Imagine that you’re looking for the perfect place to retire—somewhere warm and sunny. You probably wouldn’t base your decision on a five-day weather forecast since there’s a lot of day-to-day volatility. Instead, you would consider the overall climate to get a longer-term picture.

The same is true when it comes to investing. Rather than selecting investments based on their recent performance, long-term investors look at the long-term behavior of a group of assets. They use asset allocation to select combinations that generate the best long-term performance.

Let’s take a more detailed look at strategic asset allocation and how to determine the optimal allocation for your portfolio.

Click here to know more about the overall portfolio management process.

What is Strategic Asset Allocation?

Asset allocation refers to the mix of assets held in a portfolio. For example, a retirement investor may have an asset allocation consisting of 90 percent bonds and ten percent stocks whereas a young investor may hold 90 percent stocks and ten percent bonds. The right allocation depends on their goals, risk tolerance, and other factors.

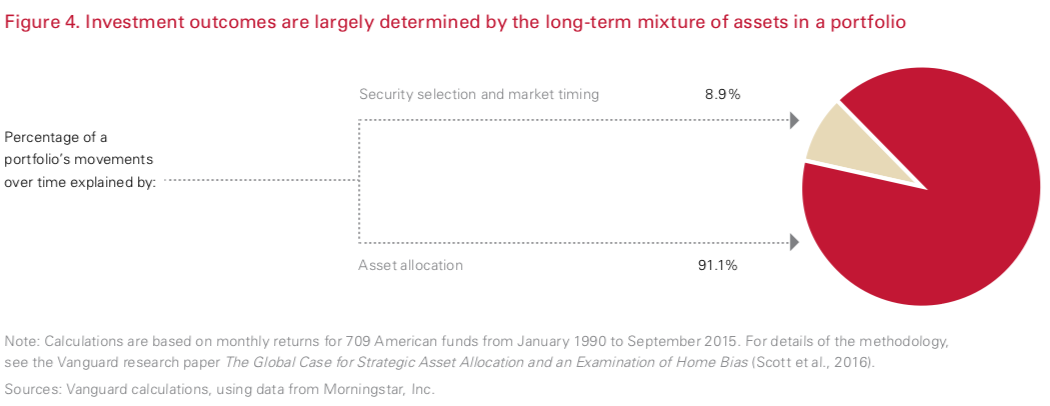

As rightly demonstrated by Vanguard’s research in the above chart, if you have a diversified portfolio, about 90 percent of your returns and volatility can be traced back to asset allocation. This means that less than ten percent of returns can be traced back to security selection and market timing! In other words, you can expect to earn about the same as other investors with the same asset allocation as you over time.

It’s important to note that asset allocation isn’t necessarily about minimizing risk—it’s about right-sizing risk. If you attempt to escape market volatility by investing in low-risk assets, you could experience high opportunity costs or lose out to inflation. These costs can be amplified by the compounding of opportunity costs over time.

How to Determine the Optimal Allocation

The right asset allocation for an individual depends on their investment horizon, risk tolerance, and investment goals. While there are some common suggestions, such as holding a stock allocation equal to 100 minus your age, most people could benefit from more specific guidance for their situations. This is especially true if they have unusual risk tolerances.

There are three key factors to consider while allocating assets:

- Timeframe: Those with shorter time frames should invest in less volatile (and lower returning) assets, while those with longer timeframes can afford to invest in more volatile (and higher returning) assets. Stocks and options tend to be more volatile than bonds and fixed income investments.

- Risk Tolerance: Burton Malkiel, who wrote A Random Walk Down Wall Street advocated for a risk level that lets someone sleep soundly at night. If you’re taking on so much risk that you can’t sleep, you may want to lower your portfolio risk, even if you have a long timeframe.

- Return Requirements: You may require a certain level of return or income from a portfolio. A retiree in need of a fixed income from their portfolio may require a certain bond allocation to generate enough recurring income to live on, while a young investor with a set retirement goal may need enough stock exposure for a viable shot at reaching that goal.

Asset allocation also changes over time as these factors change. As retirement approaches, you may have less risk tolerance and a shorter time frame, which translates to selling risky assets in favor of less risky assets. Many financial advisors make these changes on an annual basis, while target-date retirement funds can automatically handle them.

Most asset allocation advice centers on stocks and bonds, but there are many other assets and subclasses to consider. For example, real estate and other alternative assets may be attractive for some portfolios. Dividend stocks and utilities may also be less risky than growth and biotech stocks, even though they are all considered “stocks”.

You can use Dividend Screener to search for different types of dividend-paying stocks or browse through stocks from specific sectors.

Examples of Asset Allocation

The best examples of strategic asset allocation are target-date retirement funds, which automatically determines an asset allocation based on a target retirement date.

For instance, Vanguard’s Target Retirement 2040 Fund (VFORX) has the following asset allocation:

| U.S. Stocks | International Stocks | U.S. Bonds | International Bonds |

|---|---|---|---|

| 50.70% | 33.40% | 11.20% | 4.70% |

By comparison, Vanguard’s Target Retirement 2025 Fund (VTTVX) has the following asset allocation:

| U.S. Stocks | International Stocks | U.S. Bonds | International Bonds |

|---|---|---|---|

| 37.10% | 24.60% | 26.90% | 11.40% |

As you can see from these tables, the asset allocation shifted from stocks to bonds as the retirement age draws closer in these cases.

You can learn more about target date funds here.

The Bottom Line

Strategic asset allocation is one of the most important factors when investing—even more important than stock selection. By choosing the right asset allocation, you can ensure that your portfolio has the proper risk and return dynamics to meet your retirement or other investment goals.

Check out our Best Dividend Stocks page by going Premium or sign up for our free newsletter to the latest investment news.