In 2020, rules that govern retirement accounts temporarily changed in an effort to ease COVID-19-related financial hardships for Americans.

Prior to Dec. 31, 2019, investors were to take required minimum distributions (RMDs) from their individual retirement accounts at age 70 ½, but this was delayed until age 72 thanks to the SECURE Act. The CARES Act waived RMDs for the 2020 calendar year, but they’re back in play for 2021. How, when and why to take RMDs warrants a strategic discussion with your financial advisor but using your IRA income stream as a ‘retirement plan dividend’ could be an important way to replace lost income during retirement.

A Different Kind of Dividend

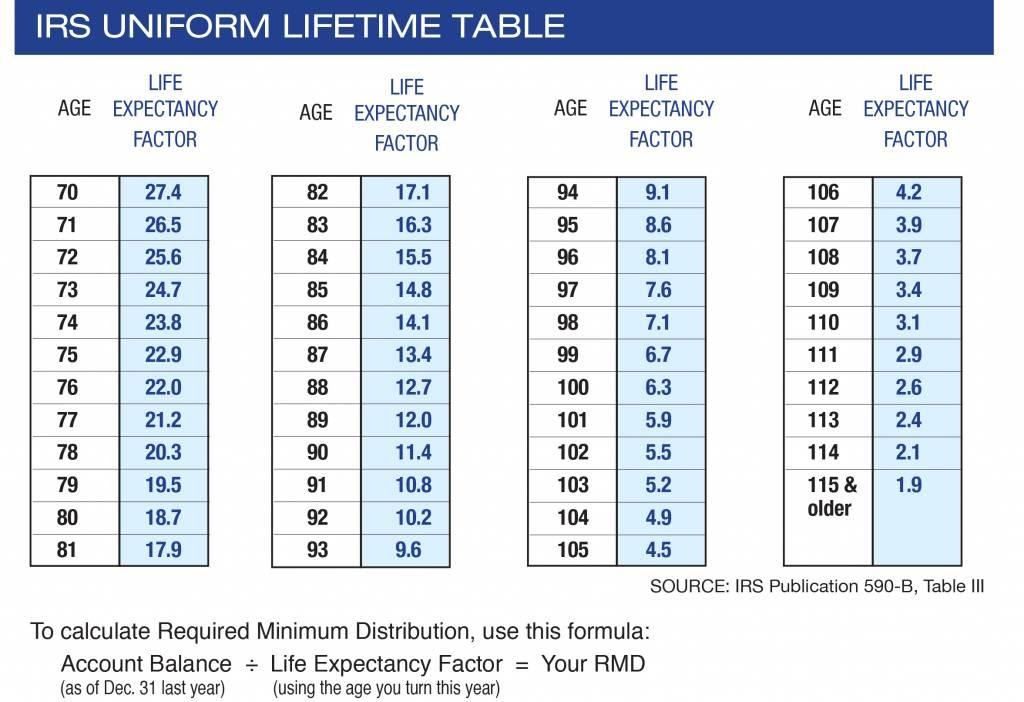

In our January article, I highlighted the broader role of dividends to provide benefits from an action or policy, and that’s exactly what RMDs can provide. RMDs are not merely funded by dividends but also a form of dividend itself by virtue of being a valuable income stream. After decades of working and contributing to your IRA, it is a policy of the Internal Revenue Service to deliver an income stream that has benefitted from compounded tax deferment over time. The following table illustrates how much of an IRA must be distributed once in mandatory distribution.

In addition to enabling retirement accounts to grow during your working (i.e., ‘accumulation’) years and retirement (‘distribution’) years, including dividend-paying companies in your portfolio can help keep your emotions in check during market downturns. The volatility of markets and cycles can be much shorter than the steadiness of sustainable and appreciating dividends in your portfolio as we discussed here in August.

Post-Paycheck Angst

Unemployment remains historically high in the United States, and millions of workers over age 55 have left their jobs since the global pandemic hit home in March 2020. An early retirement can be quite the psychological adjustment, but the loss of a regular paycheck every two weeks is an understandable source of anxiety for anyone – especially recent retirees. However, job-related compensation is merely one of many possible income streams for a household. Social Security benefits, pensions and income from other investments can keep your cash flowing, and RMDs from your IRA should be part of a multi-source plan to supplement that missing paycheck.

