With the relatively unprecedented strength we have seen in global equity markets over the past ~2.5 years (with one rather extreme hiccup in between), some investors may be apprehensive about investing in equity markets going forward.

This age-old market-timing predicament appeals to both reason and natural emotional biases. Emotionally, when you buy anything, it feels good to get a “good deal” and buying after large market run ups may not feel like a “good deal”. From a more rational standpoint, it is incredibly disadvantageous to one’s financial future to invest at historic market tops such as those we saw in the Dotcom bubble and 2008. While these historic events are certainly painful outliers, both data and market mechanics support investing at new highs or rather not “waiting for a better price.”

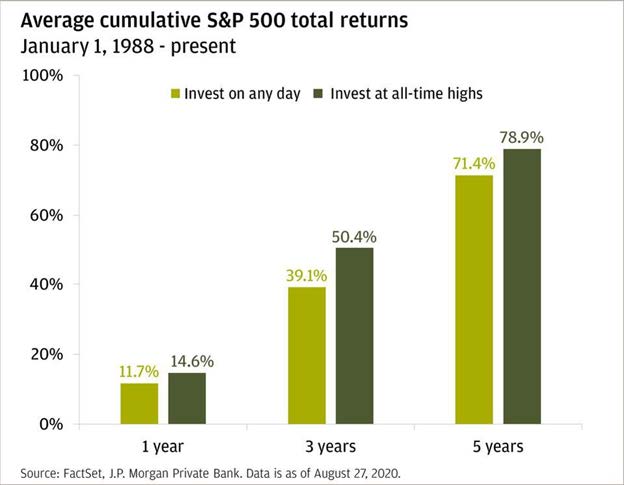

Source: FactSet, J.P Morgan Private Bank, as of 8/27/20

As the chart above shows, S&P 500® Index performance has historically been better going forward from all-time highs. This makes sense mathematically, as to go down 50% you must first go down 10% etc., but also logically because the natural state of the market is upward. While on a day-to-day basis the market’s performance is akin to a coinflip, 73% of one-year periods 1 have been positive and the longer the investment period, the more likely the results are going to be positive.

Even if we ignore the opportunity cost of staying out of the market and waiting for a “dip”, market pullbacks aren’t necessarily guaranteed buying opportunities. Obviously if you buy at a cheaper price, you’ll have better returns all else equal. However, over the past quarter century, “buying the dip” hasn’t paid over the following year. Not to mention, emotionally, how does one make this timing decision of buying the dip—how big a dip will be required? How does one know if the dip will or will not turn into something much worse?

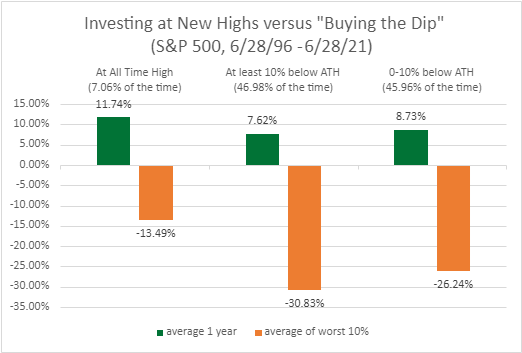

As outlined below, over the last 25 years, we see that investing at ATHs has actually been indicative of the best performance over the following year, while buying after a 10% or greater pullback has produced the worst performance. Perhaps most notably, by one measure ATHs have represented the safest time to invest with the worst 10% of one year periods after ATHs showing far smaller losses than in the other two scenarios.

Source: Koyfin, Beaumont Capital Management (BCM). Data for the period 6/28/1996 through 6/28/21.

Conversely, on average, large pullbacks represent the most dangerous time to be (or become) invested. This rather simplistic approach makes sense as usually things are going well when the market is making new highs and things are going poorly while it is falling. It also highlights some of the potential attractiveness of momentum-based strategies, which aim to capitalize on this relationship.

Ultimately, investors should not be fearful of investing at All-Time-Highs. Given that any equity investment comes with an implied return, being uninvested can be particularly painful—the market has always recovered from a drawdown but if you forego investing at an ATH, there is no assurance you’ll ever see a cheaper price. In addition, a good tactical strategy can further mitigate the strain on your portfolio (and your mind) when trying to invest in any market situation, given their ability to quickly increase or decrease risk as opportunities present themselves.

References

- 1. Capital Group Time, Not Timing, Is What Matters

Disclaimer

Copyright © 2021 Beaumont Capital Management LLC. All rights reserved. All materials appearing in this commentary are protected by copyright as a collective work or compilation under U.S. copyright laws and are the property of Beaumont Capital Management. You may not copy, reproduce, publish, use, create derivative works, transmit, sell or in any way exploit any content, in whole or in part, in this commentary without express permission from Beaumont Capital Management.

Past performance is no guarantee of future results. Index performance is shown on a gross basis and an investment cannot be made directly in an index.

This material is provided for informational purposes only and does not in any sense constitute a solicitation or offer for the purchase or sale of a specific security or other investment options, nor does it constitute investment advice for any person. The material may contain forward or backward-looking statements regarding intent, beliefs regarding current or past expectations. The views expressed are also subject to change based on market and other conditions. The information presented in this report is based on data obtained from third party sources. Although it is believed to be accurate, no representation or warranty is made as to its accuracy or completeness.

As with all investments, there are associated inherent risks including loss of principal. Stock markets, especially foreign markets, are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. Sector and factor investments concentrate in a particular industry or investment attribute, and the investments’ performance could depend heavily on the performance of that industry or attribute and be more volatile than the performance of less concentrated investment options and the market as a whole. Securities of companies with smaller market capitalizations tend to be more volatile and less liquid than larger company stocks. Foreign markets, particularly emerging markets, can be more volatile than U.S. markets due to increased political, regulatory, social or economic uncertainties. Fixed Income investments have exposure to credit, interest rate, market, and inflation risk.

Diversification does not ensure a profit or guarantee against a loss.

The Standard & Poor’s (S&P) 500® Index is an unmanaged index that tracks the performance of 500 widely held, large-capitalization U.S. stocks. Indices are not managed and do not incur fees or expenses. The MSCI ACWI Index captures large and mid-cap representation across 23 Developed Markets and 26 Emerging Markets countries.

S&P 500® is a registered trademark of Standard & Poor’s, Inc., a division of S&P Global, Inc. MSCI® is the trademark of MSCI Inc. and/or its subsidiaries.

For Investment Professional use with clients, not for independent distribution. Please contact your BCM Regional Consultant for more information or to address any questions that you may have.

Please contact your BCM Regional Consultant for more information or to address any questions that you may have.

Beaumont Capital Management was originally created in 2009 as a separate division of Beaumont Financial Partners, LLC. Beaumont Capital Management LLC spun off as its own entity as of 1/2/2020. Beaumont Financial Partners, LLC was originally registered as Beaumont Trust Associates in 1981 and was reorganized into Beaumont Financial Partners, LLC in 1999.

Beaumont Capital Management LLC, 75 2nd Ave, Suite 700, Needham, MA 02494 (844-401-7699)

David M. Haviland a Managing Partner of the firm and Lead Portfolio Manager of Beaumont Capital Management (BCM). Check out his full bio here.