney+.

Source: barchart

Caterpillar Stock Trading Near Record Highs

Caterpillar (CAT) has taken the second position in the list with an advance in viewership of 47%. Caterpillar shares are trading close to record highs as the heavy machinery maker has steadily been increasing revenue and profits over the years. The stock is up 14% over the past 12 months and 110% in the past five years.

In 2022, revenue increased by 16%, while net income was up 3% to $6.7 billion. This year is also expected to be a blowback year. In the third quarter, revenues were up 12% compared to the year-ago period, while net income surged 37% to $2.79 billion. The company is expected to announce fourth quarter and full-year results on February 5.

In addition to strong stock performance, Caterpillar has rewarded shareholders with a steadily growing dividend. In 2023, the company increased its quarterly dividend by 10 cents to $1.30 per share and is likely to do another increase at the start of this year. Caterpillar’s dividend yields a strong 1.8%.

Source: barchart

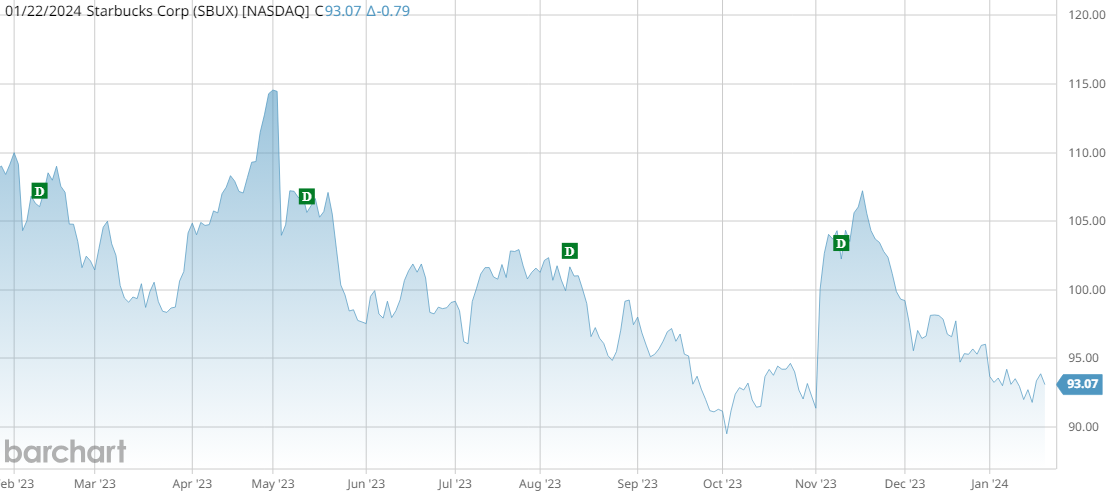

Starbucks Stock Sees Weak Sentiment

Starbucks (SBUX) has placed third, seeing an increase in viewership of about 34%. The coffee chain has been posting impressive operational performance in recent quarters, with both revenue and net income going up. However, the stock has not reflected that, dropping more than 12% over the past 12 months.

Investors have been worried about the outlook for foot traffic in the U.S. and lack of clarity on its Chinese business division. As a result, the stock trades a third lower than its record high reached in mid-2021. However, the strong past operational performance has allowed Starbucks to increase its dividend just two quarters ago, from a quarterly 53 cents per share to 57 cents. The dividend now yields about 2.4%, which is higher than the consumer discretionary sector average of 1.9%.

Source: barchart

Procter & Gamble Might Raise Dividend Again

Procter & Gamble (PG) has taken the last position with an uptick in traffic of about 30%.

Procter & Gamble is another company that has been raising dividends annually for many years, as a result of steadily improving operational performance. Shares are up 5% over the year and 58% in the past five years. In the last quarter, the company’s revenues were up 6% year-over-year, while net income rose 15% to $4.5 billion.

Just like Caterpillar, Procter & Gamble is likely to increase its dividend this year as well, as it has done for 68 consecutive years. Currently, Procter & Gamble’s dividend yields 2.5%, higher than the consumer discretionary sector average of 1.9%.

Source: barchart

The Bottom Line

EPR Properties’ dividend is very high, but the stock faces risk from the cinema operators struggling with declining foot traffic. Caterpillar stock trades near record highs, as the company steadily improved its operational performance and hiked the dividend. Starbucks’ operational performance is strong, but investors are downbeat on the stock due to China and U.S. customer traffic concerns. Procter & Gamble has a delivered solid performance and is likely to hike its dividend again this year.

Be sure to check out Dividend.com’s News section for the most trending news around income investing.