Despite all the uncertainty caused by the impacts of the coronavirus, one asset class has glittered among the chaos. We’re talking about gold. After spending much of the last decade in the doldrums, gold prices have surged to new highs, eclipsing over $2,000 per ounce at the time of writing.

And there are plenty of reasons why gold has continued to shine in this environment. Considered the currency of last resort, gold often follows its own rules and can offer a hedge against volatility and overall economic and geological uncertainty.

The question for investors is whether or not the precious metal makes sense for their portfolios today, as well as how to access the metal for their goals.

Click here to explore the portfolio management channel and learn more about different concepts.

A Big Surge Higher

After peaking at roughly $2,000 per ounce, gold has spent the back half of the decade scraping the bottom of the barrel. While crawling higher, the yellow metal never really cleared the $1,100 mark. But it looks like gold bugs may finally have the last laugh. So far, 2020 is shaping up to be a banner year for the precious metal.

Gold prices have jumped more than 28% this year and have now surpassed previous record highs. These days, spot prices for gold have the metal trading for $2,035 per ounce. And the reason is clear: traders are uncertain about the future.

The world was already on shaky footing in terms of economic growth when the coronavirus pandemic dug in deep. Thanks to the virus, shelter-in-place orders, new work from home scenarios, and other issues, growth has continued to falter further. The latest projections from the International Monetary Fund’s World Economic Outlook show the world’s economy collapsing by 4.9% this year. That’s nearly 2 percentage points lower than its previous projection.

To that end, governments, central banks and other authorities have once again cut rates, started bond-buying programs and enacted fiscal stimulus plans to keep the world’s economy humming and avoid another worldwide recession.

As investors have been confronted with various issues, they have taken a shine to gold once again. And there’s good reason to consider the precious metal.

Gold During Recessions

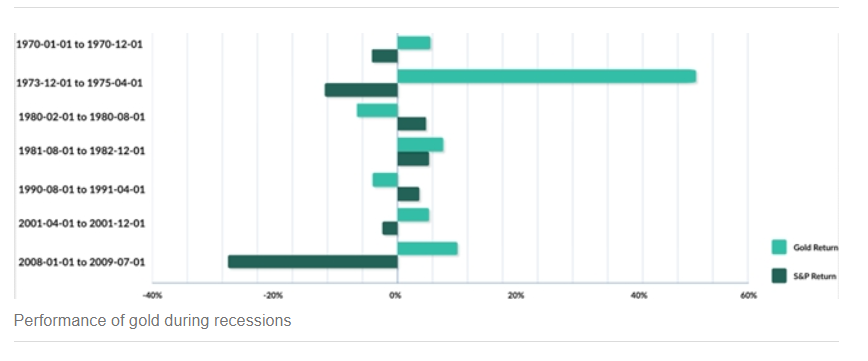

Since the beginning of time, gold has been used as currency. In a more modern sense, it’s become the ultimate store of value. If all heck breaks loose, we’ll still be able to use gold as a way to survive, buy goods and save. Because of this, investors tend to flock to the precious metal when times get a bit shaky. You can see that fact by looking at this chart.

Source: Incrementum AG

According to the data provided by investment manager Incrementum, gold has been a top performer when equity prices dip. Digging deeper, since the 1970s, gold has managed to outperform stocks in three out of the four recessionary periods. This includes the Great Recession, when gold surged to new record highs.

Better still, gold has additional tailwinds these days besides the flight to safety.

For starters, as central banks have pushed rates lower, enacted quantitative easing programs and increased the availability of “cheap” money, inflation expectations have started to surge. Gold tends to do well in periods of high inflation. While stocks reign supreme during strong economic growth, when inflation expectations are high and the economy is doing poor, gold wins. During the 1970s, gold prices surged roughly 15-fold. This period in history looks a lot like today’s current environment.

Secondly, central banks are starting to increase their gold purchases as well. The trio of China, Russia and India have resumed gold buying and set a sort of price floor underneath bullion. According to the latest 2020 Central Bank Survey, more than 20% of banks report that they are looking to buy gold in the next 12 months. This is up from just 8% recorded last year.

The combination of high inflation expectations, low economic growth from the pandemic and continued central bank buying is perhaps the perfect storm for sustained and higher gold prices for the next few months.

Click here to check out the gold stocks.

Adding Gold to a Portfolio

With these reasons in tow, several analysts have now upped their price targets for gold. Bank of America recently gave a prediction that the precious metal could hit $3,000 per ounce. So adding gold could make sense for investors as we drift towards recession. And there are several ways to do just that.

The traditional way to buy gold is, well, to buy gold – as in physical bars and coins. For those looking for real disaster insurance, this is the tried-and-true way to add glitter to a portfolio. However, investors need to keep in mind that owning physical gold can come with extra costs such as storage and insurance fees.

The more modern way could be through gold-backed exchange-traded funds (ETFs). The iShares Gold Trust (IAU ) and SPDR Gold Trust (GLD ) hold gold in a vault on behalf of investors and are great ways to get gold’s benefits in a portfolio. Buying 10 shares of GLD or 100 shares of IAU is equivalent to an ounce of gold.

Finally, you could buy the miners of gold. Thanks to their fixed costs, gold miners can offer a leveraged effect on rising gold prices and even dividends. An ETF like the VanEck Vectors Gold Miners ETF (GDX) or mutual fund like American Century Global Gold (BGEIX ) can be used as a broad way to get access. While individual stocks like Barrick (GOLD) or IAMGOLD Corp. (IAG) can be used to add yield and direct exposure.

The Bottom Line

Gold has historically been a great hedge against uncertainty and that relationship has been true in recent weeks. With the pandemic and other issues still persisting, gold makes an ideal portfolio addition these days. Investors should consider adding it to their mix.

Use the Dividend Screener to find the security that meet your investment criteria.