With the end of the year quickly approaching, it’s time to think about one thing… and that’s taxes. As one of the only certainties in life, Uncle Sam always gets his share. The question is just how much will he fill his coffers. Keeping more of what you earn can be more important than the return on your investment in a lot of cases. And there can be ways aside from actual tax fraud to lower your tax liabilities.

One of the most effective ways is tax-loss harvesting.

Selling your losers to benefit your winners may seem counter-intuitive. In reality, dumping sagging stocks, mutual funds or exchange traded funds (ETFs) can benefit you on the tax side of the equation. Even better is that there may be ways to stay invested in similar assets after the sale. For investors, familiarizing yourself with tax-loss harvesting can make a ton of sense these days.

Learn more about portfolio management on our Portfolio Management Channel.

Pruning Your Portfolio

One way to think of tax-loss harvesting is trimming a large oak tree. To spur new growth and improve the overall health of a tree, we simply cut off dead or dying branches. Your portfolio functions in much the same way. All your assets can be thought of as the oak tree. Cutting off dead weight can do wonders for its long-term performance. And that’s where tax-loss harvesting comes in.

In a nutshell, tax-loss harvesting involves selling those stocks, funds or assets that are currently showing a ‘paper’ loss in your portfolio. That may be difficult to do psychologically, but it makes a lot of sense for your overall portfolio. For example, if you own shares in the SPDR S&P 500 ETF (SPY) or Hershey (HSY) and are down around $1,000, you could sell SPY or HSY.

Why you would want to do that comes into play during the second piece of the equation. Investors are able to use those losses to offset realized gains in other securities. So, if you sold SPY and its $1,000 loss, you could offset a $1,000 gain in your Google position. By doing this, you lower your overall taxes this year.

Even better is that if your capital losses exceed the gains or if you have no capital gains in a year, $3,000 worth of those losses can be used to reduce your ordinary income. And if you lose more than $3,000 on a stock, the excess can be pushed into the future to offset capital gains and ordinary income later on.

Mutual fund investors are able to benefit in another way as well. Thanks to their structure as pooled investment vehicles, they distribute capital gains yearly. Those gains are taxed just as if you had sold your position and are taxed as ordinary income. Harvested losses can be used to offset these gains.

The Benefits of Tax-Loss Harvesting

The benefit is reducing taxes and boosting overall returns. And there’s plenty of evidence that this works to your benefit. Take a look at this example from BNY Mellon.

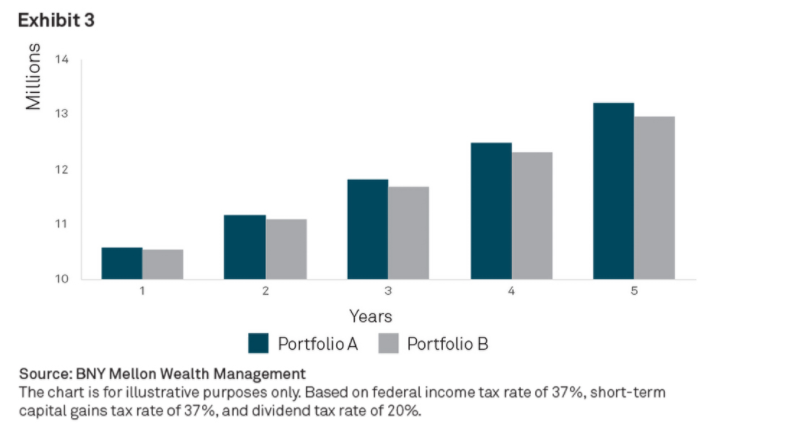

Look at two identical $10 million portfolios that both earn a 6.1% return. The ability to harvest losses makes a huge difference. Under their scenario, each portfolio has the opportunity to harvest $1 million in losses. Portfolio A – which harvests those losses – is able to grow to $13.2 million. Portfolio B – which does not tax-loss harvest – only grows to $12.9 million. The following chart shows the difference over time.

Source: BNY Mellon

There are other benefits as well.

One comes down to cash flows. When selling losers, investors have a source of cash to put to work in their portfolio. The benefit is that investors can reset their cost basis. The Internal Revenue Service (IRS) has something called the wash sale rule that prohibits taxpayers from claiming a loss on the sale of an investment and then buying the same or ‘substantially identical’ investment within 30 days. However, you can use this cash to buy a larger stake in one of your winning investments that have been sold or you can buy a similar, yet not ‘substantially identical’ security.

For example, you cannot sell the previously mentioned SPY and purchase the Vanguard 500 Index Investor (VFINX ). But you could buy the iShares Total US Stock Market Index (BKTSX ).

Use the Mutual Funds Screener to find the funds that meet your investment criteria.

Secondly, tax-loss harvesting can help you take advantage of volatility. Often, we’re forced to simply ride out periods of market strife. But being proactive during these periods can result in higher long-term returns. Dumping losers and being able to buy winners that are currently suffering a temporary setback due to widespread market corrections can amplify returns over the long haul.

This also comes into play when offsetting taxes. During periods of volatility, short-term losses can be used effectively against taxes. According to the IRS, short- and long-term losses must be used first to offset gains of the same type. But if your losses of one type exceed your gains of the same type, then you can carry the loss over to the next type of gain. You can use short-term losses from volatility to potentially offset taxes on longer-term gains in your portfolio.

The Bottom Line

While no two investor profiles, portfolios, and goals are alike, implementing tax-loss harvesting can provide benefits to most situations. Again, the higher your tax bracket, the more benefit the technique can have.

The key is to be proactive. Don’t wait until year-end to sell your losers. During periods of volatility, tax-loss harvesting throughout the year makes perfect sense. In the end, pruning a portfolio to limit taxable gains can provide a host of benefits that lead to stronger outcomes for investors.

Be sure to check our News section to keep track of the latest updates from the mutual fund industry.