An income-driven portfolio is a popular choice for many investors. Not only does it provide a steady stream of predictable returns, it helps to mitigate risk and volatility.

In the current economic environment of low yields and high stock valuations, finding a high-yield asset that doesn’t come at the cost of increased portfolio risk is a smart way to ensure steady returns.

The historical average price-to-earnings ratio for the S&P 500 Index is around 15. But right now, the S&P 500 has an average P/E over 34, which is more than double the historical average. Investors seeking safety in risk-free fixed income assets are struggling to find competitive gains with the 10-year Treasury only offering a yield around 1.24%.

Luckily, there are several ways to still generate higher-than-average yields and keep your portfolio risk to a minimum.

Be sure to check out our Portfolio Management Channel to learn more about building or rebalancing your portfolio.

Strategies to Consider

Here are a few options to consider when looking at low-risk avenues to generate recurring income.

High-Yield Dividend-Paying Stocks

Stocks that pay higher-than-average dividend yields are ideal additions to any portfolio. Over time, these stocks can often outgain the markets when dividends are reinvested. There are a number of stocks in defensive sectors such as consumer staples, healthcare, and utilities that offer yields over 1.25%.

One of the most overlooked aspects of dividend-paying stocks is their potential for long-term portfolio returns. While most investors think of high growth industries like technology to generate outsized gains, dividend payers are just as competitive.

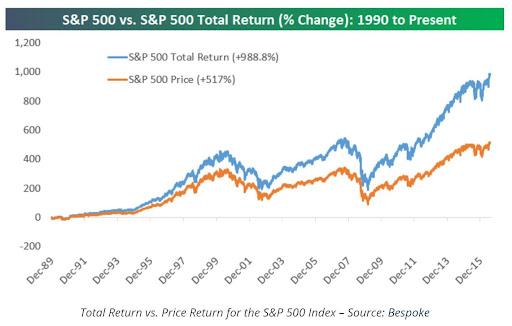

Just take a look at how dividend-paying stocks perform over time:

If you had invested in the S&P 500 Index from 1989 to 2015, you would have realized a gain of 517%, which is not too shabby. However, if you calculate for dividends reinvested over the same time period, your total return would be around 989%. The difference over that 26-year time frame is staggering and demonstrates just how powerful dividend stocks can be to improving your overall returns.

Real Estate Investment Trusts (REITs)

REITs are a popular choice for income-oriented investors due to their tendency to offer high yields. Real estate is also one of the best inflation hedges, making this asset class particularly attractive to investors right now. And while residential homes or condominiums are usually the first thing that comes to mind when it comes to real estate, REITs often include commercial or industrial properties as well. Some REITs are industry specific such as Community Healthcare Trust Inc. (CHCT), currently offering a yield of 3.60% to boot.

A REIT has to pass along at least 90% of its earnings to investors in the form of a dividend, making them prime dividend-paying candidates for your portfolio. Unlike other stocks that may cut or even eliminate their dividend payments, REITs are obligated to pay out to investors.

Master Limited Partnerships (MLPs)

A Master Limited Partnership, or MLP, is similar to a REIT in the sense that it is a liquid investment vehicle of a Limited Partnership company. MLPs usually take the form of an energy or utility company and engage in a business that has a reliable consumer base and slow, steady profits. That makes them great investments for risk-adverse or income-oriented investors who want to keep volatility to a minimum.

One of the unique advantages that MLPs can offer investors is access to environmentally-friendly and/or renewable energy companies. NextEra Energy Partners, LP (NEP) is a renewable energy and utility company that offers a yield of 3.20% and comes to a current year-to-date return of more than 18%.

Covered Calls

Using a covered call option strategy is an out-of-the-box idea that can generate impressive returns with little risk. Contrary to popular belief, option trading isn’t necessarily a high-risk endeavor. Strategies like the covered call can actually reduce portfolio risk and even generate an income stream that rivals or exceeds other high-yielding assets.

To execute a covered call trade, an investor sells a call option on a stock that they currently own at a strike price above the stock’s current price. This reduces the break-even price of the owned stock, thereby mitigating downside risk while also generating an upfront profit from the option’s premium.

Let’s demonstrate how this works with a hypothetical example.

You own 100 shares of XYZ stock that’s currently trading at $20 per share. To execute a covered call strategy, you decide to sell a call option three months out at a strike price of $30 per share at a $50 premium. Immediately upon selling the call, you realize a profit of $50, which is yours to keep regardless of what happens. If over the next three months XYZ stays below $30 per share, the call will expire worthless, allowing you to initiate another covered call with a three-month window.

That means that you netted a 2.5% gain on a stock that didn’t fluctuate much in value. If you repeated this process for an entire year, you would have a total return of 10% just from selling call options.

Check out this article to learn more about covered call options.

The Bottom Line

High-yielding investments don’t always mean that they come with high risk. By adding dividend stocks, REITs, MLPs, and covered calls to your portfolio, you can achieve steady long-term gains without adding excess risk to your investment strategy.

As with any portfolio, investors will want to be careful that they stay diversified. REITs and MLPs are great dividend-paying assets, but they are focused on the real estate and energy markets only. It’s important to make sure other stock holdings are in other market sectors to ensure a properly diversified and healthy portfolio.

Make sure to visit our News section to catch up with the latest investment themes.