Investing is a constant battle between risk and reward. This fact is one reason why we diversify our portfolios and own a multitude of asset classes. How we manage risk can often be the biggest determinant of long-term returns and whether or not we meet our financial goals. In that risk management, there are many ways to achieve that optimal level of risk/reward.

One of the best could be a barbell strategy.

In its simplest form, the risk hedging strategy involves owning super safe and super risky assets, which often involves stocks and bonds. However, we can use a barbell strategy to balance portions of our portfolios and sub-asset classes as well. When it comes to equities, that can mean owning a hefty number of dividend-paying stocks.

Our Best Dividend Stocks List has 20 of the highest-rated stocks by our proprietary Dividend.com Rating system. Go Premium to find out the entire list.

Barbell Basics

If you’ve ever been to the gym or seen someone lift weights, you have an understanding of barbell strategy basics. A barbell consists of two equally heavy weights at each end, supported by a long middle rod. Created by statistician and guru investor, Nassim Nicholas Taleb, a barbell strategy for a portfolio has a similar look. Implementing the strategy means taking ‘outsized’ positions in two sectors of the market, such as a riskier asset class and a very safe one. The idea is that the low-risk investment can be used as a hedge for the higher-risk asset class. The volatility of the risk asset is smoothed out by the safety of the low-risk one.

For many investors, this could mean balancing short-term Treasury bills with risky high-growth stocks. So, if you own a high-risk, high growth vehicle like the SPDR S&P Biotech ETF (XBI ), you could balance it with an equal position in the Vanguard Short-Term Bond ETF (BSV). The idea is that returns are steadier and more balanced than if you had taken a position on either side.

Dividends as a Source for the Strategy

The problem with using a barbell strategy today in the traditional sense—short-term bonds and high growth stocks—is that bonds are paying essentially nothing. Thanks to the power of inflation, the ‘riskless’ assets of cash and short-term bonds are actually kind of risky. The previously mentioned BSV is currently only 1.22%. That’s below the current pace of inflation. Cash is even worse with a 1-year CD yielding 0.60% at the time of writing.

But as the saying goes, “There’s more than one way to skin a cat.” And in this case, balancing a riskier portfolio of growth stocks doesn’t have to mean going to cash or low yielding short-term securities. Dividend stocks can provide a buffer when using a barbell strategy.

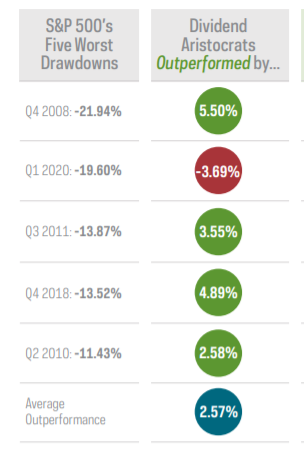

Historically, dividend stocks have been great at weathering market drawdowns. For example, since its inception, the S&P 500 Dividend Aristocrats Index has experienced just 79% of the broader market’s losses. This chart from asset manager ProShares highlights how dividend payers have done well during the S&P 500’s five worst drawdowns since 2005.

Source: Proshares

As you can see, on average, top dividend stocks outperform by 2.57% during market hiccups.

Analysts suspect that there are a few reasons for this. First, there are the dividends themselves. When you know you’ll receive 2-4% in cash as a guaranteed return, you’re less likely to sell shares during times of weakness. Second, many dividend stocks fall under the so-called ‘value’ factor. Often, they are cheaper than the broader market on a valuation standpoint. They can represent deep discounts when things get tough. Third, consistent dividend payments are a sign of fiscal conservatism. As a whole, most dividend payers are less risky than non-dividend paying ones.

As a result, dividend payers could be a prime way to balance out a portfolio.

Use the Dividend Screener to find high-quality dividend stocks based upon 16 parameters. Stocks with the highest ratings are Dividend.com’s current recommendations to investors.

Putting This Into Action

Does that mean abandoning bonds all together? Probably not. But using them to balance out your risk assets may not be wise. Even Taleb suggests that you can be “mildly aggressive or conservative” to get the same effects of using a barbell.

Putting this into practice can be quite easy. A simple portfolio could consist of owning a broad ETF like the iShares Core S&P Total U.S. Stock Market ETF (ITOT) and pairing it with a dividend-focused fund like the iShares Core Dividend Growth ETF (DGRO). The dividends will help smooth out the returns of the broader portfolio. But this can be true for any sector or equity sub-asset class.

Do you own several cloud computing and technology names like Twilio, or clinical stage-biotech stocks, medical device and fintech firms? Then dividends will provide a risk buffer for these investments. According to BlackRock, dividends are the largest source of return for investors over the last 20 years. This fact underscores just how important they are in reducing risk and building out returns.

Keep in mind that investors don’t need to use a dividend ETF to gain exposure. Owning individual dividend paying names in strong stocks can also help on the risk front. For the barbell strategy to work, make sure you own equal portions of risky and non-risky assets to form the balance.

The Bottom Line

The barbell strategy allows investors to take on risky sectors while reducing drawdowns, quelling volatility, and limiting losses. However, given how cash and bonds are yielding less than inflation, real returns are poor.

For investors, that means dividend stocks could do more of the heavy lifting in a barbell strategy portfolio. With their ability to limit drawdowns, dividend stocks could make a prime position to reduce risk.

Be sure to check out Dividend.com’s News section for next week’s Market Wrap and other great dividend investing news.