After years of quantitative easing and rock-bottom interest rates that kept real Treasury bond yields near zero, U.S. inflationary pressures are finally building. With inflation trending upwards, investors are looking at other asset classes to hedge inflation risk. Naturally, they want to know if dividends can provide inflation-adjusted returns in a period of rising interest rates.

Inflation is a hotly contested topic in the United States. The manner in which it is calculated has evolved throughout the years to reflect changing spending patterns among consumers. Today, there are several inflationary measures investors use to gauge cost pressures.

The two most closely watched indicators are the consumer price index (CPI) and the core personal consumption expenditure (PCE) index, which is the Federal Reserve’s preferred guidepost of inflation. Both indicators have trekked higher this year, giving the Fed the scope it needs to continue normalizing monetary policy.

As part of its dual mandate of price stability and economic growth, the U.S. central bank targets inflation at 2% annually.

Learn about Treasury Inflation Protected Securities.

Dividends and Inflation

It’s often understood that rising interest rates are good for savings accounts, but unfortunately banks don’t pay nearly enough in interest to justify the opportunity cost of not investing. Interest rate payments are usually so meager that they don’t even compensate investors for inflation.

Dividends – regular payments made by some companies to shareholders – have been shown to provide a stronger inflation hedge. For starters, many blue-chip companies pay dividends that are higher than the rate of inflation. Since inflation is expressed as a percentage, investors rely on the dividend yield to determine if a particular stock is a good hedge against price growth. Many Dow Jones industrials have dividend yields much higher than the current rate of inflation.

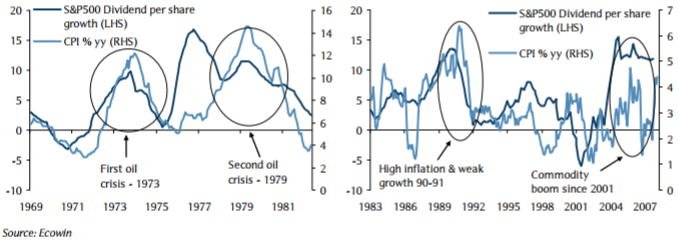

A look back at history shows that dividends have performed well during periods of inflation and even stagflation, which refers to persistent high inflation combined with high unemployment and stagnant demand. During the last three key periods of inflation – 1973, 1979 and the early 1990s – dividend income growth was over 10%. Even during periods of stagnation in the 1970s, dividend growth reached 10%. These trends are further highlighted in the following charts.

U.S. Annual Inflation Rate and S&P 500 Dividend Growth – 1970s to 2000s

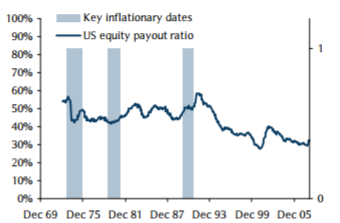

Dividend payout ratios remained more or less stable during the key inflationary periods of the last four decades. Though significant, the payout ratio is often a deceptive measure due to the fact that payouts can increase despite lowering dividends during adverse business cycles. In other words, payouts can increase when dividends are lowered due to weak earnings growth. When evaluating inflation hedges, investors should therefore explore various sectors or take a long-term approach to sector-specific dividends.

U.S. Payout Ratio (dividend yield/earnings yield), 1969 – 2005

Stay up to date with the highest-yielding stocks and their latest ex-dividend dates on our High Yield Dividend Stocks page.

Sectors That Outperform During Periods of Inflation

Dividends exhibit lower volatility than stock prices and even earnings, making them an attractive vehicle for long-term growth. This is especially the case for commodity-related sectors, such as energy and materials, which have provided strong returns during periods of rising cost pressures.

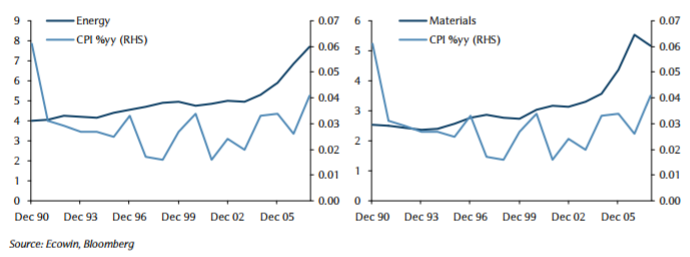

As the following charts illustrate, energy and materials dividend stocks outpaced inflation by a wide margin between 1990 and 2005. Dividend growth in these sectors rose steadily during the 1990s, even when commodity prices were subdued. The commodity boom that began in 2000 was accompanied by a sharp rise in dividend payments for both energy and materials companies.

Dividend Growth in Energy, Materials Sectors (1990 – 2015)

Click here to read about how you can judge inflation using holiday traditions.

Inflation Protection: Long-Term Implications

The longer the holding period, the better dividends become at protecting against inflation. This is especially the case for higher dividend-yielding stocks, which are in a better position to outpace inflation over the long term. Although inflation may win in certain years, high-quality dividend stocks stand a better chance of prevailing over longer time horizons.

High-yielding dividend earners can also generate significant wealth during periods of low inflation, which has become the norm since the 2008 financial crisis. Although inflationary pressures are rising around the world, central banks have relied on extraordinary stimulus measures to make it happen. Another downturn, should it materialize, could signal another deflationary spiral accompanied by years of lower or even negative cost pressures.

Although dividend stocks generally provide solid protection against inflation, there are a few important caveats investors should bear in mind. For starters, dividends from some sectors are more correlated with inflation than others. So-called defensive sectors like consumer staples, healthcare and telecommunications services have demonstrated weak correlation with rising U.S. interest rates, which makes them less likely to outperform during periods of higher inflation (after all, interest rates usually rise when inflation approaches, meets or exceeds the Fed’s 2% target). It is therefore vital to look beyond just dividend yield when protecting against inflation. Researching the strength of the company and the stock’s underlying price stability are equally as important.

On the other hand, companies that have strong pricing power are more likely to exhibit stronger correlation with inflation as they can pass on the higher costs to consumers. However, other sectors may not be in position to pass on rising costs to the end consumer without a decline in competitiveness or revenue.

Though necessary, protection from inflation may not be enough to safeguard your portfolio from broader macroeconomic forces, such as weak economic growth, a stronger dollar and political uncertainty. That’s why it’s important to keep abreast of global economic developments and adjust your portfolio accordingly.

The Bottom Line

Dividends provide investors with an important layer of protection against inflation. Simply put, as more dollars are required to purchase a particular good or service, more dollars are paid for that particular good and services. Thus, more dividends should be passed along to the investor in a commensurate fashion, assuming that inflation is uniform and the payout ratio is consistent.

Check out our Best Dividend Stocks page by going Premium for free.