Dividend stocks are a popular way to generate income in a portfolio, particularly during low interest rate environments, but they’re not the only option. With equity valuations moving to highs that haven’t been seen since 2000, many investors are looking to diversify their income investments away from just dividend stocks and fixed income securities.

Let’s take a look at why dividend stocks might fall out of favor and five alternatives that you may want to consider to diversify your portfolio income.

Learn more about portfolio management on our Portfolio Management Channel.

Stock Valuations Aren’t Cheap

Dividend stocks have long been a staple of income-focused investment portfolios. With interest rates near record lows, they became a popular alternative to bonds and other fixed income securities. Investors could realize a reasonable level of income while simultaneously benefiting from stock price appreciation spurred by record low interest rates.

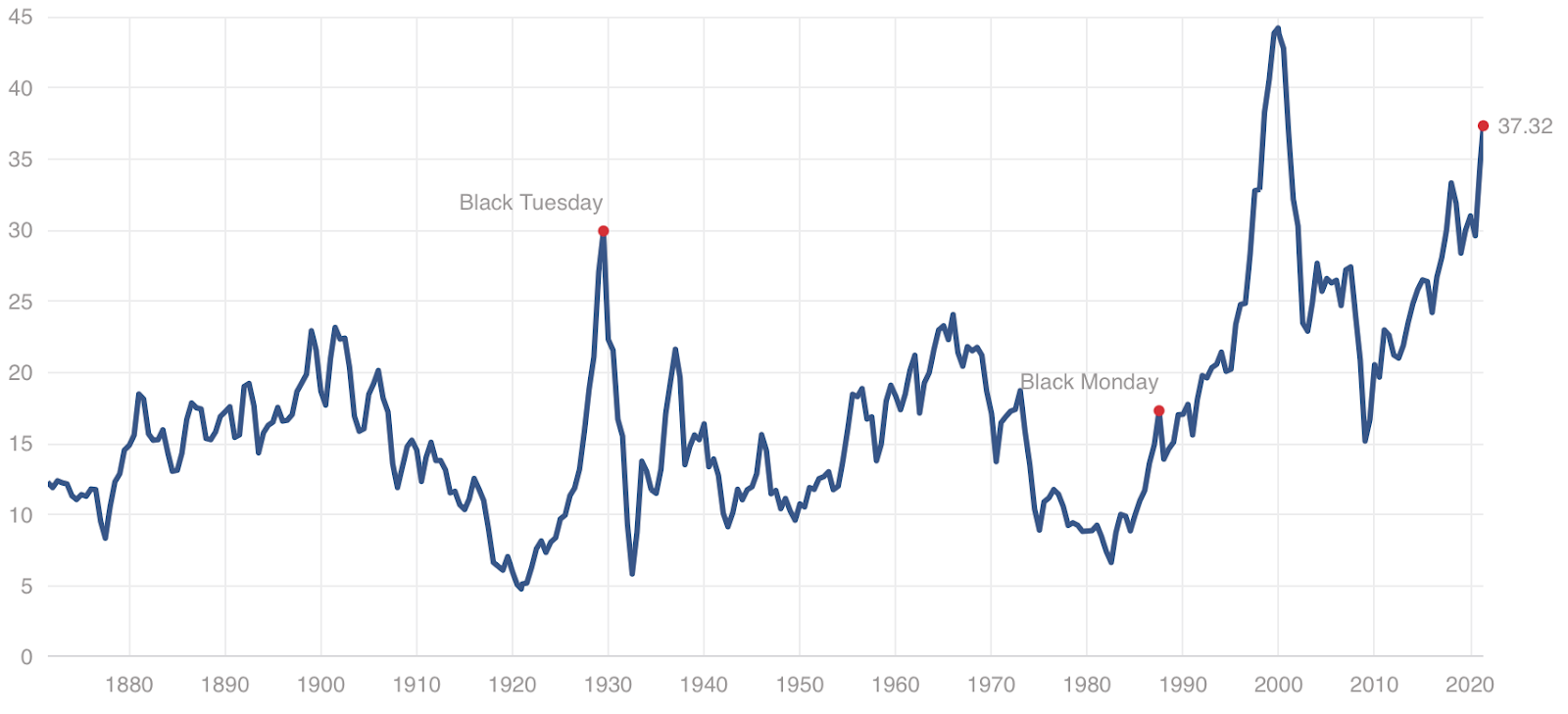

In recent months, the stock market has seen valuations soar to fresh highs. The S&P 500 index’s Shiller price-earnings ratio is nearly 40x, which represents the highest levels seen since the 2000 dotcom bust. If interest rates rise in response to spending-driven inflation concerns, the market could see a contraction over the coming years from their current levels.

