Retirement portfolios were originally designed to supplement a pension plan and Social Security income. With the decline in defined benefit (DB) plans and the rise in defined contribution (DC) plans, retirement portfolios have shifted from a supplemental source of income to a core source of income – and made proper planning imperative to success.

While there are no account balances for DB plans, the account balances found in DC plans changed the mechanism of retirement planning. Retirees must ensure that they save enough to fund their retirement, and potentially leave money to their heirs. Successful planning depends on coordinating four key factors that influence income.

Let’s take a look at the four factors that influence retirement income and how the current market environment is affecting them.

Be sure to check out the Retirement Channel to learn more about retirement planning concepts and strategies.

Interest Income & Dividends

We’ll start with prospects of interest income and dividends, the first two factors considered in this article.

Interest income has historically been an important source of retirement income, but since the 2008 financial crisis, record-low interest rates have decreased their income potential. With bonds near record lows and inflation prospects on the horizon, bond yields could rise over the coming years, but current bonds could see a precipitous drop in value.

In fact, Warren Buffett famously warned in the latest Berkshire Hathaway annual letter that fixed income investors worldwide – whether pension funds, insurance companies or retirees – face a bleak future. The Oracle of Omaha also warned against shifting purchases to obligations backed by shaky borrowers.

Many retirees have shifted their focus from fixed income to equity dividends to avoid these risks. Unfortunately, the search for yield has stretched the valuations of top-paying dividend sectors, like utilities and energy companies. Real estate investment trusts, or REITs, and other dividend-paying sectors have also become expensive in recent years.

Principal & Capital Gains

The next two factors are principal and capital gains.

The lack of interest and dividend income has come amid a sharp rise in the S&P 500’s performance since the market bottom in 2009. In fact, the S&P 500 returned 31.5% in 2019 and 18.4% in 2020 compared to a long-term average of 9.6% since its inception. Retirees focused solely on interest, and dividends may have missed out on these big moves.

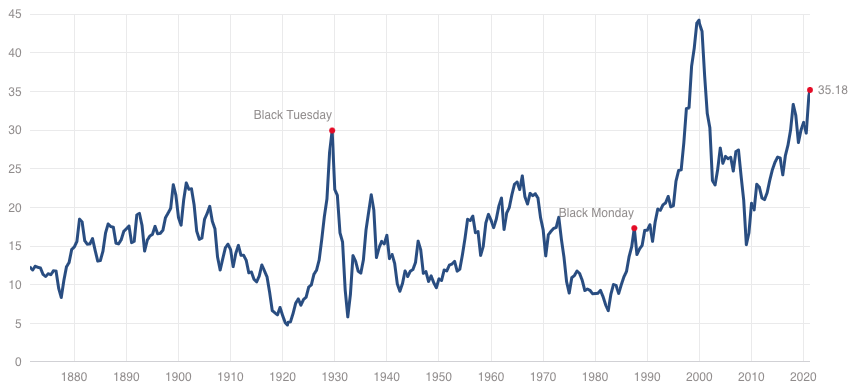

Of course, there’s a good reason that retirees avoid equity-heavy portfolios – most of them cannot afford to take a large loss. The 22.1% drop in the S&P 500 in 2002 or the 37% drop in 2008 could be catastrophic to any retirement fund. With the S&P 500’s Shiller P/E ratio trading near 35X, valuations in today’s market are ominously high.

That said, the S&P 500 has historically bounced back from sharp declines. The index posted a 28.7% gain in 2003 and a 26.4% gain in 2008. Retirees relying on a drawdown of principal may experience some sharp losses, but the subsequent rebounds could be enough to sustain the entire portfolio over the long-term assuming they are well diversified.

Adjusting to Today’s Market

Most investors are familiar with the principles of diversification. By relying on all four sources of retirement income – including interest income, dividends, capital gains and principal – investors can give themselves the best potential to realize income without taking on excessive risk or concentrating their portfolio in a few different asset classes.

That said, some advice may need to be adjusted given the current environment. A retirement portfolio following the 60/40 strategy – or 60% equities and 40% bonds – could see limited income from bonds and a steep decline in the portfolio’s value if yields rise. These investors may want to consider making some changes to de-risk their portfolio.

Municipal bonds, convertible bonds and preferred stocks may provide less risky after-tax income, while a diversified portfolio of dividend stocks can boost equity-related income. While chasing higher yields from riskier issuers may boost income, risk-adjusted returns could suffer if these issuers start to default in a rising rate environment.

Don’t forget to explore our Portfolio Management channel to learn about different ways to rebalance your portfolio.

The Bottom Line

There are four primary sources of income in retirement, including interest income, dividends, capital gains and principal. While conventional advice has been to avoid drawing down a portfolio, the low interest rate environment has made it risky to own a large number of bonds, and the strong market performance means drawing down may be an acceptable idea.

At the same time, investors should review their asset allocations to ensure that they are appropriately balancing these four sources of income while being mindful of the current market dynamics.

Be sure to check out MutualFunds.com’s News section for next week’s trending news.