Less than a year after the 1987 stock market crash known as ‘Black Monday’, I sat in my office at an old-line Wall Street firm in San Francisco. The office manager dropped Ben Graham’s book The Intelligent Investor on my desk, asked how much I knew about value and dividend-paying stocks, and then walked out without awaiting my answer. That began a lifelong hunt for smart financial strategies to produce reliable, rising streams of income for my clients.

Analyzing Rising Dividend Investment Opportunities

Over the course of my career, I came to adopt the strategy of rising dividend investing over mostly growth, and if there’s a piece of advice I wish I could give to my younger self, it’s ‘Don’t wait so long to start’. But how does one determine which companies – and which dividends – are worthy of their investment?

Companies that pay a dividend are evaluated by two primary metrics: a track record of growing the dividend and the company’s payout ratio.

- Growing the Dividend: According to an April 2013 study by J.P. Morgan Asset Management, when a company consistently increases its dividend, typically we believe it’s a well-run company with enough surplus to operate and grow effectively while continuing to reward investors. However, companies shouldn’t grow their dividends for the sake of growth. There are other factors to assess when making this decision.

- Payout Ratio: A company’s payout ratio reflects the percentage of net income it distributes to investors. A high payout ratio means there isn’t much income left over, and there’s little cushion to accommodate the company’s future needs. A low payout ratio signals that a company has room to grow its dividend.

When evaluating opportunities for dividend investing, companies that regularly increase their dividends without putting the business – and dividend – at risk often are the wisest choice.

The Impact of Dividends on Total Returns

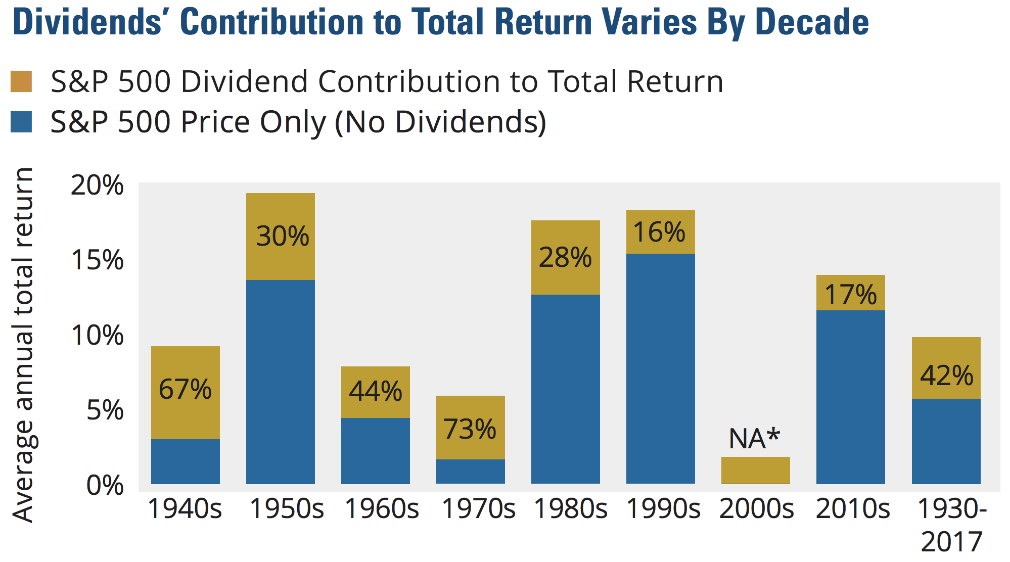

Not all companies that make up the S&P 500 pay a dividend and not all that do grow them. Since the 1980s, 70-90% of S&P constituents were dividend-paying companies, but studies differ on dividends’ impact on the Index’s total return. This study by Hartford Funds cites that 78% of S&P total returns since 1970 can be attributed to dividend reinvestment, but other research puts dividends’ contributions much higher or lower. Investors in their accumulation years might consider dividend investing to temper portfolio volatility while also benefitting from the compounding effect of dividend reinvestment.

The bottom line: dividends are important to total returns, but the extent to which they’ll benefit investors varies significantly by decade and by the investor’s life stage and long-term goals.

Data sources: Morningstar and Hartford Funds, 2/20. *Total return for the S&P 500 Index was negative for the 2000s. Dividends provided a 1.8% annualized return over the decade. Past performance does not guarantee future results. The graph shown is for illustrative purposes only.

Success Through Clarity and Consistency

Rising dividend investing is not a passive practice. It requires clarity about the ideal stocks to select, knowledge of the industries and enterprises in which you’re investing, and consistency in monitoring and modifications.

Here are six steps to increase your probability of success with rising dividend investing:

- Target rising income streams: Regular increases in dividends provide higher flows of conservative income over time. So, look for stocks that consistently increase dividends over many years at a compounded annual growth rate that stays ahead of inflation and minimizes taxes and fees.

- Diversify the industries and companies in your portfolio: A broad variety of companies in diverse market sectors reduces portfolio risk and helps protect against market volatility.

- Monitor. Monitor. Monitor.: Make sure your financial advisory, ETF or mutual fund (if you’re a DIYer) has the expertise and capacity to monitor regularly your holdings in dividend-paying stocks.

- Evaluate each enterprise: Companies worthy of your investment should be in strong financial condition and have high investment grades for their bonds and debt structure.

- Seek companies with free cash flow: Companies should have a track record of using free cash flow to pay or raise their dividends. Be leery of those that borrow to pay dividends.

- Bank on adaptable businesses: It’s important to invest in proven, well-developed businesses that deliver necessary products and services regardless of potential changes in the economic environment.

The Role of Rising Income Streams in Retirement

Investors typically have different needs and tolerances for risk depending on their stage of life. During the accumulation years, you’re likely more comfortable with risk in order to pursue aggressive growth. As you approach distribution age, your appetite for risk often diminishes in favor of more conservative sources of income.

A rising dividend strategy could meet the needs of both risk tolerances as it can provide the potential for higher total returns to achieve growth while supplying steady income if the investor elects not to reinvest them.

For example, a growth-oriented young investor who used the Diversified Stock Income Plan with a starting portfolio value of $500,000 could generate $12,000 annually toward retirement income by reinvesting dividends. An older, conservative investor whose portfolio is in distribution might opt not to reinvest the dividends in an uncertain future – feeling that a bird in the hand is worth two in the bush.

Every individual must assess their comfort level with investment strategies and use a cost-benefit analysis to determine the approach that’s right for them. Explore your options – from mutual funds and ETFs to rising dividend portfolios, separately managed accounts and more – but then commit to a well-thought-out, long-term plan. When it comes to investing, discipline pays dividends.

Wayne Anderman CFP® MBA is the founder of Anderman Wealth Partners, based in the Greater Fort Lauderdale Area, and a registered representative of Avantax Investment ServicesSM. Member FINRA, SIPC. Investment advisory services offered through Avantax Advisory ServicesSM.

This information is intended to be for illustrative purposes only and does not reflect any particular investment or investment needs of any specific investor. By including these links, we are not making a specific product recommendation.

Diversification and asset allocation do not assure or guarantee better performance/profit and cannot eliminate the risk of investment losses in declining markets. Investments are subject to market risks including the potential loss of principal invested.

These opinions are based on observations and research and are not intended to predict or depict performance of any investment. These views are as of the close of business on 08/06/2020 and are subject to change based on subsequent developments. Information is based on sources believe to be reliable; however, their accuracy or completeness cannot be guaranteed. These views should not be construed as a recommendation to buy or sell any securities. Past performance does not guarantee future results.