2020 has been a roller coaster year for stocks, but according to several strategists, the “barbell strategy” is still the right approach for yield-seeking investors.

Coined by Nassim Nicholas Taleb, the barbell strategy refers to the process of taking “outsized” or larger positions in two focus areas. These focus areas can be equity or fixed-income assets and generally depend on the investor’s risk tolerance, preference, and investing horizon. The strategy can be applied to bond portfolios, equity portfolios, or an overall wealth portfolio.

Just like a physical barbell that is used for weightlifting, the barbell portfolio is most heavily weighted at each end with only a thin bar connecting the two sides.

One end of the barbell consists of low-risk, low-return investments that can be used to hedge against risk. On the other side is higher-risk assets with the potential for higher returns.

For some investors, the barbell strategy may consist of income-generating assets (i.e., dividend socks) and sectors whose growth is driven by secular themes (i.e., aging population, the rise of China’s middle class, the global transition to a gig economy, etc.).

Use the Dividend Screener to find the security that meets your investment criteria.

How Can the Barbell Strategy Be Applied?

As mentioned above, the barbell strategy is usually applied to three types of portfolios: bond, equity, and overall wealth portfolio.

Fixed Income

When applied to fixed-income portfolios, the barbell approach requires investors to pair short-duration bonds with longer-term bonds. However, the success of this approach is highly dependent on interest rates, which have nosedived in recent months as central banks embarked on a new round of monetary easing.

Equity

For equity portfolios, the barbell strategy requires more attention because you are essentially holding two different groups of stocks in your portfolio. One group of stocks could be classified as “safe” (i.e., stocks with a long history of dividend payments), whereas the second group is very risky (i.e., technology stocks).

Nassim Nicholas Taleb provides the following advice from his famous book, Black Swan:

“If you know that you are vulnerable to prediction errors, and accept that most risk measures are flawed, then your strategy is to be as hyper-conservative and hyper-aggressive as you can be, instead of being mildly aggressive or conservative.” [Taleb, 2007]

Wealth Portfolio

The barbell strategy can also be applied more broadly to your wealth portfolio. An overall wealth portfolio may include a blend of ultra-safe investments, index funds that track major markets and alternative investments designed to achieve outsized returns. These alternative investments may include owning real estate, investing in startups, or venture capital funds.

How Has the Barbell Strategy Performed?

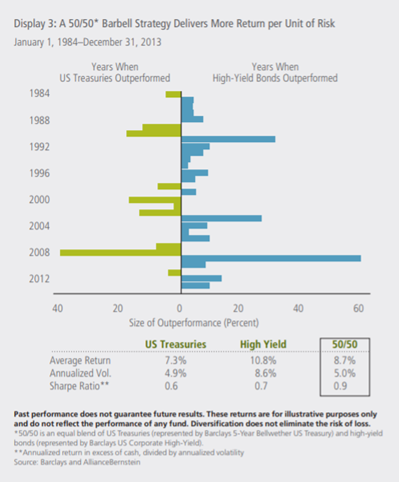

A 50/50 barbell strategy with exposure to U.S. Treasuries and high-yield bonds has delivered more return per unit of risk, according to Alliance Bernstein. Strikingly, this is true of larger time frames as well.

Between 1984 and 2013, the above-mentioned barbell strategy yielded an average return of 8.7%, compared with 7.3% for U.S. Treasuries and 10.8% for high-yielding bonds.

In other words, investors who were looking for a more effective long-term portfolio would have opted for the barbell strategy as a good way to generate returns while minimizing risk.

Source: Alliance Bernstein

As Alliance Bernstein notes, this 50/50 construction represents a simple barbell strategy. Results could be optimized by adding other sectors and adjusting the blend of equities included in the portfolio. According to DBS, applying secular themes to one’s portfolio can better capture those opportunities.

Click here to explore the portfolio management channel and learn more about different concepts.

The Bottom Line

Despite plunging interest rates, the barbell strategy remains highly relevant in today’s market. When used effectively, the strategy blends asset classes whose returns are negatively correlated. This provides much-needed protection as well as the opportunity to earn outsized returns from alternative investments.

Be sure to check our News section to keep track of the latest updates around income investing.