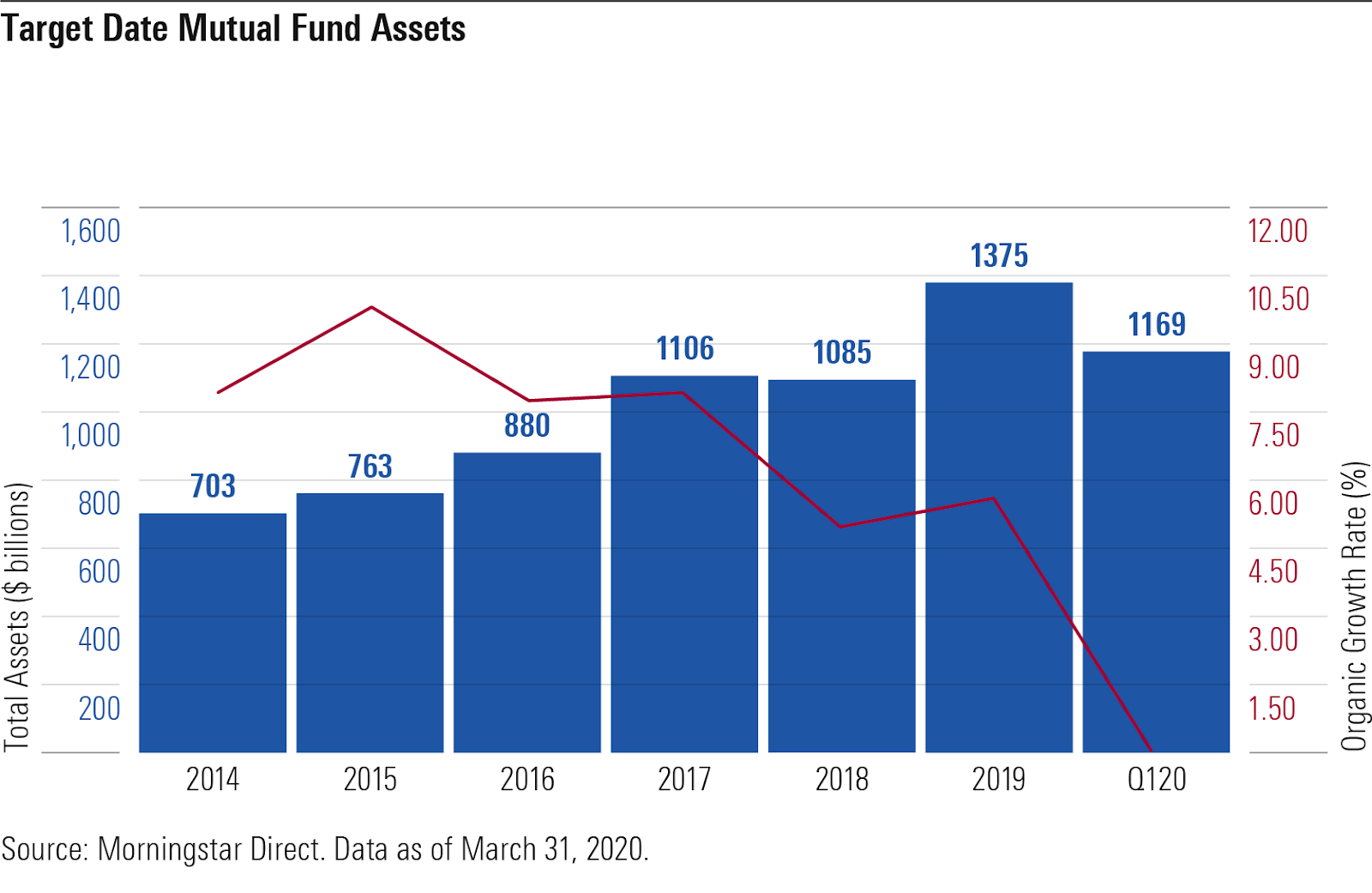

Target-date fund assets jumped 27% to just under $1.4 trillion at the end of 2019, according to data from Morningstar. While most investors ignored short-term stock market volatility, large price movements forced many of them to reconsider their portfolios – especially if they’re close to retirement. The good news is that the industry has come a long way since the 2008 financial crisis.

Let’s take a look at the impact of the COVID-19 pandemic on target-date funds, including its impact on assets under management and performance during the first quarter.

Use the Mutual Funds Screener to find the funds that meet your investment criteria.

Impact on Assets Under Management

Imagine that you’re two years away from retirement with target-date funds that you believe are conservatively invested in the market and yet you’re seeing one-third of your portfolio vanish over the period of just a few weeks. Of course, this scenario played out during the 2008 financial crisis, when 2011 through 2015 target-date fund investors – those who were hoping to retire in just a few years – lost nearly 30% of their value.

Click here to explore target-date funds.