Of course, fixed income investments aren’t a very good alternative for those seeking safer sources of income. The same concerns over rising inflation and interest rates could push bond yields higher and prices lower, which creates a risk for those that were already holding bonds. In fact, Warren Buffett recently underscored these concerns in a note to his shareholders that you can read here.

1. Real Estate Investment Trusts

Real estate investment trusts, or REITs, provide attractive yields and built-in inflation protection. While parts of the real estate market may be overvalued, there are many different types of REITs that provide exposure to different areas of the market. You can invest in residential or commercial real estate, as well as properties in different industries or locations.

Of course, the performance of REITs depends on the wider real estate market. Residential REITs have soared with the combination of low mortgage interest rates and stimulus checks, whereas commercial REITs have struggled due to COVID-19-related shutdowns. Rising interest rates could also have a negative effect on real estate prices by increasing the cost of mortgage loans.

Be sure to check our REIT funds and ETFs section to know more about different ways to invest in this asset class.

2. Closed-end Funds

Closed-end funds, or CEFs, provide an attractive source of income from illiquid bonds or loans. Unlike open-ended funds, CEFs have a fixed number of shares that are bought and sold in the open market, which means they often sell at a discount to the underlying net asset value, or NAV. These dynamics could create an opportunity to acquire CEFs at an attractive valuation.

The ability to purchase CEFs below NAV is also their greatest drawback. If you purchase a CEF, there’s a chance it will drop below its NAV for a prolonged period of time, which means you may have to sell for less than the underlying assets are worth. Many CEFs also have less trading volume than more popular funds, which introduces some liquidity risk.

3. Master Limited Partnerships

Master limited partnerships, or MLPs, provide an attractive yield from energy investments. While they’re a bit more complex than most income investments from a tax perspective, they often offer a much higher yield than conventional dividend stocks. These yields also tend to be stable since income typically comes from long-term pipeline contracts with energy producers.

MLPs tend to react less to energy prices than companies involved in oil and gas exploration, but they are still vulnerable to long-term trends in the industry. A prolonged drop in crude oil or natural gas prices could lead to lower dividends. In addition to these risks, higher interest rates could reduce capital inflows into the space and jeopardize expansion plans for many issuers.

Check out MLP industry funds and ETFs to know more about different investment options.

4. Preferred Stock

Preferred stock, as its name implies, has preferential treatment over common stock. In addition to liquidity preference in the event of bankruptcy, preferred stock has a fixed dividend that is paid out before any dividends are paid to common stock owners. These dividends also tend to be higher than common stock dividends, making them an attractive option for investors.

The biggest risk of preferred stock is that they are callable. If interest rates fall, issuers might redeem preferred stock shares for the price specified in their prospectus and reissue new shares with lower dividend yields. If interest rates rise, the price of preferred stock tends to fall as investors sell and seek better opportunities to generate income.

5. Income ETFs

Income-focused exchange-traded funds, or ETFs, and mutual funds are another option for income investors who want to avoid dividend stocks. While some of these funds invest in dividend stocks, many others focus on preferred stock, bonds, and other income-related securities. They also provide built-in diversification.

Like any ETF or mutual fund, income funds have expense ratios that can impact long-term performance. Investors should also carefully consider a fund’s portfolio, liquidity, turnover, and other risk factors before making an investment. Low-cost index funds tend to offer the best performance and the lowest cost of ownership.

The Bottom Line

Dividend stocks have been a staple of income portfolios for a long time, especially given the prolonged low interest rate environment. With equities trading at lofty valuations, many investors are looking for ways to diversify portfolio income.

REITs, CEFs, MLPs, preferred stock, and income funds are potential options to consider with various benefits and drawbacks. When choosing an option for your portfolio, it’s important to consider both the yield and the unique risk factors involved with each one.

Be sure to check our News section to keep track of the latest updates from the mutual fund industry.