One of the main tenets of modern portfolio theory is that by using a variety of asset classes, we can smooth out our long-term rides and improve our returns. By taking bonds, stocks, cash and even real estate, our portfolios become stronger. When one asset class is down, another can pull its weight and help produce gains or reduce overall losses.

That’s the theory anyway. For the most part, modern portfolio theory does a good job of doing just that. However, lately, many asset classes have been moving in tandem, which sort of defeats the underlying reasons to be invested in a diverse group of assets.

But there is one way investors could get their diversification mojo back.

And that’s focusing on something shiny. Precious metals like gold, silver and even platinum could provide the diversification benefits that portfolios need in the modern era.

Be sure to check out our Portfolio Management Channel to learn more about building or rebalancing your portfolio.

More Than an Inflation & Disaster Hedge

Most investors probably don’t think of gold and other precious metals at all when it comes to their portfolios. And those that do tend to be a very vocal minority that believe that precious metals are the savior of the fiat money system. Thanks to its history, gold and its kin provide a major disaster hedge when the world goes kaput. So, precious metals are sort of the currency of last resort.

And that’s been true to a point. During prolonged periods of high inflation and disaster, gold and other precious metals have been strong hedges. The key word in that sentence is prolonged. Gold doesn’t really have a positive or negative correlation to short-term spikes to volatility or the CBOE Volatility Index. Kicking out the hyperinflation period of the 1970s produced a muted effect for inflation fighting. From 1986 to 1990 when inflation jumped from 1% to nearly 6%, gold actually lost money.

Now this doesn’t mean that gold and other precious metals aren’t useless in a portfolio. Just perhaps in a different manner than we think.

Where precious metals shine is as a diversification tool with regards to modern portfolio theory. The beauty of precious metals is that they do their own thing. Influenced by a variety of factors that don’t affect the broader stock, bond or real estate markets, precious metals move to the beat of their own drum. That’s important in a world where many asset classes are getting more correlated.

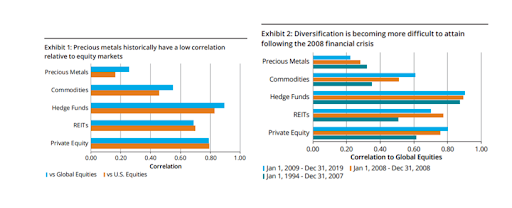

These two charts from Aberdeen Standard sum up the appeal of precious metals as a diversification tool.

Source: Aberdeen Standard Investments

The chart on the right shows that more and more assets are correlated with global equities during rolling periods since the Great Recession. Many asset classes simply function like stocks these days. This is a major problem as it throws modern portfolio theory for a loop. However, the chart on the left provides some hope. This shows that precious metals can still provide bang for your buck when it comes to non-correlated assets. According to Aberdeen, silver, gold, platinum and palladium have just a 0.26 correlation to global equities.

Secondly, precious metals can provide another portfolio benefit – limiting downside while still participating in the upside. An upside and downside capture ratio shows how an asset class performs in both drawdowns and rising markets versus other asset classes. Historically, when equities have experienced positive returns, precious metals have captured 53% of this upside. On the flipside, when stocks have fallen, precious metals have captured only 17% of the downside.

This combined with their low correlation to other asset classes make gold, silver, etc., a top addition to any portfolio as a diversification tool.

Dont forget to check our Precious Metals Industry page to explore more investment opportunities based on your risk profile.

Getting That Exposure

Given that precious metals are a top diversification tool, adding them to a portfolio makes sense. The question is how. Gold bugs will certainly suggest that bullion and coins are the only way to go. And that’s fine if you’re looking for a disaster hedge if World War III happens. But those looking to harness the diversification power have it easier. All it takes is a trip to your brokerage account.

There are numerous exchange-traded funds (ETFs) that track gold, silver and the like. They basically come in two flavors. Funds like the SPDR Gold Trust (GLD) and iShares Silver Trust (IAU) hold physical gold or silver bars in vaults on behalf of investors. While funds like the Invesco DB Precious Metals Fund (DBP) use futures contracts to get exposure. They offer an easy way to add a swath of precious metals to a portfolio.

There is a caveat for holding these ETFs. And that’s taxes. Precious metals are charged as collectibles, which comes at a 28% tax rate no matter what bracket you’re in. Secondly, futures-focused funds issue K-1 statements and are considered partnerships. The best place to stick these vehicles is in tax-deferred accounts like IRAs.

The next question is how much exposure? Experts suggest that even a small 5% weighting to precious metals can significantly add to diversification benefits. The max weighting seems to hover around 15% as, at this point, the lower overall returns of precious metals start to influence long-term gains.

The Bottom Line

Precious metals ETFs belong in your portfolio. Under normal market conditions, gold, silver, platinum and others provide non-correlated returns to a portfolio. Reducing risk and enhancing returns are really the name of the game. By adding even a small weighting, investors can gain some very good diversification benefits.

Make sure to check our Screener to make sure you are picking the right security for your portfolio. You can also select securities that are rated high on our proprietary Dividend.com Rating system.