Investors are generally familiar with the basics of portfolio design and benefits of diversification using different asset classes, especially stocks and bonds. However, commodities are often left out of the mix. Usually this happens because investors aren’t really aware of the fact that commodities are an important asset class when it comes to having a fully diversified investment portfolio.

Adding commodities to your portfolio is easier than you might think. There are a plethora of mutual funds and ETFs specifically geared to the commodities market while many stocks are pure plays to a particular commodity like Alcoa (AA) for aluminum or Barrick Gold (GOLD) for gold.

Lets see how commodities can be effectively used in portfolios.

Be sure to check our Portfolio Management Channel to learn more about different portfolio rebalancing strategies.

The Role of Commodities in the Economic Cycle

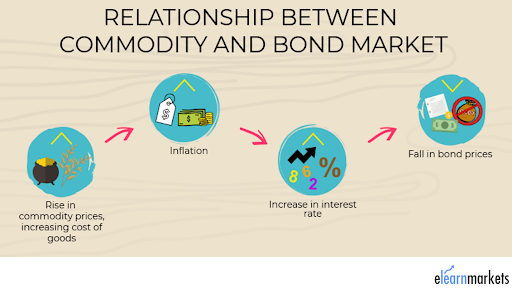

Stocks, bonds, currencies, and commodities are all major inter-related asset classes within the economic cycle. Commodities and stocks generally have an inverse correlation – when stocks are rising, commodity prices fall and vice versa. Behavioral changes within each asset class are largely driven by inflation and to a lesser extent, interest rates. The following infographic demonstrates how this works:

Note how closely tied inflation is with commodity prices here. When inflation is high – there’s a good chance it means that commodity values are high. And rising inflation translates into higher interest rates, leading to lower bond and stock prices.

In the past couple of months, inflation has been one of the top concerns for most investors. As of July 2021, the inflation rate in the U.S. was at 5.4% – over double what it was only four months prior in March, when it was 2.6%. Interest rates haven’t caught up to the inflation data yet with the average yield of the 10-year treasury at about 1.33%. And while stocks are still heading higher, average valuations are twice the historical average suggesting that a correction may be overdue.

You can find out more about how commodity investments are ideal to combat inflation here.

Examining the Various Niches Within the Commodities Market

Commodities can be broken down into two major sub-groups:

- hard commodities

- soft commodities

Hard commodities are natural resources that need to be mined or processed, such as oil or minerals, while soft commodities are agricultural products or livestock.

Energy

The energy commodity market is primarily comprised of crude oil, natural gas, heating oil, and gasoline. These are products that are essential to virtually every aspect of business and life across the globe. Energy products are highly cyclical as well and closely follow the path of the global economy – when the economy is growing, there is a greater demand for energy products.

Despite the push for more renewable energy sources to supplant fossil fuels which harm the environment, the current consumption of energy is growing rapidly. According to the US Energy Information Agency (EIA), annual consumption worldwide of energy is more than 125 quadrillion Btu while estimates project that it will exceed 138 quadrillion Btu by 2050.

Check out the list of all stocks, ETFs and mutual funds from the Energy Sector.

Precious Metals

Precious metals include assets like gold, silver, and platinum. While they do have some industrial uses, they are primarily categorized as inflation hedges or capital preservation purpose. Investors interested in precious metals will find numerous mutual funds and ETFs that cater specifically to this niche while many mining stocks are pure plays or near-pure plays on gold and silver.

Gold is usually referenced by analysts and Wall Street pundits when it comes to protecting your portfolio against inflation, but silver and platinum are also good inflation hedges you can incorporate. Because gold is a limited resource and not subject to the central banking whims of any one country, it maintains its value regardless of how much stocks, bonds, or currencies fluctuate in price. For this reason, gold is considered a “wealth preservation” asset – it doesn’t appreciate in value like a stock will, but it prevents you from larger-than-average losses in bear markets.

One important takeaway for investors is the consideration of interest rates when it comes to the effectiveness of precious metals as a hedge against risk. In order for gold to truly be the best investment option, it needs to offer a better return than anything else. This only happens when inflation is higher than the return investors would get at the risk-free rate.

Base Metals

Base metals, or industrial metals, are used in construction, manufacturing, engineering, and many other industries. The top commodities in this category are aluminum, copper, steel, and zinc. While these metals are more common in the Earth than precious metals, they are more prone to oxidation and weathering, which means that materials need constant maintenance over time.

As with energy commodities, base metals are indicative of economic health. Copper in particular is nicknamed “Dr. Copper” because it correlates strongly with economic expansions or recessions. This metal is so commonly used in construction materials that following its supply/demand curve over time reflects the current condition that the global economy is in.

Agriculture

One segment of the commodities market that investors generally don’t get enough exposure to is agriculture. Farm crops such as soybeans, wheat, and corn are used not only for food production, but more recently have also been included in the growing global demand for clean energy. Biodiesel is growing in popularity quickly and should help keep agricultural commodity prices more in line with hard commodities like oil and copper.

Final Considerations

Incorporating commodities into your portfolio is a great way to add greater diversification, hedge against market risks like inflation and stagflation, and boost overall portfolio returns.

Commodity prices often perform in cycles that the broader market indexes don’t follow, allowing a well-diversified portfolio.

Make sure to check our Screener to make sure you are picking the right security for your portfolio. You can also select securities that are rated high on our proprietary Dividend.com Rating system.