RMDs = Retirement Monthly Deposits

Instead of taking lump sums at the start or end of a year, streaming distributions monthly can provide much-needed cash flow for retirees comfortable with paycheck-based budgeting. For many of our clients, ‘RMDs’ have come to mean ‘Retirement Monthly Deposits’ for their households. Additionally, it can allow for continued tax-deferred growth and earnings on any balances that need not be taken until the year-end deadline. However, keep the following things in mind if you plan to use this approach:

- Be sure to withhold taxes from each monthly distribution or set aside money to pay taxes in a lump sum, so you can avoid penalties for under-withholding. In fact, it’s always best to have your tax professional and financial advisors collaborate on ongoing strategies.

- If you’re fortunate enough not to need mandatory withdrawals as a source of income during retirement, enjoy the advantage of tax-deferred growth and dividends until the last possible moment.

- The simple streaming of dividends monthly likely will not cover a retiree’s full minimum distribution requirement. It might be necessary to raise cash from growth positions in your portfolio, matured fixed-income instruments, and possibly dividend-paying stocks.

- Your tax preparer should calculate your required withdrawal amount each January using the IRA Uniform Lifetime Tables.

- Be sure to plan for RMDs across all accounts – even those at different custodians. The penalty of overlooking one is 50% of the amount missed.

- Consider keeping a year of cash in your accounts to fulfill your RMD obligations, or if you want full market participation during the year, at least keep on hand the amount not covered by projected income streamed monthly.

- Customize your accounts’ periodic payment plan to meet your needs for monthly income.

For example, assume an IRA produces $15,000 per year but receives most of its dividends and interest unevenly due to semi-annual and quarterly payments. If the cash balance or money market maintained covers the annual amount you require, you should be able to comfortably transfer $1,000 a month to your bank account and allow dividends paid into the IRA to keep balances level throughout the year, replacing what is used as your Social Security supplemental paycheck.

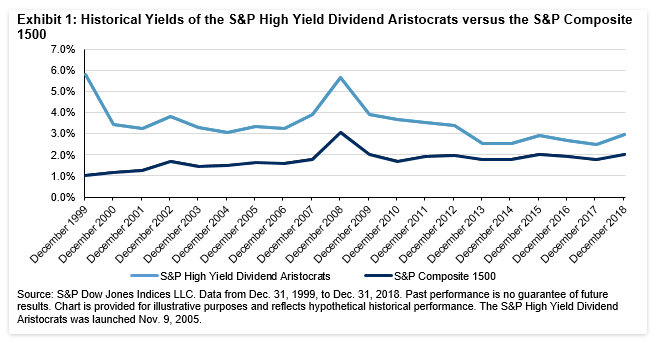

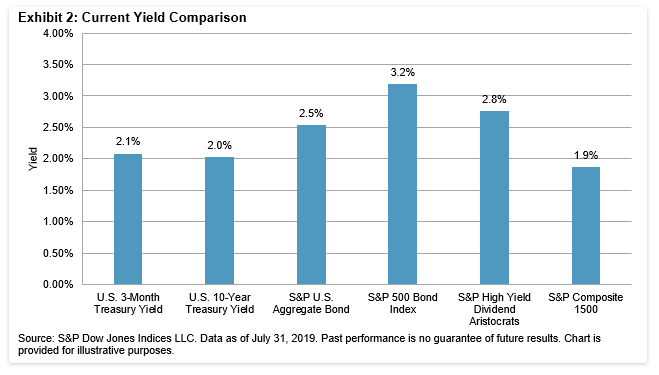

Together, dividends generated from preferred stocks, dividend aristocrat members, bonds, funds and potential capital gains distributions may provide a great source of recurring income. Meeting your RMD requirement now – or in the future – may come to depend on more than just stock dividends of course. Sustainable, consistent and rising-dividend yields (the average yield of the Aristocrat index was 2.5% vs 1.8% for the S&P 500 in the 21-year period – 1999 – 2018) combined with potential growth in an investor’s suitably asset allocated portfolio, can be a great source of solace in constructing at least one of two paychecks in retirement. Social Security and your RMDs are the benefit of a career and savings discipline that can yield platinum dividends in your golden years.

Wayne Anderman CFP® MBA is the founder of Anderman Wealth Partners, based in the Greater Fort Lauderdale Area, and a registered representative of Avantax Investment ServicesSM. Member FINRA, SIPC. Investment advisory services offered through Avantax Advisory ServicesSM.

These opinions are based on Wayne Anderman’s observations and research and are not intended to predict or depict performance of any investment. These views are as of the close of business on 02/01/2021 and are subject to change based on subsequent developments. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. These views should not be construed as a recommendation to buy or sell any securities. Past performance does not guarantee future results.