Small-cap stocks tend to outperform their larger peers over time. For example, global small-cap stocks posted 10-year annualized gains of 8.5% versus 5.5% for large caps between May 1994 and June 2021. At the same time, they outperformed in 187 of 206 ten-year periods, suggesting these gains aren’t simply attributable to one spectacular year.

That said, the Russell 2000 Index has been trading lower than the S&P 500 since January amid the broad market sell-off. With a recession on the horizon, many investors are understandably hesitant to invest in small-cap companies that may not have as much cash in the bank to weather a higher interest rate environment and slower consumer demand.

Let’s examine whether small-cap stocks represent a good opportunity in today’s market and where to find opportunities.

Be sure to check our Portfolio Management Channel to learn more about different portfolio rebalancing strategies.

What’s Coming Up?

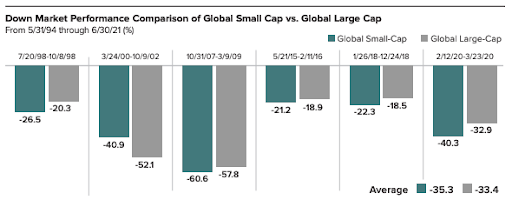

Small-cap stocks tend to underperform large-cap stocks during a down market as investors sell riskier assets. After all, on an absolute basis, they have significantly higher volatility than large-cap stocks, making them more dangerous to hold during a downturn. As a result, investors would have been wise to shift away from them earlier this year.

Small-cap stocks fall further than large-cap stocks in a down market. Source: Royce Funds

That said, global small-cap stocks experience stronger recoveries than large-cap stocks one year after market troughs. And the magnitude of these recoveries tends to offset the sharper declines during down markets. Those lucky enough to buy small-cap stocks near the market trough could benefit from these more considerable recoveries.

Moreover, global small-cap stocks had fewer negative or flat return periods than global large-caps over a rolling five-year period – and no negative returns over 10-year holding periods. So, on the whole, they tend to offer a superior risk-adjusted return than large-cap stocks – particularly when buying after a substantial market decline.

Betting on a Rebound

Warren Buffett once suggested that investors buy when there’s blood in the streets. In other words, he prefers to buy assets during an economic downturn when they’re cheaper rather than paying a premium for them in a bull market. And, of course, there’s more than just his spectacular returns to suggest that it’s good advice to follow.

The Russell 2000’s three-year and five-year monthly rolling averages, since inception in 1978, have been 10.8% and 10.5%, respectively. By comparison, the three-year and five-year annualized returns leading up to September 30, 2022, have been just 4.3% and 3.6%, respectively. These data suggest that the index is performing well-below average.

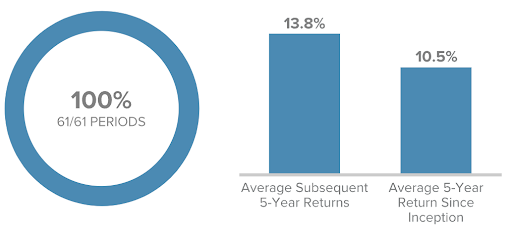

100% of the Time, Positive 5-Year Returns Have Followed 5-Year Low Return Markets – Source: Royce Funds

Interestingly, a Royce Funds analysis found that the Russell 2000 tends to significantly outperform after a period of underperformance. As seen above, the index averaged a 13.8% five-year annual return following a five-year period with annualized returns of 0% to 5%. As a result, investors could see a strong rebound from current levels over the long term.

Small-Cap ETFs to Consider

| Name | Ticker | Expense Ratio | AUM |

| Vanguard Small-Cap Value ETF | VBR | 0.07% | $24.7 Billion |

| Schwab US Small-Cap ETF | SCHA | 0.04% | $14 Billion |

| Vanguard Small-Cap Growth ETF | VBK | 0.07% | $12.7 Billion |

| iShares Russell 2000 Growth ETF | IWO | 0.23% | $9.8 Billion |

| Schwab Fundamental US Small Company ETF | FNDA | 0.25% | $6 Billion |

Data as of November 14, 2022

Make sure to visit our News section to catch up with the latest news about income investing.

The Bottom Line

Small-cap stocks have a robust track record of outperforming large-cap stocks on a risk-adjusted basis. While they’ve suffered during the recent market rout, investors may want to consider adding exposure ahead of a potential recovery, particularly given their historical outperformance of large-cap stocks over the ensuing five-year period.

Take a look at our recently launched Model Portfolios to see how you can rebalance your portfolio.