Target-date funds recovered in popularity over the ensuing decade, but that doesn’t mean investors forgot what happened during the financial crisis. During the first quarter of 2020, target-date fund assets fell 15% from $1.37 trillion to $1.17 trillion as the COVID-19 pandemic accelerated. Investors pulled out their assets early on during the crisis in an attempt to safeguard their portfolio.

The 2020 through 2030 vintages experienced the most significant outflows as investors nearing retirement panicked and liquidated their assets. On the other hand, the 2040 through 2060 vintages experienced net inflows during the first quarter. These investors have time on their side and may have assumed that the COVID-19 pandemic could create an opportunity to acquire shares at a discount.

Target-Date Fund Performance

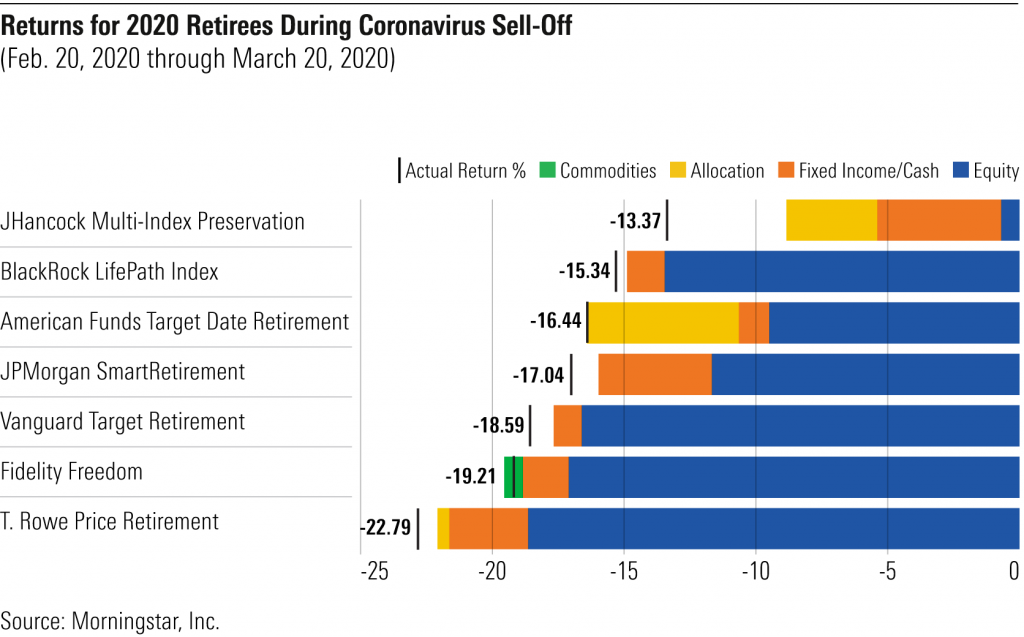

Target-date funds posted meaningful losses during the first quarter, but those losses were on par with what you’d expect given the market volatility. For example, Vanguard’s 2020 fund experienced a 10.7% loss that was probably concerning for many people hoping to retire soon. Vintages beyond 2020 experienced greater losses during the first quarter due to their riskier holdings.

Target-date retirement funds aren’t fundamentally different than they were in 2008 in terms of portfolio allocations – most still hold significant amounts of equity at the retirement date. That said, there are some target-date funds that offer significantly less risky allocations under monikers-like preservation funds. Greater fixed income and cash allocations typically translate to less volatility for investors.

Learn more about mutual funds here.

What It Means for Fiduciaries

Target-date funds are a convenient way to help clients plan for retirement, but despite their similar goals, they aren’t all created equal. Many target-date funds feature relatively high equity allocations for investors that are near or past retirement age, which means that they may not be right for risk-averse investors or those that aren’t comfortable holding a lot of equity.

Fiduciaries should keep several things in mind:

- Establish an objective process for comparing, selecting and reviewing target-date funds.

- Understand the sponsor’s investments – equities and bonds – and how they change over time.

- Determine if the target-date fund’s expenses are appropriate and suitable for clients.

- Learn if target-date funds have the ability to get defensive during market crashes.

- Develop an effective communication policy and review portfolios with clients.

- Document everything to ensure that you’ve made defensible decisions.

During uncertain times, fiduciaries may face a lot of client phone calls and concerns. It’s common for investors approaching retirement age to feel blindsided by these sudden market downturns, but it’s equally important to stress the value of sticking with a long-term plan. You may also want to discuss making any adjustments to portfolio risk moving forward.

The Bottom Line

The COVID-19 pandemic led to a sharp market downturn during the first quarter of 2020. While it wasn’t as severe as the 2008 financial crisis, many near-term target-date funds lost more than ten percent of their value, causing many investors to liquidate their funds. The good news is that long-term investors in 2040 to 2060 target-date funds appear to have been less concerned.

Fiduciaries should take the time to review client portfolios and ensure that they are assigning the right level of risk given their clients’ risk tolerance and return expectations. As part of that exercise, it’s important to take a look at target-date fund allocations and ensure that they aren’t too aggressive despite clients looking to retire at the fund’s vintage date.

Be sure to check our News section to keep track of the latest updates from the mutual fund industry.