Asset allocation is a core tenet of successful value investing. As the value of your portfolio changes over time, rebalancing becomes necessary to ensure your desired risk-reward profile is maintained.

Simply put, rebalancing is the process of realigning the weighting of your portfolio’s assets. When you ‘rebalance your portfolio,’ you are periodically buying or selling assets to maintain your desired asset allocation levels.

There’s a great deal of literature that talks about the desired frequency of portfolio allocation. After all, rebalancing too infrequently puts your portfolio further away from its original risk-reward profile. But rebalancing too frequently increases transaction, fees, and tax payments.

In general, there are three common approaches to portfolio rebalancing. Any one of these rebalancing strategies is better than not rebalancing at all.

Want to know what is portfolio rebalancing? Click here.

Time-Only Approach

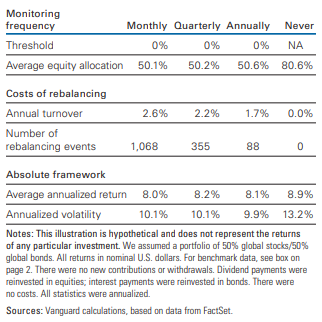

The time-only strategy requires that you rebalance your portfolio in pre-specified time intervals, regardless of how much or how little your asset allocation has drifted from its original target. Research carried out by Vanguard suggests there is no specific rebalancing frequency that consistently outperforms other strategies. Below is a snapshot of risk-adjusted returns based on monthly, quarterly, and annual time-only rebalancing.

Threshold-Only Approach

Threshold rebalancing is the process of setting allocation boundaries for your portfolio and rebalancing whenever they are breached. For example, if you maintain a 60/40 equity/bond allocation and a 5% rebalancing threshold, you would rebalance when either asset drifts above or below the desired allocation by 5%.

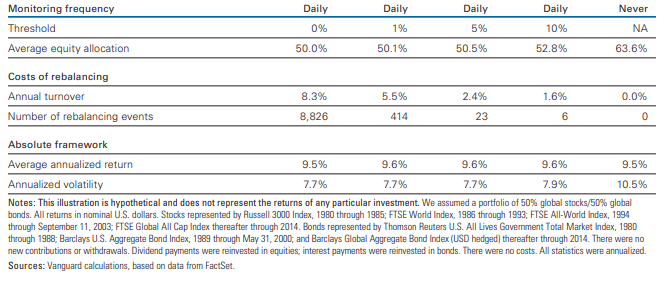

Vanguard has researched threshold rebalancing results for the period 1980 through 2014. As the following chart illustrates, average annual returns and volatility are consistent for threshold strategies that range from 1% to 10%.

Time-and-Threshold Approach

As the name implies, the time-and-threshold rebalancing approach combines time and threshold strategies. The strategy calls for rebalancing on a scheduled basis (i.e., monthly, quarterly or annually) only if the portfolio’s asset allocation has drifted from its target by a predetermined threshold (i.e., 1%, 5%, 10%).

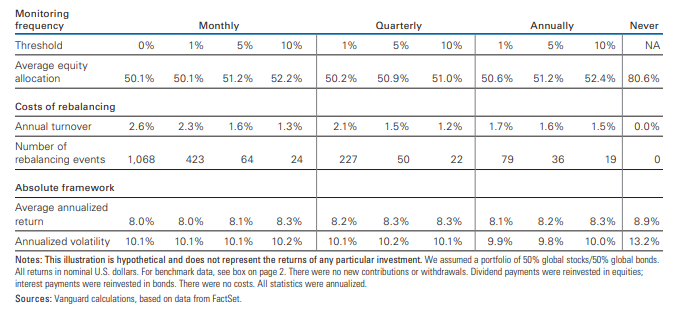

Vanguard analyzed the time-and-threshold between 1926 and 2014. As the following chart shows, rebalancing strategies that required more frequent monitoring at a lower threshold were more costly to implement. For example, a monthly monitoring strategy at a threshold of 1% had 423 rebalancing events. If you monitored quarterly and rebalanced at 5%, the number of rebalancing events plunged to 50. Average annual returns were relatively consistent across various timeframes, so investors with a smaller number of rebalancing events performed better.

Based on Vanguard’s extensive research into rebalancing, the firm concludes that annual or semiannual monitoring with a 5% rebalancing threshold is the most optimal strategy for most broadly diversified equity and bond portfolios. This strategy is more likely to produce a reasonable balance between risk control and cost minimization.

Learn about other portfolio management concepts here..

The Bottom Line

Portfolio rebalancing is all about risk management. By getting your monitoring and threshold frequency right, you stand a better chance of minimizing risk and reducing cost. Both factors play an important role in the overall success of your portfolio.

Sign up for our free newsletter to get the latest insights on mutual funds.